Ftb Form Certificate PDF pdfFiller 2021

Understanding the California 590 P Form

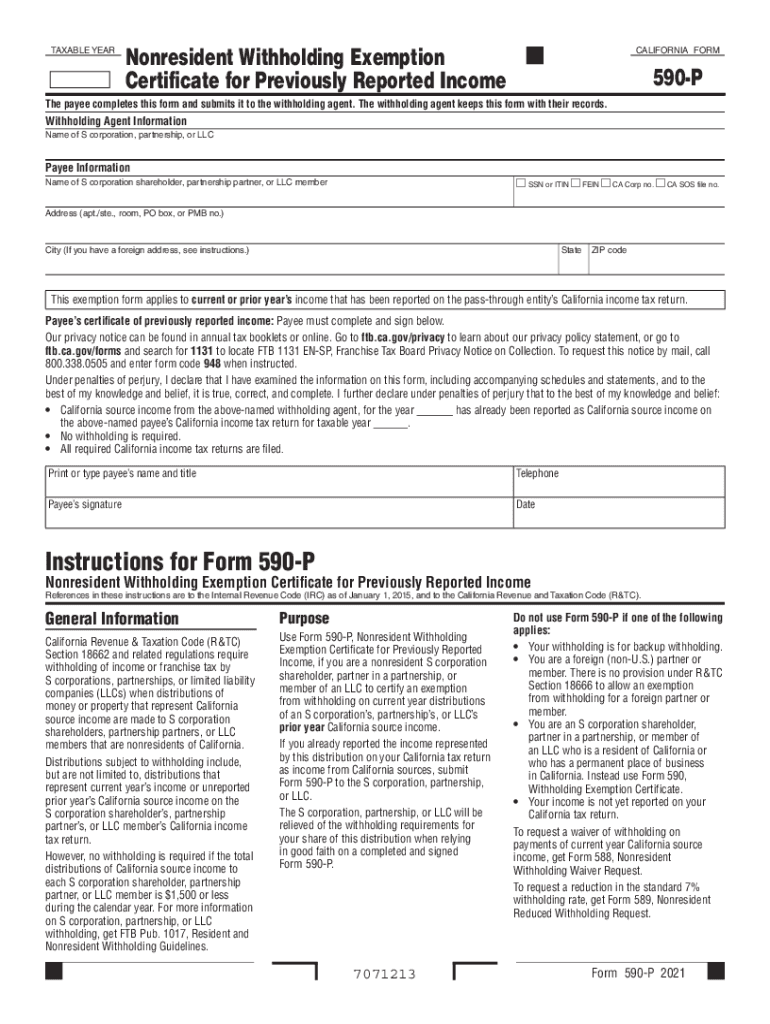

The California 590 P form, also known as the California Form 590, is a crucial document used for tax purposes. It is primarily utilized to certify that a taxpayer qualifies for an exemption from withholding on certain types of income. This form is particularly relevant for non-residents and those claiming the Military Spouse Residency Relief Act (MSRRA) exemption. Understanding its purpose and requirements is essential for ensuring compliance with California tax regulations.

Steps to Complete the California 590 P Form

Completing the California 590 P form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your name, address, and taxpayer identification number. Next, provide details about the income for which you are claiming the exemption. Carefully read the instructions provided with the form to ensure that all sections are filled out correctly. After completing the form, review it for any errors before submission.

Legal Use of the California 590 P Form

The California 590 P form is legally binding when completed correctly and submitted to the appropriate tax authorities. It serves as a declaration of eligibility for tax withholding exemptions. To ensure its legal standing, the form must be signed and dated by the taxpayer or authorized representative. Compliance with California tax laws is critical, as improper use of the form can lead to penalties or additional tax liabilities.

Filing Deadlines for the California 590 P Form

Filing deadlines for the California 590 P form are essential to adhere to in order to avoid penalties. Generally, the form must be submitted to the withholding agent before the payment of income for which the exemption is claimed. It is advisable to check the California Franchise Tax Board website for specific deadlines, as they may vary based on the type of income and the taxpayer's situation. Timely submission is crucial for maintaining compliance.

Required Documents for the California 590 P Form

When submitting the California 590 P form, certain documents may be required to support your exemption claim. These may include proof of residency, such as a driver's license or utility bill, and any documentation related to the income being reported. Having these documents ready can streamline the process and help ensure that your form is accepted without delays.

Examples of Using the California 590 P Form

The California 590 P form can be used in various scenarios. For instance, a non-resident who receives rental income from California properties may use this form to claim an exemption from withholding. Similarly, a military spouse stationed in California may utilize the form to avoid unnecessary tax withholding due to their spouse's military status. Understanding these examples can help taxpayers determine when to use the form effectively.

Quick guide on how to complete ftb form certificate pdf pdffiller

Complete Ftb Form Certificate Pdf PdfFiller effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Ftb Form Certificate Pdf PdfFiller on any device using the airSlate SignNow Android or iOS applications and streamline any document-based process today.

The easiest way to alter and eSign Ftb Form Certificate Pdf PdfFiller without hassle

- Obtain Ftb Form Certificate Pdf PdfFiller and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight pertinent sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ftb Form Certificate Pdf PdfFiller and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ftb form certificate pdf pdffiller

Create this form in 5 minutes!

How to create an eSignature for the ftb form certificate pdf pdffiller

How to generate an e-signature for a PDF file in the online mode

How to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an e-signature from your smartphone

The best way to create an e-signature for a PDF file on iOS devices

How to make an e-signature for a PDF file on Android

People also ask

-

What is the california 590 p form and why is it important?

The california 590 p form is a crucial document for tax withholding in California. It is necessary for businesses and individuals to ensure proper state tax compliance. By using airSlate SignNow, you can easily eSign and submit the california 590 p form, streamlining your tax processes.

-

How does airSlate SignNow simplify the process of eSigning the california 590 p?

With airSlate SignNow, eSigning the california 590 p form is straightforward. Our intuitive platform allows you to prepare, send, and sign documents electronically in just a few clicks, saving you time and reducing paperwork. Plus, your signed documents are securely stored for easy access later.

-

What are the pricing options for using airSlate SignNow for the california 590 p?

airSlate SignNow offers flexible pricing plans designed to fit the needs of businesses of all sizes looking to manage the california 590 p form. Our pricing is transparent, with options ranging from free trials to custom solutions based on your requirements. You'll enjoy cost-effective solutions without compromising on features.

-

Can I integrate airSlate SignNow with other applications for managing the california 590 p?

Yes, airSlate SignNow supports integrations with various applications, enhancing the management of the california 590 p form. You can connect with CRMs, storage solutions, and more to streamline your workflows. This helps ensure a seamless electronic document management experience.

-

What features does airSlate SignNow offer for completing the california 590 p?

airSlate SignNow provides a range of features for efficiently completing the california 590 p form. These include customizable templates, real-time tracking of document status, and mobile eSigning options. These features help you manage your documents more effectively.

-

Is airSlate SignNow secure for signing the california 590 p?

Absolutely, airSlate SignNow prioritizes security when it comes to signing documents like the california 590 p. Our platform uses industry-standard encryption and complies with regulations to ensure your sensitive information remains protected. You can eSign with confidence, knowing your data is safe.

-

How does airSlate SignNow improve efficiency in handling the california 590 p?

airSlate SignNow enhances efficiency by automating the eSigning process for the california 590 p form. With features like bulk sending, notifications, and reminders, you can reduce the time spent on paperwork and focus more on core business activities. This leads to increased productivity and enhanced workflow.

Get more for Ftb Form Certificate Pdf PdfFiller

- Quitclaim deed from corporation to two individuals massachusetts form

- Warranty deed from corporation to two individuals massachusetts form

- Warranty deed from individual to a trust massachusetts form

- Warranty deed from husband and wife to a trust massachusetts form

- Ma selling form

- Massachusetts note 497309568 form

- Massachusetts wife form

- Quitclaim deed from husband to himself and wife massachusetts form

Find out other Ftb Form Certificate Pdf PdfFiller

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now