Tell IRS to Direct Deposit Your Refund to One, Two, or Three 2022

What is the Tell IRS To Direct Deposit Your Refund To One, Two, Or Three

The form known as "Tell IRS To Direct Deposit Your Refund To One, Two, Or Three" is a tax-related document that allows taxpayers to specify how they would like their tax refunds deposited. This form provides options for directing the refund into one, two, or three different bank accounts, offering flexibility to manage personal finances. By using this form, taxpayers can ensure that their refunds are allocated according to their preferences, whether for savings, spending, or other financial goals.

How to use the Tell IRS To Direct Deposit Your Refund To One, Two, Or Three

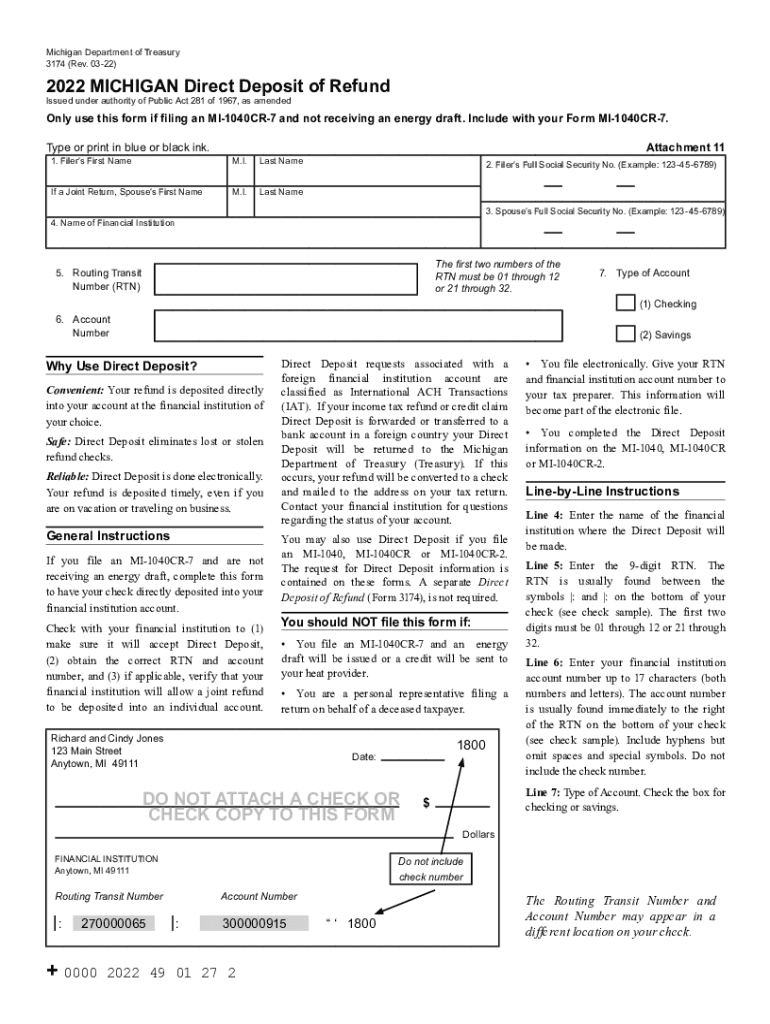

Using the "Tell IRS To Direct Deposit Your Refund To One, Two, Or Three" form involves a straightforward process. Taxpayers need to fill out the form with their personal information, including Social Security number, filing status, and the bank account details for the deposits. It is essential to provide accurate account numbers and routing information to avoid delays in receiving the refund. Once completed, the form should be submitted along with the taxpayer's tax return, either electronically or via mail.

Steps to complete the Tell IRS To Direct Deposit Your Refund To One, Two, Or Three

Completing the "Tell IRS To Direct Deposit Your Refund To One, Two, Or Three" form requires careful attention to detail. Here are the steps to follow:

- Gather necessary personal information, including your Social Security number and filing status.

- Decide how many accounts you want to use for your refund—one, two, or three.

- Obtain the routing numbers and account numbers for each bank account.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the form for any errors before submission.

- Submit the form along with your tax return.

Legal use of the Tell IRS To Direct Deposit Your Refund To One, Two, Or Three

The "Tell IRS To Direct Deposit Your Refund To One, Two, Or Three" form is legally recognized by the IRS as a valid way to direct tax refunds. To ensure the form is legally binding, it must be completed accurately and submitted according to IRS guidelines. Utilizing electronic signatures through a compliant platform can enhance the legal standing of the submitted form, ensuring that it meets eSignature regulations such as ESIGN and UETA.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the "Tell IRS To Direct Deposit Your Refund To One, Two, Or Three" form. Taxpayers should be aware of the following:

- Refunds can only be deposited into accounts that are in the taxpayer's name.

- The IRS limits the number of accounts to which a refund can be directed to three.

- All account information must be accurate to avoid processing delays.

- Taxpayers should retain copies of their forms for their records.

Required Documents

To complete the "Tell IRS To Direct Deposit Your Refund To One, Two, Or Three" form, taxpayers need to prepare several documents, including:

- Your completed tax return form (e.g., Form 1040).

- Bank statements or account information for the accounts you wish to use.

- Identification details, such as your Social Security number.

Quick guide on how to complete tell irs to direct deposit your refund to one two or three

Effortlessly Prepare Tell IRS To Direct Deposit Your Refund To One, Two, Or Three on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, adjust, and electronically sign your documents swiftly without delays. Manage Tell IRS To Direct Deposit Your Refund To One, Two, Or Three on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Tell IRS To Direct Deposit Your Refund To One, Two, Or Three with Ease

- Obtain Tell IRS To Direct Deposit Your Refund To One, Two, Or Three and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tell IRS To Direct Deposit Your Refund To One, Two, Or Three and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tell irs to direct deposit your refund to one two or three

Create this form in 5 minutes!

How to create an eSignature for the tell irs to direct deposit your refund to one two or three

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can I Tell IRS To Direct Deposit Your Refund To One, Two, Or Three accounts?

To tell the IRS to direct deposit your refund into multiple accounts, you'll need to fill out the correct IRS form, typically the Form 1040. This form allows you to specify up to three bank accounts for your refund. Make sure to provide accurate routing and account numbers to avoid any delays.

-

What features does airSlate SignNow offer to help with IRS forms?

airSlate SignNow provides a user-friendly interface that allows you to easily fill out and eSign IRS forms electronically. You can collaborate with others to complete your form and ensure all sections are accurately filled out. This will streamline the process of telling the IRS to direct deposit your refund to multiple accounts.

-

Is there a cost associated with using airSlate SignNow for IRS form submissions?

airSlate SignNow offers a variety of pricing plans tailored to different needs. While there is a subscription fee, the efficiency of the platform can save you time and hassle, making it a cost-effective solution for managing your documents and instructing the IRS to direct deposit your refund to one, two, or three accounts.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow provides numerous benefits, including enhanced security for personal information, the ability to eSign documents from anywhere, and quick turnaround times. By utilizing this platform, you can efficiently tell the IRS to direct deposit your refund to multiple accounts without worrying about the integrity of your data.

-

Can I integrate airSlate SignNow with other tools?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications such as Google Drive, Dropbox, and Salesforce. This integration allows you to streamline workflows and manage your IRS forms more effectively. You can easily tell the IRS to direct deposit your refund to one, two, or three accounts while maintaining full control over your data.

-

How secure is my data with airSlate SignNow?

airSlate SignNow prioritizes data security with advanced encryption and compliance with industry standards. This ensures that your personal information is protected when you fill out and submit IRS forms. Feel confident knowing that your instructions to tell the IRS to direct deposit your refund to multiple accounts are secure.

-

How does airSlate SignNow simplify the tax filing process?

airSlate SignNow simplifies the tax filing process by enabling you to complete and eSign documents quickly and efficiently. This functionality reduces the likelihood of errors and ensures that you can instruct the IRS to direct deposit your refund into one, two, or three accounts without unnecessary complications.

Get more for Tell IRS To Direct Deposit Your Refund To One, Two, Or Three

- Tn workers compensation 497326950 form

- Notice of waiver occupational diseases for workers compensation tennessee form

- Tennessee notice workers form

- Tn workers compensation 497326953 form

- Common carrier form

- Agreement of general contractor for workers compensation tennessee form

- Notice of termination of agreement general contractor for workers compensation tennessee form

- Tennessee workers compensation 497326957 form

Find out other Tell IRS To Direct Deposit Your Refund To One, Two, Or Three

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple