3174, Michigan Direct Deposit of Refund 3174, Michigan Direct Deposit of Refund 2024-2026

Understanding the 3174, Michigan Direct Deposit Of Refund

The 3174 form, known as the Michigan Direct Deposit Of Refund, is a crucial document for taxpayers in Michigan who wish to receive their tax refunds directly into their bank accounts. This method is not only secure but also expedites the refund process, allowing taxpayers to access their funds more quickly than waiting for a paper check. By opting for direct deposit, individuals can ensure that their refunds are deposited into their chosen financial institution, reducing the risk of lost or stolen checks.

Steps to Complete the 3174, Michigan Direct Deposit Of Refund

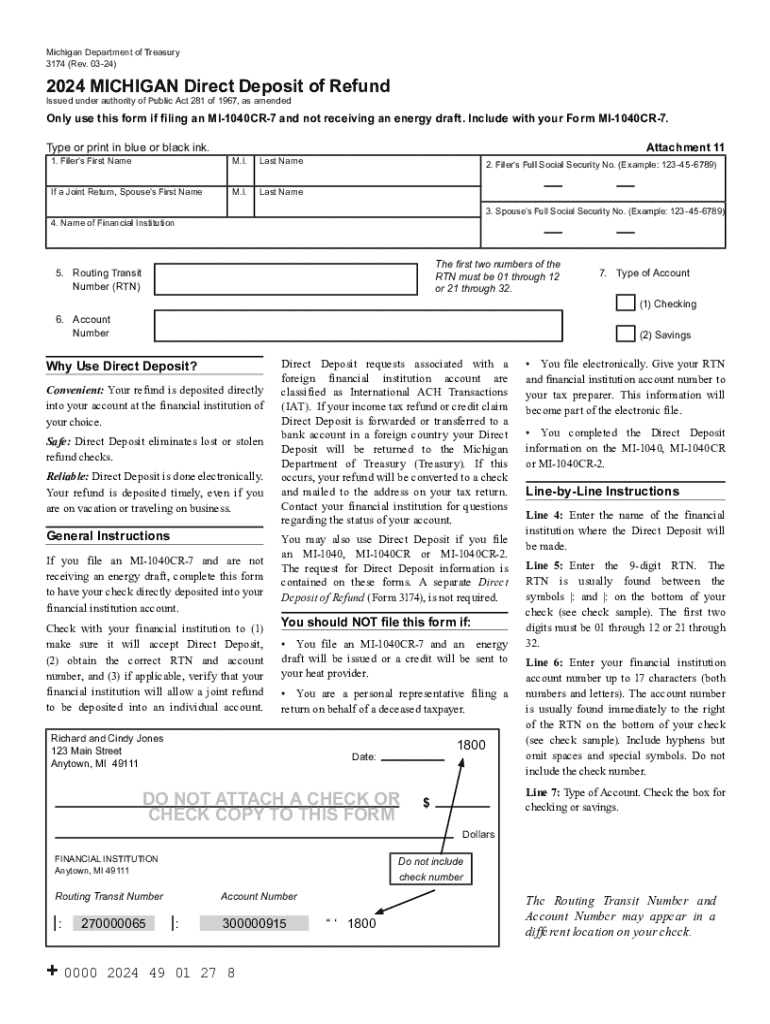

Completing the 3174 form involves several straightforward steps. First, gather your personal information, including your Social Security number and bank account details. Next, accurately fill out the form, ensuring that all information is correct to avoid delays. Pay particular attention to your bank account number and routing number, as errors can lead to misdirected funds. Once completed, review the form for accuracy before submitting it with your tax return.

Eligibility Criteria for the 3174, Michigan Direct Deposit Of Refund

To be eligible for the Michigan Direct Deposit Of Refund, taxpayers must meet specific criteria. Primarily, you must be filing a Michigan individual income tax return and expect a refund. Additionally, the bank account you designate for direct deposit must be a checking or savings account held at a financial institution within the United States. It's important to note that certain types of refunds, such as those related to specific tax credits, may have different requirements or processing times.

Required Documents for the 3174, Michigan Direct Deposit Of Refund

When filling out the 3174 form, certain documents are necessary to ensure a smooth submission process. You will need your completed Michigan income tax return, which provides the basis for your refund. Additionally, having your bank account information readily available is essential, including your account number and routing number. If you are filing jointly, both taxpayers' information may need to be included on the form.

Form Submission Methods for the 3174, Michigan Direct Deposit Of Refund

The 3174 form can be submitted in several ways, depending on how you file your taxes. If you are filing electronically, you can include the form as part of your e-filed tax return. For those who prefer to file by mail, you can print the completed form and send it along with your paper tax return. Ensure that you follow the guidelines provided by the Michigan Department of Treasury for proper submission to avoid any processing delays.

Key Elements of the 3174, Michigan Direct Deposit Of Refund

Several key elements are essential when completing the 3174 form. These include your personal identification details, such as your name and Social Security number, as well as your bank account information. Additionally, the form requires you to indicate whether you want your refund deposited into a checking or savings account. Providing accurate information is critical to ensure that your refund is processed correctly and efficiently.

Create this form in 5 minutes or less

Find and fill out the correct 3174 michigan direct deposit of refund 3174 michigan direct deposit of refund

Create this form in 5 minutes!

How to create an eSignature for the 3174 michigan direct deposit of refund 3174 michigan direct deposit of refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3174, Michigan Direct Deposit Of Refund process?

The 3174, Michigan Direct Deposit Of Refund process allows taxpayers to receive their tax refunds directly into their bank accounts. This method is faster and more secure than receiving a paper check. By opting for direct deposit, you can ensure that your funds are available immediately upon processing.

-

How do I set up 3174, Michigan Direct Deposit Of Refund?

To set up the 3174, Michigan Direct Deposit Of Refund, you need to provide your bank account information when filing your tax return. This includes your bank's routing number and your account number. Ensure that the information is accurate to avoid delays in receiving your refund.

-

What are the benefits of using 3174, Michigan Direct Deposit Of Refund?

Using the 3174, Michigan Direct Deposit Of Refund offers several benefits, including faster access to your funds and reduced risk of lost or stolen checks. Additionally, it simplifies the refund process, allowing you to track your refund status online. Overall, it enhances the convenience of managing your finances.

-

Is there a fee for 3174, Michigan Direct Deposit Of Refund?

No, there is no fee associated with the 3174, Michigan Direct Deposit Of Refund. This service is provided by the state of Michigan at no additional cost to taxpayers. It is a cost-effective way to receive your tax refund without any hidden charges.

-

Can I change my bank account for 3174, Michigan Direct Deposit Of Refund?

Yes, you can change your bank account for the 3174, Michigan Direct Deposit Of Refund by updating your information when you file your tax return. Make sure to provide the correct routing and account numbers to ensure that your refund is deposited into the right account.

-

What if I don’t receive my 3174, Michigan Direct Deposit Of Refund?

If you do not receive your 3174, Michigan Direct Deposit Of Refund, you should first check the status of your refund online. If there are any issues, you may need to contact the Michigan Department of Treasury for assistance. They can provide information on any delays or problems with your direct deposit.

-

Are there any eligibility requirements for 3174, Michigan Direct Deposit Of Refund?

Most taxpayers are eligible for the 3174, Michigan Direct Deposit Of Refund as long as they file their tax returns accurately and on time. However, certain conditions may apply based on your tax situation. It’s best to consult the Michigan Department of Treasury for specific eligibility criteria.

Get more for 3174, Michigan Direct Deposit Of Refund 3174, Michigan Direct Deposit Of Refund

- Documents and perform such acts as may be required for seller to perfect the security interest

- Before any recipient of this form

- The tenant under the lease agreement or under applicable form

- Document form

- Leased premises identified above and are providing you this ninety 90 day notice in accordance form

- Vacate and surrender the leased premises unto landlord within the thirty 30 day notice form

- Areas of sales form

- Name or names of person or persons form

Find out other 3174, Michigan Direct Deposit Of Refund 3174, Michigan Direct Deposit Of Refund

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe