Form it 225 New York State Modifications Tax Year 2024-2026

What is the Form IT 225 New York State Modifications Tax Year

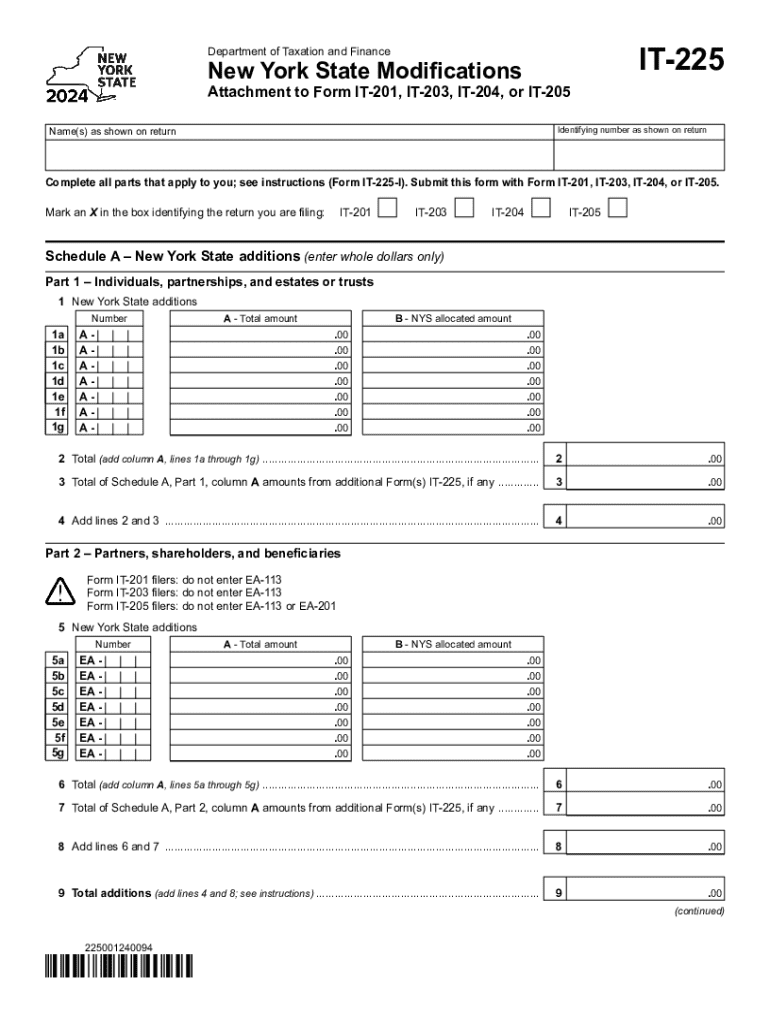

The Form IT 225 is a New York State tax form used to report modifications to income for the tax year 2024. This form allows taxpayers to adjust their federal adjusted gross income to reflect specific New York State modifications. These modifications can include various additions and subtractions that affect the overall taxable income, ensuring compliance with state tax regulations.

How to use the Form IT 225 New York State Modifications Tax Year

To effectively use the Form IT 225, taxpayers must first gather their federal tax information. This includes the federal adjusted gross income, which serves as the starting point for the modifications. The form provides sections where taxpayers can enter specific modifications, such as state and local taxes paid or certain types of income that are exempt from state tax. It is essential to carefully follow the instructions provided on the form to ensure accurate reporting.

Steps to complete the Form IT 225 New York State Modifications Tax Year

Completing the Form IT 225 involves several key steps:

- Start by entering your personal information, including name, address, and Social Security number.

- Input your federal adjusted gross income as reported on your federal tax return.

- Identify and enter any applicable modifications in the designated sections of the form.

- Calculate the total modifications to determine your New York State taxable income.

- Review the completed form for accuracy before submission.

Key elements of the Form IT 225 New York State Modifications Tax Year

The Form IT 225 includes several critical elements that taxpayers should be aware of:

- Personal Information: This section requires basic identification details.

- Federal Adjusted Gross Income: The starting point for modifications.

- Modifications Section: Areas to report specific additions and subtractions.

- Calculation of Taxable Income: A summary of how modifications affect overall income.

Filing Deadlines / Important Dates

For the tax year 2024, the filing deadline for the Form IT 225 aligns with the general tax return deadline, which is typically April 15. Taxpayers should ensure that they submit the form by this date to avoid penalties. It is advisable to check for any updates or changes to deadlines, especially if they fall on a weekend or holiday.

Required Documents

When completing the Form IT 225, taxpayers should have the following documents ready:

- Federal tax return (Form 1040 or equivalent).

- Documentation of any income modifications, such as W-2 forms or 1099s.

- Records of state and local taxes paid.

- Any relevant receipts or statements that support the reported modifications.

Create this form in 5 minutes or less

Find and fill out the correct form it 225 new york state modifications tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 225 new york state modifications tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 it 225 pricing structure for airSlate SignNow?

The 2024 it 225 pricing structure for airSlate SignNow is designed to be cost-effective, offering various plans to suit different business needs. You can choose from monthly or annual subscriptions, with discounts available for long-term commitments. Each plan includes essential features to streamline your document signing process.

-

What features does airSlate SignNow offer in the 2024 it 225 package?

The 2024 it 225 package includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, users can enjoy advanced eSignature capabilities and integration with popular applications, making document management seamless and efficient.

-

How can airSlate SignNow benefit my business in 2024?

In 2024, airSlate SignNow can signNowly enhance your business operations by simplifying the document signing process. With its user-friendly interface and robust features, you can save time and reduce errors, ultimately improving productivity and customer satisfaction.

-

Are there any integrations available with airSlate SignNow for 2024 it 225?

Yes, airSlate SignNow offers numerous integrations with popular tools and platforms in the 2024 it 225 package. This includes CRM systems, cloud storage services, and productivity applications, allowing you to streamline your workflow and enhance collaboration across your organization.

-

Is airSlate SignNow secure for handling sensitive documents in 2024?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents are encrypted and stored securely. The 2024 it 225 package complies with industry standards and regulations, providing peace of mind when handling sensitive information.

-

Can I customize templates in the 2024 it 225 package?

Yes, the 2024 it 225 package allows you to create and customize templates to fit your specific business needs. This feature enables you to save time on repetitive tasks and ensures consistency in your document workflows.

-

What support options are available for airSlate SignNow users in 2024?

In 2024, airSlate SignNow provides comprehensive support options, including live chat, email support, and an extensive knowledge base. Users can access resources and assistance to help them maximize the benefits of the 2024 it 225 package.

Get more for Form IT 225 New York State Modifications Tax Year

- Denver county absentee affidavid form

- Kaiser on the job occupational health treatment referral form documents dgs ca

- Standard survey work order form outer banks engineering

- Swindon emergency assistance fund form

- Chemistry periodicity worksheet form

- Sherwin williams paint msds sheets pdf form

- For questions regarding voter registration call your county recorder listed on the back of the form you can use this form to

- U s dod form dod va 28 1900

Find out other Form IT 225 New York State Modifications Tax Year

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template