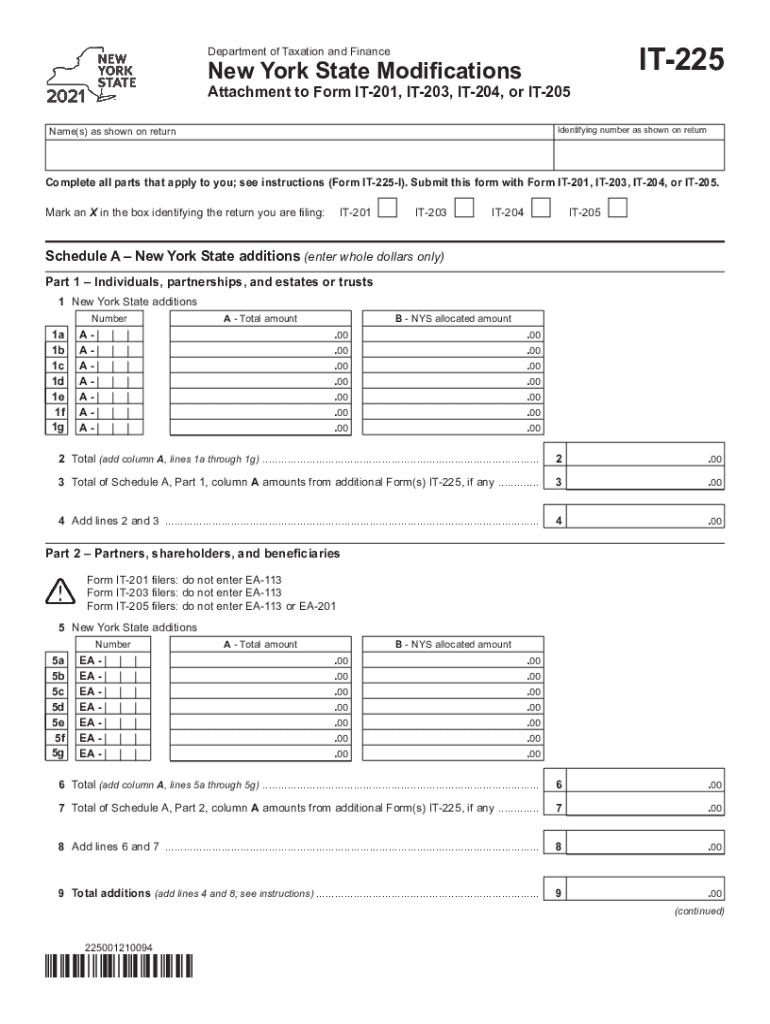

Attachment to Form it 201 or it 203 Tax Ny Gov 2021

What is the Attachment to Form IT 201 or IT 203?

The Attachment to Form IT 201 or IT 203 is a crucial document used in New York State for reporting various modifications to income. This attachment is specifically designed for individuals who need to adjust their taxable income based on specific deductions or credits that are applicable under New York tax law. Understanding this attachment is essential for ensuring accurate tax reporting and compliance with state regulations.

Steps to Complete the Attachment to Form IT 201 or IT 203

Completing the Attachment to Form IT 201 or IT 203 involves several key steps:

- Gather necessary documents, including income statements and any relevant deductions or credits.

- Clearly indicate the modifications to your income on the attachment, ensuring all figures are accurate.

- Double-check calculations to avoid errors that could lead to penalties or delays in processing.

- Attach the completed form to your IT 201 or IT 203 when submitting your tax return.

Legal Use of the Attachment to Form IT 201 or IT 203

The legal use of the Attachment to Form IT 201 or IT 203 is governed by New York State tax laws. It serves as an official record of any modifications made to your income, which is necessary for compliance with state tax obligations. Properly completing this attachment ensures that taxpayers can substantiate their claims for deductions or credits during audits or reviews by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Attachment to Form IT 201 or IT 203 align with the overall tax filing deadlines in New York State. Typically, individual income tax returns are due by April fifteenth of each year. It is important to be aware of any extensions or changes in deadlines that may occur, especially during tax season.

Required Documents

To accurately complete the Attachment to Form IT 201 or IT 203, taxpayers should have the following documents on hand:

- W-2 forms and 1099 statements for income verification.

- Documentation for any deductions or credits being claimed.

- Previous tax returns, if applicable, for reference.

Examples of Using the Attachment to Form IT 201 or IT 203

Examples of when to use the Attachment to Form IT 201 or IT 203 include:

- Claiming deductions for student loan interest paid during the tax year.

- Adjusting income for contributions made to a qualified retirement plan.

- Reporting losses from investments that can offset taxable income.

Who Issues the Form

The Attachment to Form IT 201 or IT 203 is issued by the New York State Department of Taxation and Finance. This agency is responsible for the administration of tax laws in New York, including the issuance of forms and guidelines for taxpayers to follow when filing their returns.

Quick guide on how to complete attachment to form it 201 or it 203 taxnygov

Complete Attachment To Form IT 201 Or IT 203 Tax ny gov effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly and without delays. Handle Attachment To Form IT 201 Or IT 203 Tax ny gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Attachment To Form IT 201 Or IT 203 Tax ny gov with ease

- Find Attachment To Form IT 201 Or IT 203 Tax ny gov and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize essential sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Modify and eSign Attachment To Form IT 201 Or IT 203 Tax ny gov and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct attachment to form it 201 or it 203 taxnygov

Create this form in 5 minutes!

How to create an eSignature for the attachment to form it 201 or it 203 taxnygov

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an e-signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the it 225 feature in airSlate SignNow?

The it 225 feature in airSlate SignNow allows users to easily create, send, and manage electronic signatures for their documents. This feature streamlines the signing process, making it faster and more efficient for businesses of all sizes.

-

How does airSlate SignNow's it 225 integrate with other software?

airSlate SignNow's it 225 offers seamless integrations with popular tools such as Google Drive, Dropbox, and Salesforce. This ensures that you can manage eSigning alongside your existing workflows without any disruptions.

-

What are the pricing options for airSlate SignNow's it 225?

The pricing for airSlate SignNow's it 225 is competitive, with various plans available to suit different business needs. From basic to advanced features, each plan is designed to provide value while enhancing your document management capabilities.

-

Can airSlate SignNow's it 225 help improve document turnaround time?

Yes, utilizing the it 225 feature in airSlate SignNow signNowly improves document turnaround time. By reducing the time spent on printing, signing, and scanning, businesses can expedite their approval processes and enhance productivity.

-

Is it easy to use the it 225 interface in airSlate SignNow?

Absolutely! The it 225 interface in airSlate SignNow is designed with user-friendliness in mind. Your team can quickly learn how to navigate the platform, making electronic signing straightforward and hassle-free.

-

What security measures does airSlate SignNow's it 225 provide?

airSlate SignNow's it 225 prioritizes security with features like encryption and secure access controls. These measures ensure that your documents and signatures are protected against unauthorized access, giving you peace of mind during the signing process.

-

How can it 225 benefit remote teams using airSlate SignNow?

The it 225 feature in airSlate SignNow greatly benefits remote teams by facilitating electronic signatures from any location. This enables seamless collaboration, ensuring that teams can finalize agreements without the need for in-person meetings.

Get more for Attachment To Form IT 201 Or IT 203 Tax ny gov

- Conditional waiver and release upon progress payment colorado form

- Transfer death colorado form

- Deed tod 497299755 form

- Order interrogatories form

- Intestate succession colorado form

- Colorado llc company 497299759 form

- Quitclaim deed individual to individual colorado form

- Special warranty deed personal representative to individual colorado form

Find out other Attachment To Form IT 201 Or IT 203 Tax ny gov

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed