Form it 225 New York State Modifications Tax Year 2022

What is the Form IT 225 New York State Modifications Tax Year

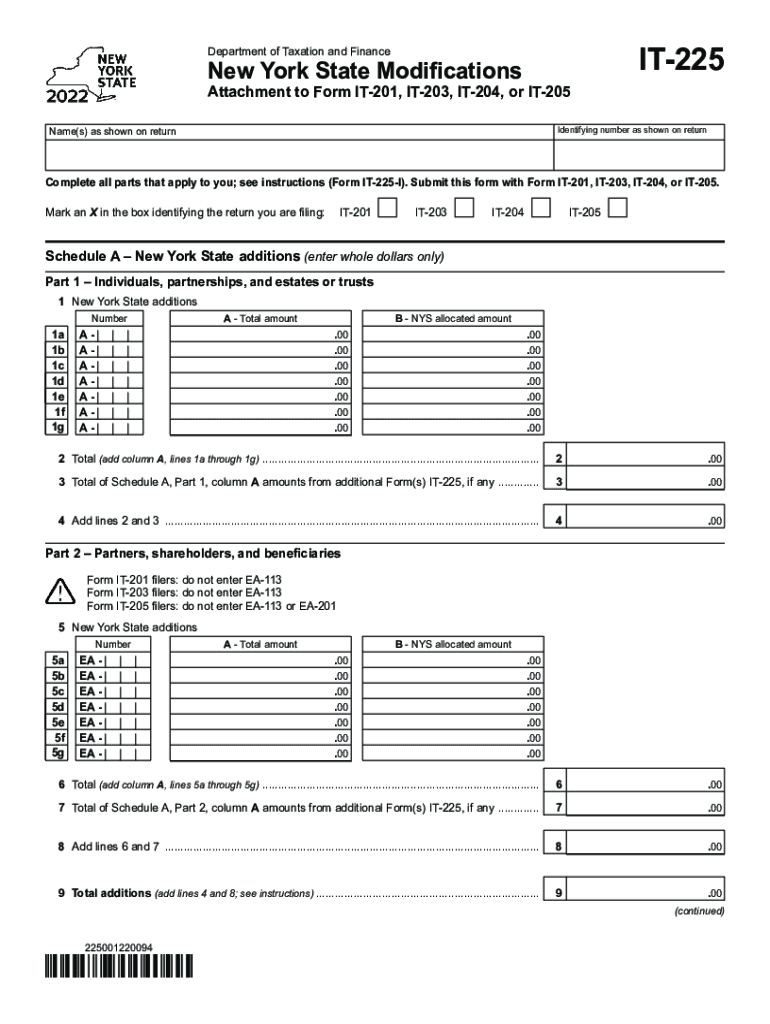

The Form IT 225 is a tax document used by residents of New York State to report modifications to their federal adjusted gross income. This form is essential for calculating the New York State income tax owed or refunded. It allows taxpayers to make specific adjustments based on various deductions, credits, and other factors that may affect their taxable income. Understanding the purpose of this form is crucial for accurate tax filing and compliance with state regulations.

How to use the Form IT 225 New York State Modifications Tax Year

Using the Form IT 225 involves several steps to ensure that all modifications are accurately reported. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, complete the form by entering the required information regarding income adjustments. This includes detailing any additions or subtractions to the federal adjusted gross income. After filling out the form, review it carefully for any errors before submission to avoid delays or penalties.

Steps to complete the Form IT 225 New York State Modifications Tax Year

Completing the Form IT 225 requires a systematic approach:

- Gather all relevant income documentation.

- Access the Form IT 225, available as a PDF from the New York State Department of Taxation and Finance.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your federal adjusted gross income as stated on your federal tax return.

- Detail any modifications by completing the appropriate sections of the form.

- Review the completed form for accuracy.

- Submit the form either electronically or by mail, following the specific submission guidelines provided.

Legal use of the Form IT 225 New York State Modifications Tax Year

The legal use of the Form IT 225 is governed by New York State tax laws. To be considered valid, the form must be completed accurately and submitted within the designated filing period. Ensuring compliance with state regulations is essential, as incorrect or late submissions can result in penalties or interest charges. The use of electronic signatures through trusted platforms can enhance the legal standing of the submitted form, as long as they meet the requirements set forth by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 225 typically align with the overall New York State income tax return deadlines. For most taxpayers, the due date is usually April fifteenth of the following year. However, if that date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can affect submission timelines. Keeping track of these dates is crucial for avoiding penalties.

Required Documents

To complete the Form IT 225, several documents are necessary:

- Federal tax return (Form 1040 or 1040-SR).

- W-2 forms from employers showing income earned.

- 1099 forms for any additional income sources.

- Documentation for any deductions or credits being claimed.

- Previous year’s tax return for reference, if applicable.

Quick guide on how to complete form it 225 new york state modifications tax year 2022

Complete Form IT 225 New York State Modifications Tax Year effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Form IT 225 New York State Modifications Tax Year on any platform using airSlate SignNow's Android or iOS apps and enhance any document-centric process today.

How to modify and eSign Form IT 225 New York State Modifications Tax Year without hassle

- Locate Form IT 225 New York State Modifications Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Simplify the process of dealing with lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form IT 225 New York State Modifications Tax Year and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 225 new york state modifications tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 225 new york state modifications tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to IT 225 instructions?

AirSlate SignNow offers a range of features that simplify the process of managing IT 225 instructions. Users can create, send, and eSign documents seamlessly while ensuring compliance with regulatory standards. The platform also provides team collaboration tools to streamline document workflows, making it perfect for businesses of all sizes.

-

How does airSlate SignNow help with compliance regarding IT 225 instructions?

AirSlate SignNow ensures compliance with IT 225 instructions by offering robust security features and audit trails. Every signed document is easily traceable, giving businesses peace of mind that they are adhering to legal requirements. Additionally, the platform stays updated with compliance regulations to keep your documentation secure.

-

What is the pricing structure for airSlate SignNow for IT 225 instructions?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, particularly for managing IT 225 instructions. Each plan is designed to provide excellent value, including features like unlimited document signing and integration capabilities. Interested customers can visit our website to compare plans and select one that fits their budget.

-

How can airSlate SignNow improve efficiency when handling IT 225 instructions?

By using airSlate SignNow, businesses can dramatically improve efficiency with IT 225 instructions management. The platform automates document workflows, reducing the time spent on manual processes. This means quicker turnaround times for approvals and a more streamlined experience for users.

-

Can airSlate SignNow integrate with other tools for managing IT 225 instructions?

Yes, airSlate SignNow offers seamless integrations with a variety of tools that can help manage IT 225 instructions. It can easily connect with popular applications like CRM systems, document storage, and project management tools. This enhances your workflow and ensures that all your processes are aligned for maximum productivity.

-

What benefits can I expect from using airSlate SignNow for IT 225 instructions?

The primary benefits of using airSlate SignNow for IT 225 instructions include higher efficiency, enhanced security, and lower operational costs. By digitizing the signing process, you eliminate paper waste and reduce delays associated with traditional document signing. Additionally, the platform’s user-friendly interface makes it easy for teams to adopt and utilize.

-

Is airSlate SignNow suitable for small businesses for handling IT 225 instructions?

Absolutely! AirSlate SignNow is an excellent choice for small businesses managing IT 225 instructions. It provides an affordable solution with powerful features that help streamline document processes without the need for complex infrastructure. Small businesses can easily scale with the platform as they grow.

Get more for Form IT 225 New York State Modifications Tax Year

- Tennessee middle district bankruptcy guide and forms package for chapters 7 or 13 tennessee

- Tennessee western district bankruptcy guide and forms package for chapters 7 or 13 tennessee

- Bill of sale with warranty by individual seller tennessee form

- Tennessee seller 497326890 form

- Bill of sale without warranty by individual seller tennessee form

- Bill of sale without warranty by corporate seller tennessee form

- Tennessee chapter 13 form

- Chapter 13 plan tennessee form

Find out other Form IT 225 New York State Modifications Tax Year

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample