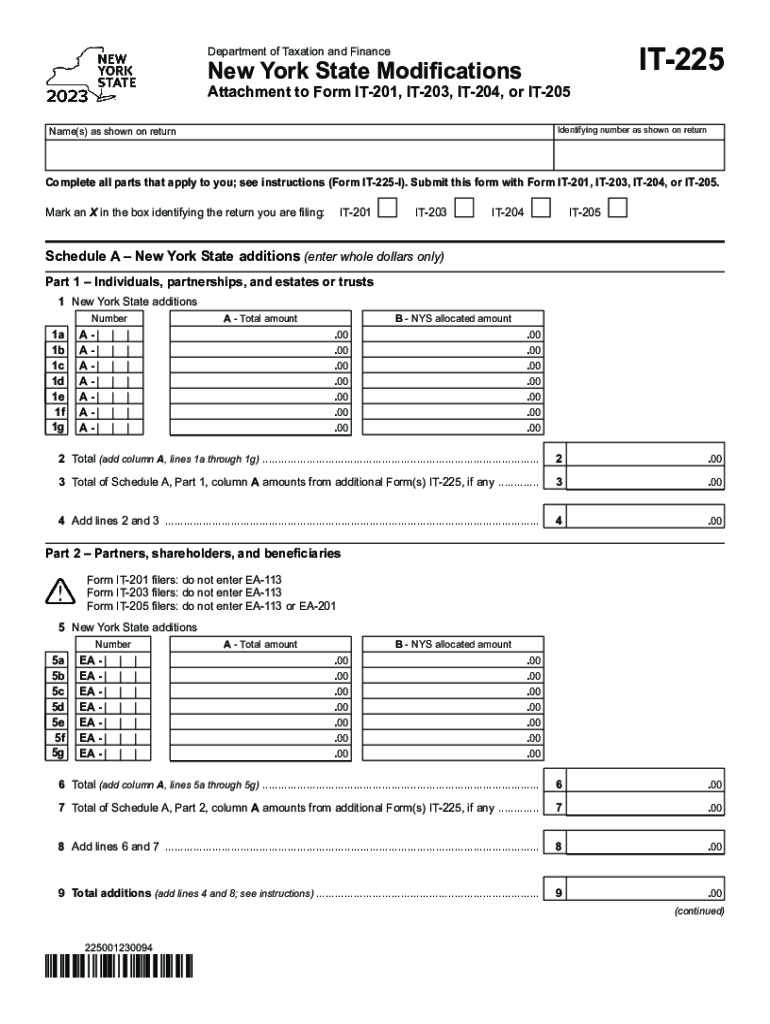

New York Form it 225 New York State Modifications 2023

What is the New York Form IT 225?

The New York Form IT 225 is a state tax form used to report modifications to federal adjusted gross income for New York State tax purposes. This form is essential for individuals who need to make specific adjustments based on New York tax laws. It helps taxpayers accurately calculate their New York taxable income by allowing them to add or subtract certain items that differ from federal tax calculations.

Common modifications reported on the IT 225 include items like New York State lottery winnings, certain pension and annuity income, and adjustments related to college tuition. Understanding this form is crucial for ensuring compliance with state tax regulations and optimizing tax liabilities.

Steps to Complete the New York Form IT 225

Completing the New York Form IT 225 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including your federal tax return and any relevant financial statements. Next, follow these steps:

- Begin by entering your personal information at the top of the form, including your name, address, and Social Security number.

- Review your federal adjusted gross income and determine any modifications that apply to your situation.

- Complete the modification sections of the form, carefully adding or subtracting the relevant amounts as indicated in the instructions.

- Double-check all calculations to ensure accuracy, as errors can lead to delays or penalties.

- Sign and date the form before submitting it with your New York State tax return.

By following these steps, you can effectively complete the IT 225 and ensure all necessary modifications are accounted for in your state tax filing.

How to Obtain the New York Form IT 225

The New York Form IT 225 can be obtained through several convenient methods. The most straightforward way is to visit the New York State Department of Taxation and Finance website, where the form is available for download in PDF format. You can also request a physical copy by contacting the department directly or visiting a local tax office.

Additionally, many tax preparation software programs include the IT 225 as part of their offerings, allowing you to fill it out electronically. This can streamline the process and reduce the likelihood of errors.

Key Elements of the New York Form IT 225

The New York Form IT 225 contains several key elements that are essential for accurate reporting. These include:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Federal Adjusted Gross Income: The starting point for calculating New York taxable income.

- Modification Sections: Specific lines for adding or subtracting various income items as per New York tax law.

- Total Modifications: A summary of all modifications made, which will adjust the federal income figure.

Understanding these elements is crucial for ensuring that all necessary information is accurately reported on the form.

Filing Deadlines for the New York Form IT 225

Filing deadlines for the New York Form IT 225 align with the general deadlines for state tax returns. Typically, individual taxpayers must file their New York State tax return, including the IT 225, by April fifteenth of the year following the tax year. For instance, for the 2021 tax year, the deadline would be April 15, 2022.

If you are unable to meet this deadline, you may be eligible for an extension. However, it is important to note that an extension to file does not extend the time to pay any taxes owed. Therefore, timely payment is necessary to avoid penalties and interest.

Legal Use of the New York Form IT 225

The New York Form IT 225 is legally recognized for reporting modifications to income for state tax purposes. It is essential to use this form correctly to comply with New York tax laws. Failure to accurately report modifications can lead to penalties, interest, or audits by the New York State Department of Taxation and Finance.

Taxpayers should ensure that all information reported on the IT 225 is truthful and complete, as discrepancies can result in legal consequences. Consulting with a tax professional may be beneficial for those with complex financial situations or uncertainties regarding modifications.

Quick guide on how to complete new york form it 225 new york state modifications

Accomplish New York Form IT 225 New York State Modifications effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle New York Form IT 225 New York State Modifications on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign New York Form IT 225 New York State Modifications with ease

- Locate New York Form IT 225 New York State Modifications and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or mislaid documents, monotonous form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign New York Form IT 225 New York State Modifications and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 225 new york state modifications

Create this form in 5 minutes!

How to create an eSignature for the new york form it 225 new york state modifications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2021 NY IT225 form and how does it relate to airSlate SignNow?

The 2021 NY IT225 form is used for reporting various income adjustments on New York State tax returns. airSlate SignNow simplifies the process of signing and sending this document electronically, ensuring that you can manage your tax-related forms efficiently and securely.

-

How can airSlate SignNow help with filling out the 2021 NY IT225 form?

With airSlate SignNow, users can easily upload and fill out the 2021 NY IT225 form online. The platform provides an intuitive interface for editing and signing documents, making it a valuable tool for anyone needing to manage their tax forms.

-

Is airSlate SignNow a cost-effective solution for managing tax documents like the 2021 NY IT225?

Yes, airSlate SignNow offers competitive pricing plans designed to be cost-effective for businesses and individuals managing tax documents such as the 2021 NY IT225. By streamlining your document management, you can save both time and money.

-

What features does airSlate SignNow offer for electronic signatures on documents like the 2021 NY IT225?

airSlate SignNow provides robust features for electronic signatures, including secure eSigning, document tracking, and customizable workflows. These features enhance the signing process for documents like the 2021 NY IT225, ensuring compliance and ease of use.

-

Can I integrate airSlate SignNow with other software to manage the 2021 NY IT225 more effectively?

Yes, airSlate SignNow supports various integrations with popular software applications, making it easier to manage documents including the 2021 NY IT225. This seamless integration allows you to streamline your workflow and maintain all necessary documents in one place.

-

What benefits can I expect from using airSlate SignNow for the 2021 NY IT225?

Using airSlate SignNow for the 2021 NY IT225 provides multiple benefits, including faster processing times, reduced paperwork, and increased security. These advantages help you efficiently manage your tax documents while ensuring compliance with state regulations.

-

Is it easy to share the completed 2021 NY IT225 form using airSlate SignNow?

Absolutely! airSlate SignNow makes it simple to share completed documents like the 2021 NY IT225 with clients or tax preparers via email or secure links. This functionality enhances collaboration and ensures timely submission of your tax forms.

Get more for New York Form IT 225 New York State Modifications

- Positive returns from investment in fusiform rust research srs fs usda

- Maine name change consent waiver form

- Maine state police traffic division motor vehicle form

- Cl8 5 19 mandatory 7 19 form

- Cl8 9 12 mandatory 1 13 form

- First right of refusal horse contract template form

- Fiscal agent contract template form

- Fitness coach contract template form

Find out other New York Form IT 225 New York State Modifications

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship