Ca Form 590 P 2016

What is the Ca Form 590 P

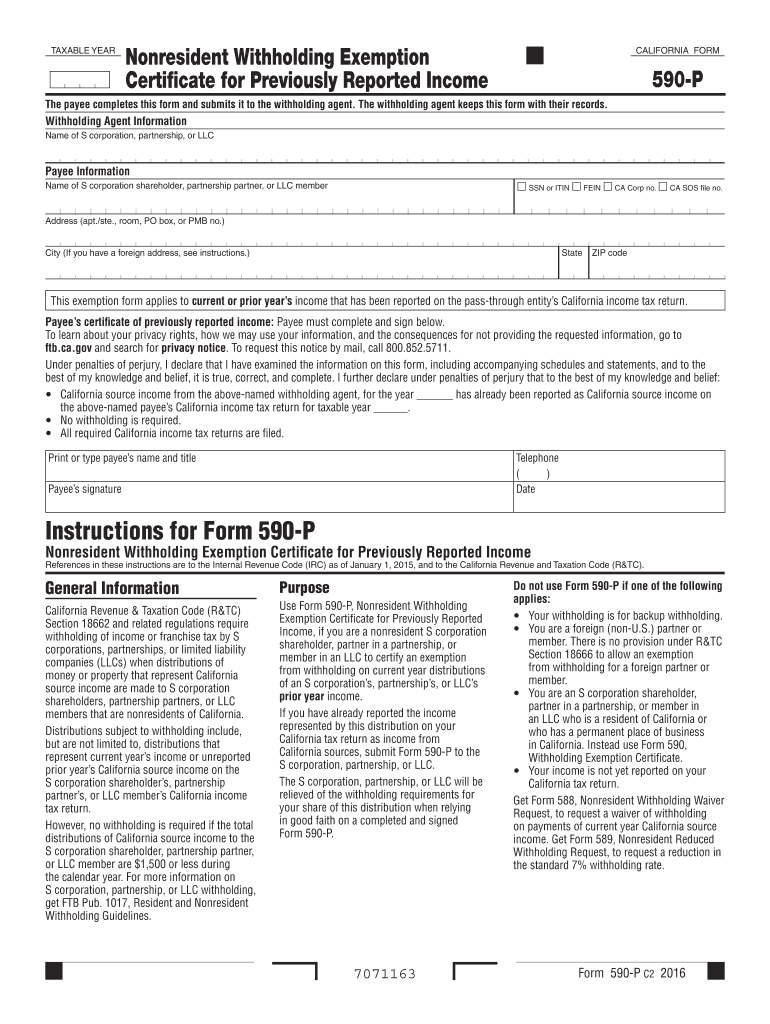

The Ca Form 590 P is a tax form used in California for withholding exemption certification. This form allows individuals to claim exemption from state income tax withholding if they meet specific criteria. It is primarily utilized by residents who expect to owe no California income tax for the year due to low income or other qualifying factors. Understanding this form is essential for ensuring compliance with state tax regulations and avoiding unnecessary withholding from paychecks.

How to use the Ca Form 590 P

Using the Ca Form 590 P involves several straightforward steps. First, individuals must determine their eligibility for withholding exemption. Next, they should complete the form by providing accurate personal information, including their name, address, and Social Security number. After filling out the necessary sections, the form must be signed and dated before submission. It is crucial to keep a copy of the completed form for personal records, as it may be needed for future reference or verification.

Steps to complete the Ca Form 590 P

Completing the Ca Form 590 P requires careful attention to detail. Follow these steps:

- Download the form from the California Franchise Tax Board website or obtain a physical copy.

- Fill in your personal information accurately, including your full name and Social Security number.

- Indicate your eligibility for exemption by checking the appropriate boxes on the form.

- Review the completed form for any errors or omissions.

- Sign and date the form at the bottom.

- Submit the form to your employer or the appropriate tax authority as instructed.

Legal use of the Ca Form 590 P

The Ca Form 590 P is legally recognized for claiming exemption from state income tax withholding in California. To ensure its legal validity, the form must be completed accurately and submitted to the appropriate parties. It is essential to adhere to the guidelines set forth by the California Franchise Tax Board to avoid penalties or issues with tax compliance. The use of this form must align with the stipulations outlined in California tax law.

Key elements of the Ca Form 590 P

Several key elements define the Ca Form 590 P. These include:

- Personal Information: Name, address, and Social Security number of the individual claiming exemption.

- Eligibility Criteria: Specific conditions that must be met to qualify for exemption from withholding.

- Signature: The form must be signed and dated by the individual to validate the claim.

- Submission Instructions: Guidelines on where and how to submit the completed form.

Form Submission Methods

The Ca Form 590 P can be submitted through various methods, ensuring convenience for users. Individuals can provide the completed form directly to their employer, who will then process it for payroll purposes. Alternatively, the form may be mailed to the appropriate tax authority if required. Some employers may also offer electronic submission options, allowing for a more streamlined process. It is important to confirm the preferred submission method with the employer or tax authority.

Quick guide on how to complete ca form 590 p 2016

Complete Ca Form 590 P easily on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without any delays. Handle Ca Form 590 P on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

The simplest way to modify and electronically sign Ca Form 590 P effortlessly

- Obtain Ca Form 590 P and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes no time at all and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ca Form 590 P and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca form 590 p 2016

Create this form in 5 minutes!

How to create an eSignature for the ca form 590 p 2016

How to create an electronic signature for your Ca Form 590 P 2016 online

How to generate an electronic signature for the Ca Form 590 P 2016 in Google Chrome

How to make an electronic signature for signing the Ca Form 590 P 2016 in Gmail

How to generate an electronic signature for the Ca Form 590 P 2016 right from your smart phone

How to make an electronic signature for the Ca Form 590 P 2016 on iOS devices

How to make an electronic signature for the Ca Form 590 P 2016 on Android OS

People also ask

-

What is the CA Form 590 P and how is it used?

The CA Form 590 P is a crucial document used by California residents for reporting the withholding on payments made to non-residents. It is essential for ensuring compliance with California tax regulations. By utilizing airSlate SignNow, you can easily eSign and manage your CA Form 590 P, streamlining your tax documentation process.

-

How can airSlate SignNow help with completing the CA Form 590 P?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out the CA Form 590 P. You can easily input the required information, electronically sign the document, and share it securely with relevant parties. This capability not only enhances efficiency but also reduces the likelihood of errors.

-

What are the pricing options for using airSlate SignNow for the CA Form 590 P?

airSlate SignNow offers flexible pricing plans tailored to different business needs, making it an affordable option for managing the CA Form 590 P. You can choose from various subscription models, including monthly and annual plans, ensuring you get the best value for your eSigning needs.

-

Is airSlate SignNow secure for handling the CA Form 590 P?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your CA Form 590 P and other sensitive documents are protected with advanced encryption protocols. The platform complies with industry standards, so you can confidently eSign and manage your documents without worrying about data bsignNowes.

-

Can I integrate airSlate SignNow with other applications for the CA Form 590 P?

Absolutely! airSlate SignNow seamlessly integrates with various applications, such as Google Drive, Dropbox, and CRM systems, for easy access to your CA Form 590 P documents. This integration streamlines your workflow, allowing you to manage and eSign documents within your preferred applications.

-

What are the benefits of using airSlate SignNow for the CA Form 590 P?

Using airSlate SignNow for the CA Form 590 P offers numerous benefits, including increased efficiency, improved accuracy, and enhanced document security. This user-friendly platform allows you to eSign documents quickly, reducing turnaround times and ensuring compliance with California tax regulations.

-

Is there customer support available for assistance with the CA Form 590 P?

Yes, airSlate SignNow provides comprehensive customer support to assist you with any questions related to the CA Form 590 P. Whether you need help with eSigning or navigating the platform, our support team is available via chat, email, or phone to ensure a smooth experience.

Get more for Ca Form 590 P

Find out other Ca Form 590 P

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure