590 P Form 2018

What is the 590 P Form

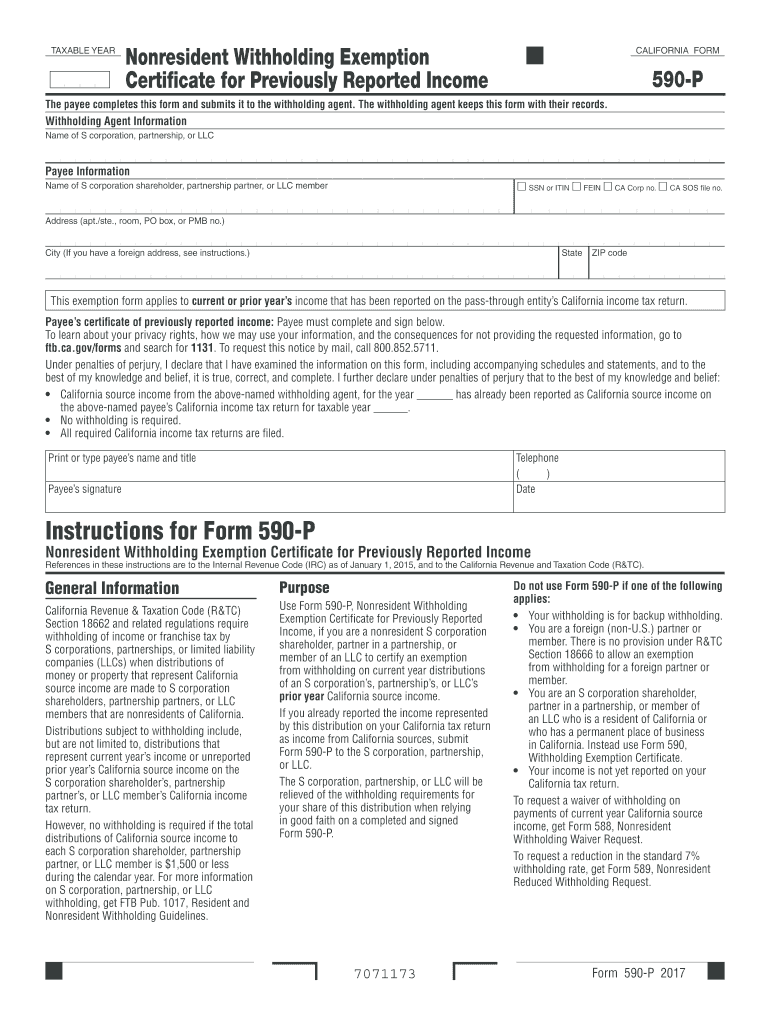

The 590 P Form is a tax document used by individuals and businesses to report certain income and deductions to the Internal Revenue Service (IRS). This form is particularly relevant for taxpayers who need to claim specific exemptions or adjustments related to their tax liabilities. It serves as a formal declaration of eligibility for various tax benefits, ensuring compliance with federal tax regulations. Understanding the purpose and requirements of the 590 P Form is essential for accurate tax reporting and avoiding potential penalties.

How to use the 590 P Form

Using the 590 P Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully read the instructions provided with the form to understand the specific information required. Fill out the form with accurate data, ensuring that all entries are clear and legible. Once completed, review the form for any errors or omissions before submitting it to the IRS. Proper use of the 590 P Form can help maximize tax benefits and ensure compliance with tax laws.

Steps to complete the 590 P Form

Completing the 590 P Form requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the 590 P Form from the IRS website or authorized sources.

- Read the instructions thoroughly to understand each section of the form.

- Gather all necessary documents, including income records and previous tax filings.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the form for any errors or missing information.

- Sign and date the form where required.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the 590 P Form

The legal use of the 590 P Form is crucial for ensuring compliance with IRS regulations. This form must be completed accurately to avoid issues such as audits or penalties. It is essential to understand the legal implications of the information provided on the form, as inaccuracies can lead to legal consequences. The form is designed to be a formal declaration of tax status, and its proper use is vital for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the 590 P Form are critical to avoid penalties and ensure timely processing. Typically, the IRS sets specific dates for tax filings, which may vary each year. It is important to keep track of these deadlines to ensure that the form is submitted on time. Missing a deadline can result in late fees or additional interest on owed taxes. Taxpayers should mark important dates on their calendars and prepare their documents in advance to facilitate timely submission.

Required Documents

When completing the 590 P Form, certain documents are required to support the information provided. These may include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Documentation of deductions or credits being claimed.

- Any relevant financial statements that support the entries on the form.

Having these documents ready will streamline the completion process and enhance the accuracy of the information submitted.

Form Submission Methods (Online / Mail / In-Person)

The 590 P Form can be submitted through various methods, providing flexibility to taxpayers. Options include:

- Online submission through the IRS e-filing system, which is often the fastest method.

- Mailing a physical copy of the form to the appropriate IRS address, as specified in the form instructions.

- In-person submission at designated IRS offices, if available.

Choosing the right submission method depends on individual preferences and circumstances, but online submission is generally recommended for its efficiency and tracking capabilities.

Quick guide on how to complete 590 p 2018 form

Complete 590 P Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents promptly without interruptions. Manage 590 P Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign 590 P Form seamlessly

- Obtain 590 P Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign 590 P Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 590 p 2018 form

Create this form in 5 minutes!

How to create an eSignature for the 590 p 2018 form

How to generate an electronic signature for your 590 P 2018 Form online

How to generate an electronic signature for your 590 P 2018 Form in Google Chrome

How to make an electronic signature for signing the 590 P 2018 Form in Gmail

How to generate an eSignature for the 590 P 2018 Form right from your mobile device

How to generate an eSignature for the 590 P 2018 Form on iOS devices

How to make an eSignature for the 590 P 2018 Form on Android OS

People also ask

-

What is the 590 P Form and how can airSlate SignNow help with it?

The 590 P Form is a critical tax document used by businesses in California to claim tax exemptions. airSlate SignNow streamlines the process of sending and eSigning the 590 P Form, ensuring that all parties can easily review and approve the document without delays.

-

How much does it cost to use airSlate SignNow for the 590 P Form?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, starting from a basic plan that provides essential features for managing the 590 P Form. You can choose a plan that fits your needs and budget, allowing you to efficiently handle your eSigning requirements with no hidden fees.

-

What features does airSlate SignNow offer for managing the 590 P Form?

With airSlate SignNow, you can easily create, send, and eSign the 590 P Form with features like customizable templates, real-time tracking, and secure cloud storage. These features enhance your document workflow, making it simpler to manage important tax documents.

-

Is airSlate SignNow compliant with legal requirements for the 590 P Form?

Yes, airSlate SignNow complies with all legal standards for electronic signatures, ensuring that your eSigned 590 P Form is valid and enforceable. Our platform adheres to the ESIGN Act and UETA, giving you peace of mind when sending important documentation.

-

Can I integrate airSlate SignNow with other software for handling the 590 P Form?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enabling you to manage the 590 P Form alongside your existing workflows. This integration allows for better data management and streamlines the eSigning process.

-

How secure is my information when using airSlate SignNow for the 590 P Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and secure data storage protocols to protect your information, including the sensitive details contained in the 590 P Form, ensuring that your documents remain confidential.

-

Can I track the status of the 590 P Form once it's sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your documents, including the 590 P Form. You can easily see when the document is viewed, signed, and completed, allowing you to manage your workflow more effectively.

Get more for 590 P Form

Find out other 590 P Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors