Form 590 P Nonresident Withholding Exemption Certificate for Previously Reported Income 2022-2026

What is the California Form 590 P Nonresident Withholding Exemption Certificate?

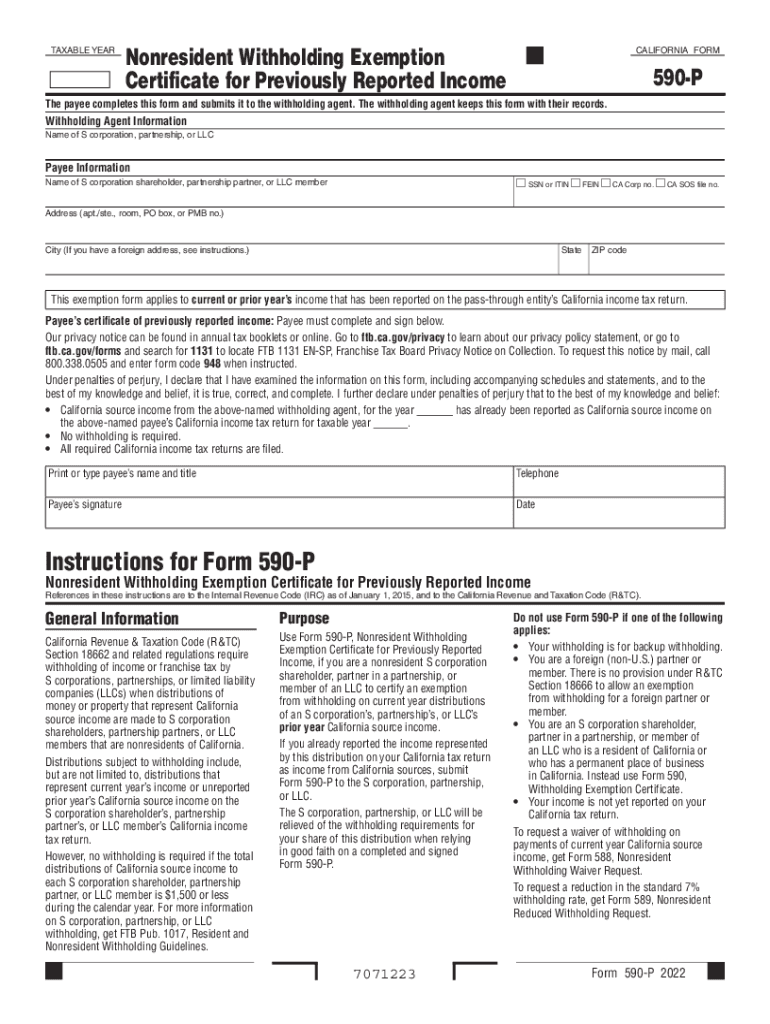

The California Form 590 P is a Nonresident Withholding Exemption Certificate designed for individuals who wish to claim an exemption from withholding on income that has already been reported. This form is particularly relevant for nonresidents who receive income from California sources and have already reported that income to the state. By submitting this form, nonresidents can avoid unnecessary withholding on their income, ensuring that they are not taxed twice on the same earnings. The form is essential for maintaining compliance with California tax laws while allowing for efficient tax management.

Steps to Complete the California Form 590 P

Completing the California Form 590 P involves several straightforward steps to ensure accuracy and compliance. First, gather all necessary information, including your name, address, and taxpayer identification number. Next, indicate the type of income you are reporting and provide details regarding the income amounts. It is crucial to ensure that all information is accurate to avoid any delays or issues with processing. After filling out the form, review it carefully for any errors before submitting it to the appropriate tax authority. This diligence helps in maintaining compliance and avoiding potential penalties.

Eligibility Criteria for the California Form 590 P

To be eligible for the California Form 590 P, you must be a nonresident who has received income from California sources that has already been reported. This typically includes individuals who have earned income through investments, rental properties, or other sources while residing outside of California. Additionally, you must meet specific income thresholds and provide documentation to support your exemption claim. Understanding these criteria is essential to ensure that you qualify for the exemption and can complete the form accurately.

Legal Use of the California Form 590 P

The legal use of the California Form 590 P is governed by state tax regulations. When properly completed and submitted, this form serves as a legally binding declaration that the income in question has been reported and that the individual is entitled to an exemption from withholding. It is important to comply with all relevant regulations and guidelines to ensure that the form is accepted by the California tax authorities. Failure to adhere to these legal requirements may result in penalties or denial of the exemption.

Key Elements of the California Form 590 P

The California Form 590 P includes several key elements that must be accurately filled out. These elements typically consist of the taxpayer's personal information, the type of income being reported, and the specific exemption being claimed. Additionally, the form may require supporting documentation to validate the exemption claim. Understanding these key components is essential for ensuring that the form is completed correctly and submitted without issues.

Filing Deadlines for the California Form 590 P

Filing deadlines for the California Form 590 P are crucial for ensuring compliance with state tax laws. Typically, the form must be submitted by the due date of the income tax return for the year in which the income was earned. It is essential to be aware of these deadlines to avoid penalties and ensure that your exemption claim is processed in a timely manner. Keeping track of these important dates helps in managing your tax obligations effectively.

Quick guide on how to complete 2023 form 590 p nonresident withholding exemption certificate for previously reported income

Complete Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals alike. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your files swiftly and without delays. Manage Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income on any device using airSlate SignNow's Android or iOS apps and enhance any document-focused process today.

The easiest way to modify and eSign Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income without any hassle

- Obtain Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize important sections of the documents or obscure sensitive details using tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to record your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that require new printed copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2023 form 590 p nonresident withholding exemption certificate for previously reported income

Create this form in 5 minutes!

How to create an eSignature for the 2023 form 590 p nonresident withholding exemption certificate for previously reported income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Form 590 P?

The California Form 590 P is a crucial document used by businesses and individuals to report withholding for nonresident payments in the state of California. It helps ensure that the appropriate tax amount is withheld and reported to the California Franchise Tax Board, thereby streamlining tax compliance.

-

How can airSlate SignNow help me with California Form 590 P?

airSlate SignNow provides an efficient platform for eSigning and sending your California Form 590 P quickly and securely. Our electronic signature solution simplifies the process of signing and submitting this important document, making it accessible anytime and anywhere.

-

What are the pricing options for airSlate SignNow when dealing with California Form 590 P?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs, including those that require frequent handling of California Form 590 P. By choosing a subscription, you gain access to all our features designed for efficient document management and eSigning.

-

Are there any specific features in airSlate SignNow that benefit California Form 590 P processing?

Yes, airSlate SignNow includes features like custom templates and automated workflows specifically designed for documents like California Form 590 P. This streamlines the preparation and signing process, ensuring that all necessary information is captured accurately.

-

Can airSlate SignNow assist with integrating California Form 590 P into my existing systems?

Absolutely! airSlate SignNow supports various integrations with popular applications, allowing you to seamlessly incorporate California Form 590 P processing into your existing workflows. This enhances productivity and reduces the chances of errors.

-

What are the benefits of using airSlate SignNow for California Form 590 P eSigning?

Using airSlate SignNow for eSigning your California Form 590 P offers enhanced convenience, speed, and security. Our platform ensures that your documents are legally binding and can be completed in just a few clicks, streamlining the tax reporting process.

-

Is airSlate SignNow compliant with California regulations for Form 590 P?

Yes, airSlate SignNow is designed to comply with California regulations, ensuring that your handling of the California Form 590 P adheres to legal standards. Our commitment to compliance means you can trust our platform for secure document management.

Get more for Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income

- Interrogatories to defendant for motor vehicle accident south dakota form

- Llc notices resolutions and other operations forms package south dakota

- Residential real estate sales disclosure statement south dakota form

- Notice of dishonored check civil keywords bad check bounced check south dakota form

- South dakota trust 497326266 form

- South dakota corporation 497326267 form

- Mutual wills containing last will and testaments for man and woman living together not married with no children south dakota form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children south dakota form

Find out other Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure