Make Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax 2019

What is the Make Michigan Individual Income Tax E Payments?

The Make Michigan Individual Income Tax E Payments is a digital method for taxpayers in Michigan to submit their state income tax payments electronically. This system allows individuals to pay their taxes conveniently online, ensuring a faster and more efficient process compared to traditional payment methods. The e-payment system is designed to streamline tax compliance and reduce the burden of paperwork, making it easier for residents to meet their tax obligations.

How to Use the Make Michigan Individual Income Tax E Payments

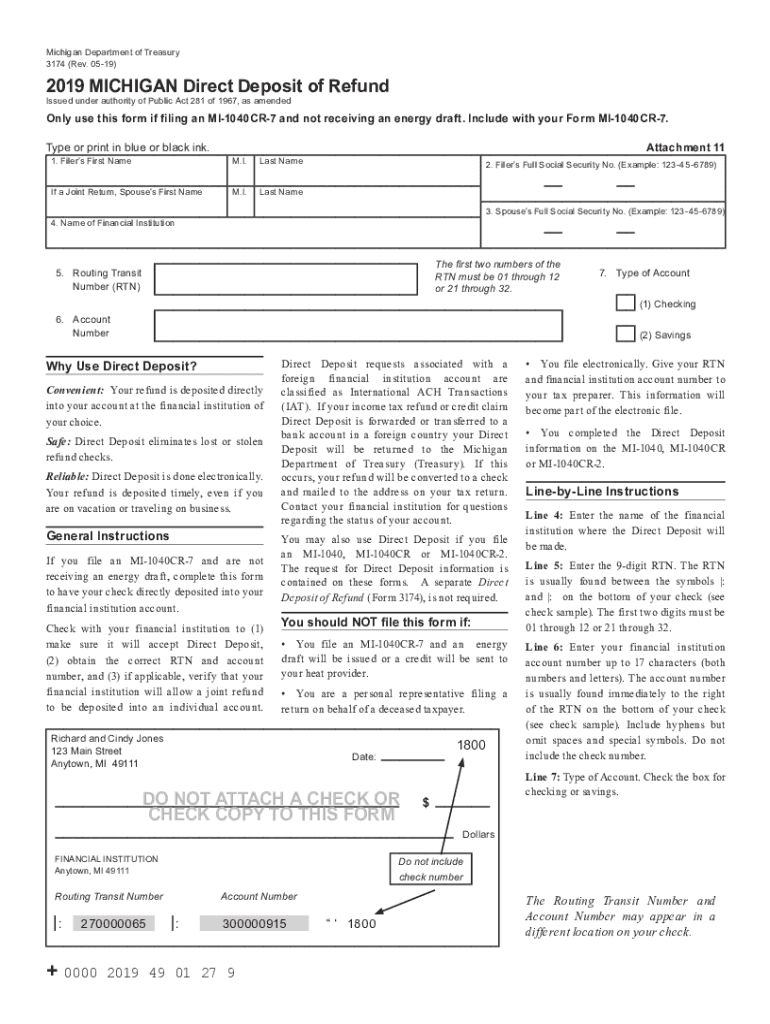

To use the Make Michigan Individual Income Tax E Payments, taxpayers must first access the Michigan Department of Treasury's online payment portal. Users will need to provide their personal information, including Social Security number and tax year, to initiate the payment process. Once logged in, individuals can select their payment method, which may include direct debit from a bank account or credit card options. After confirming the payment details, users can submit their payment securely.

Steps to Complete the Make Michigan Individual Income Tax E Payments

Completing the Make Michigan Individual Income Tax E Payments involves several key steps:

- Visit the Michigan Department of Treasury's e-payment portal.

- Enter your personal information, including your Social Security number and the tax year for which you are making a payment.

- Select your preferred payment method, such as bank transfer or credit card.

- Review the payment details to ensure accuracy.

- Submit your payment and save the confirmation for your records.

Legal Use of the Make Michigan Individual Income Tax E Payments

The Make Michigan Individual Income Tax E Payments is legally recognized as a valid method for fulfilling state tax obligations. To ensure that the payment is considered legitimate, it must comply with the electronic signature regulations set forth by the ESIGN Act and UETA. This means that the digital transaction must include proper authentication measures, such as a secure connection and confirmation receipts, to protect both the taxpayer and the state.

Required Documents for the Make Michigan Individual Income Tax E Payments

When preparing to make Michigan Individual Income Tax E Payments, taxpayers should have the following documents ready:

- Social Security number or Individual Taxpayer Identification Number (ITIN).

- Details of the tax year for which payment is being made.

- Bank account information or credit card details for processing the payment.

Filing Deadlines for the Make Michigan Individual Income Tax E Payments

It is essential for taxpayers to be aware of the filing deadlines associated with the Make Michigan Individual Income Tax E Payments. Typically, individual income tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Timely payments help avoid penalties and interest, ensuring compliance with state tax laws.

Quick guide on how to complete make michigan individual income tax e paymentsmake michigan individual income tax e paymentsmake michigan individual income tax

Accomplish Make Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax effortlessly on any gadget

Digital document administration has surged in popularity among companies and individuals. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, as you can easily locate the appropriate template and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Make Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and eSign Make Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax with ease

- Locate Make Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your updates.

- Choose your method of sharing your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Make Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct make michigan individual income tax e paymentsmake michigan individual income tax e paymentsmake michigan individual income tax

Create this form in 5 minutes!

How to create an eSignature for the make michigan individual income tax e paymentsmake michigan individual income tax e paymentsmake michigan individual income tax

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the process to make Michigan Individual Income Tax e Payments?

To make Michigan Individual Income Tax e Payments, simply visit the Michigan Department of Treasury's e-Payment portal. You'll need to provide your tax information and payment details. After completing the form, you can securely submit your payment online, ensuring a convenient and efficient way to comply with tax regulations.

-

Are there any fees associated with making Michigan Individual Income Tax e Payments?

While making Michigan Individual Income Tax e Payments through the official portal is generally free, additional fees may apply depending on the payment method used. It's essential to review the payment options and their associated costs. Utilizing services like airSlate SignNow can help streamline document management, ensuring all related paperwork is handled efficiently.

-

Can I use airSlate SignNow to manage my tax documents when making Michigan Individual Income Tax e Payments?

Yes, you can use airSlate SignNow to manage and eSign your tax documents when preparing to make Michigan Individual Income Tax e Payments. Our platform helps you easily organize and store your documents, making the tax payment process smoother and ensuring compliance with state regulations.

-

What are the benefits of making Michigan Individual Income Tax e Payments?

Making Michigan Individual Income Tax e Payments offers numerous benefits, including faster processing times and immediate confirmation of your payment. This electronic method eliminates mailing delays and provides a secure way to pay your taxes. Utilizing tools like airSlate SignNow further enhances the experience by simplifying document management.

-

Is my information secure when making Michigan Individual Income Tax e Payments?

Yes, when you make Michigan Individual Income Tax e Payments, security is a top priority. The state utilizes encryption and secure processing technologies to protect your personal and financial information. Additionally, using airSlate SignNow for document management ensures that sensitive tax documents are securely handled and stored.

-

How do I know if my Michigan Individual Income Tax e Payment was successful?

After making Michigan Individual Income Tax e Payments, you will receive immediate confirmation via the online portal. It’s suggested to keep the confirmation number for your records. For added assurance, you can also use airSlate SignNow to track and manage all related correspondence and documentation efficiently.

-

Can I schedule future Michigan Individual Income Tax e Payments?

Yes, many taxpayers can schedule future Michigan Individual Income Tax e Payments through the online payment portal. This feature allows you to set up payments ahead of time, making it easier to manage your tax obligations. Using airSlate SignNow can help ensure that your documents related to these payments are always organized and up-to-date.

Get more for Make Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax

- Imperial county health department in el centro ca form

- Sacramento county stage one child care request for reimbursement 2145 form

- Dha child care 2145s saccounty net form

- Cdph 325 form

- Tax withholding election tax withholding election form

- Application for appointment advisory boards and committees form

- Printable animal bite report form

- Oon medical records cover sheet form

Find out other Make Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax E PaymentsMake Michigan Individual Income Tax

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document