RETURN of EXCISE TAX by VENDORS of UTILITY 2022-2026

What is the return of excise tax by vendors of utility?

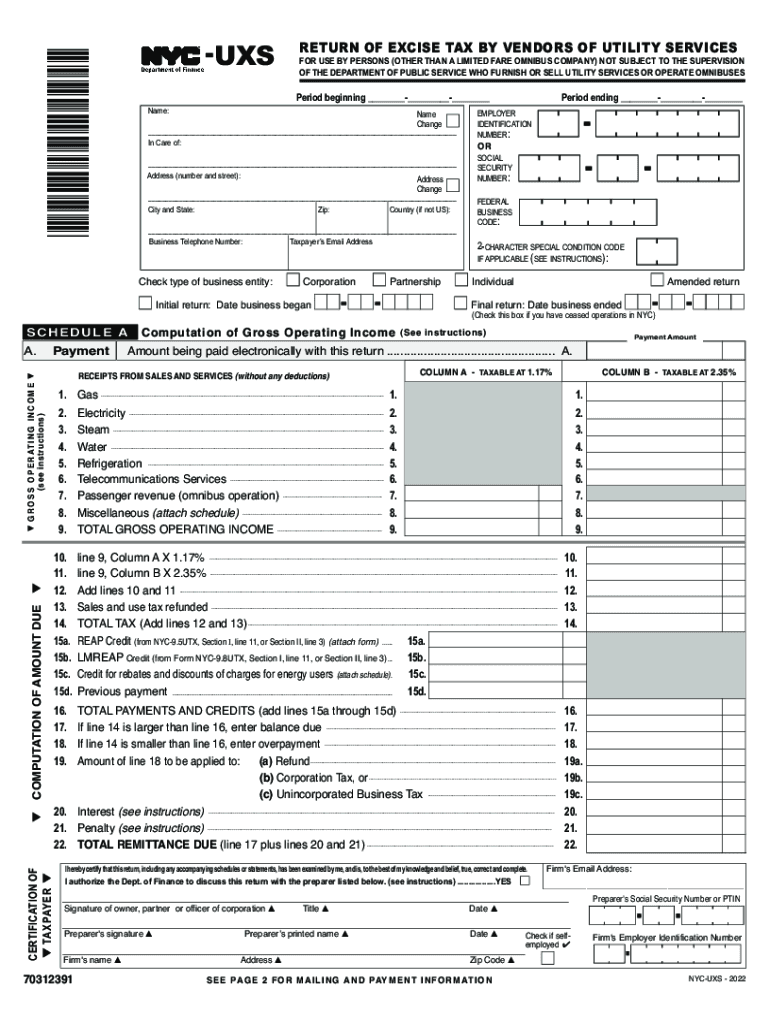

The return of excise tax by vendors of utility refers to the formal process through which utility vendors report and remit excise taxes collected on services provided. This tax is typically levied on services such as electricity, gas, and water. Vendors must ensure compliance with state regulations to avoid penalties. Understanding the nature of this tax is crucial for accurate reporting and maintaining good standing with tax authorities.

How to use the return of excise tax by vendors of utility

To effectively use the return of excise tax by vendors of utility, vendors should first familiarize themselves with the specific form required for reporting. This form typically includes sections for detailing the amount of excise tax collected, the period of reporting, and any deductions or exemptions applicable. Accurate completion of the form is essential to ensure proper tax remittance and compliance with state laws.

Steps to complete the return of excise tax by vendors of utility

Completing the return of excise tax involves several key steps:

- Gather all necessary financial records, including invoices and receipts that reflect the excise tax collected.

- Fill out the return form accurately, ensuring all figures are correct and align with your records.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline, either online or via mail, as per state requirements.

Required documents for the return of excise tax by vendors of utility

When filing the return of excise tax, vendors must prepare several key documents:

- Invoices showing the excise tax collected from customers.

- Financial statements that provide a summary of total sales and tax collected.

- Any applicable exemption certificates if certain sales are exempt from excise tax.

Filing deadlines / important dates

Filing deadlines for the return of excise tax by vendors of utility vary by state. Vendors should be aware of the following important dates:

- Quarterly filing deadlines, typically at the end of each quarter.

- Annual filing deadlines, which may differ from quarterly deadlines.

- Any specific dates for amendments or corrections to previously filed returns.

Penalties for non-compliance

Failure to comply with the requirements for the return of excise tax can result in significant penalties. These may include:

- Fines based on the amount of tax owed.

- Interest accrued on unpaid taxes.

- Potential legal action for repeated non-compliance.

Quick guide on how to complete return of excise tax by vendors of utility

Complete RETURN OF EXCISE TAX BY VENDORS OF UTILITY seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow furnishes you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Handle RETURN OF EXCISE TAX BY VENDORS OF UTILITY on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The simplest way to alter and eSign RETURN OF EXCISE TAX BY VENDORS OF UTILITY effortlessly

- Locate RETURN OF EXCISE TAX BY VENDORS OF UTILITY and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred submission method, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searches, or errors that require reprinting document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign RETURN OF EXCISE TAX BY VENDORS OF UTILITY and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct return of excise tax by vendors of utility

Create this form in 5 minutes!

How to create an eSignature for the return of excise tax by vendors of utility

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York excise tax utility and how does it work?

The New York excise tax utility is a system that helps businesses calculate and manage excise taxes efficiently. By using this utility, organizations can automate their tax compliance processes, reducing the chances of errors. This tool is designed to streamline tax reporting specific to New York's excise tax regulations.

-

How can airSlate SignNow assist with New York excise tax utility documentation?

airSlate SignNow simplifies the process of sending and eSigning documents related to the New York excise tax utility. Our platform enables users to securely share tax-related documents with stakeholders, ensuring compliance and timely submissions. This feature enhances collaboration and minimizes paperwork hassles.

-

Is the New York excise tax utility integrated with other accounting software?

Yes, the New York excise tax utility can integrate seamlessly with popular accounting software solutions. This integration allows businesses to synchronize their financial data efficiently, ensuring accurate tax calculations. By using airSlate SignNow's integration capabilities, companies can enhance their overall financial management.

-

What are the pricing options available for using airSlate SignNow's New York excise tax utility?

airSlate SignNow offers a range of pricing plans designed to accommodate various business sizes and needs. Our plans are cost-effective, ensuring that users of the New York excise tax utility receive great value for their investment. More detailed pricing information can be found on our website, and we also offer a free trial.

-

What features does airSlate SignNow provide for managing New York excise tax utility?

airSlate SignNow includes features such as eSigning, document tracking, and secure storage tailored for New York excise tax utility needs. These features allow users to handle their tax documents safely and efficiently, ensuring compliance with state regulations. The intuitive interface makes it easy for users to navigate and utilize these functionalities.

-

How can I ensure compliance with New York excise tax using airSlate SignNow?

By utilizing airSlate SignNow for your New York excise tax utility needs, you can ensure compliance through automated document management and eSignature verification. Our platform helps you maintain accurate records and timely submissions, reducing the risk of penalties. Additionally, users receive timely updates related to tax law changes.

-

What benefits do businesses experience from using the New York excise tax utility?

Businesses using the New York excise tax utility can expect enhanced efficiency in their tax processes. By automating calculations and filings, companies save time and reduce errors associated with manual processing. This leads to improved cash flow management and a stronger focus on core business operations.

Get more for RETURN OF EXCISE TAX BY VENDORS OF UTILITY

Find out other RETURN OF EXCISE TAX BY VENDORS OF UTILITY

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors