Individual Income TaxDepartment of Revenue Tax Colorado 2022

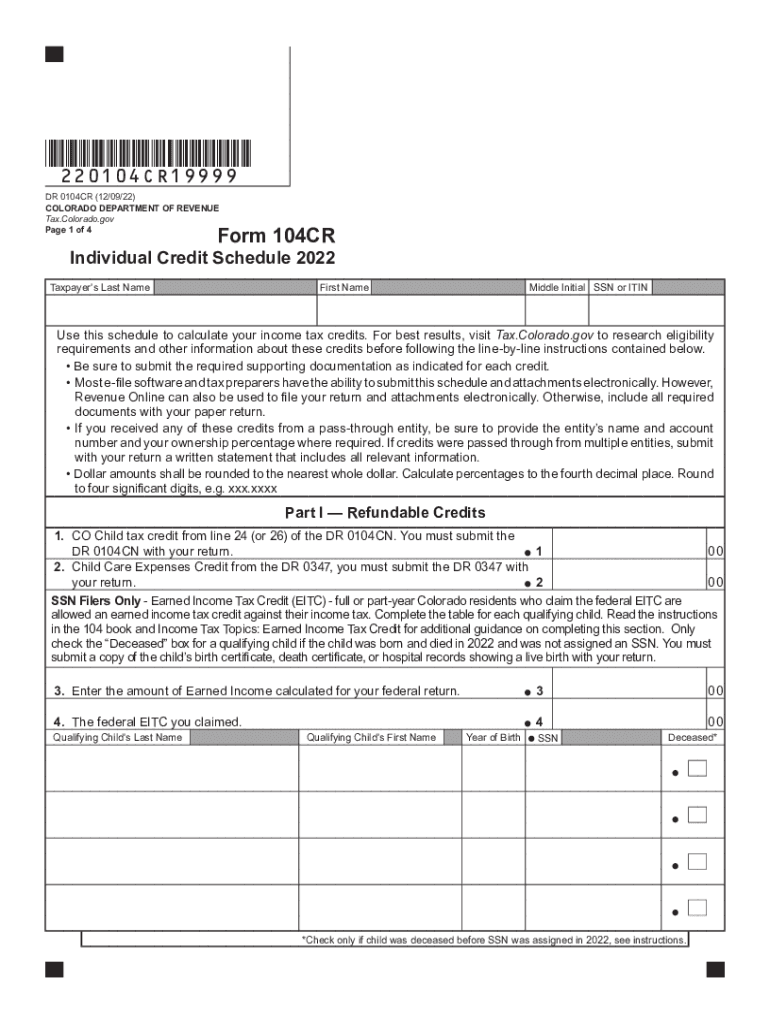

What is the 104CR Form?

The 104CR form, officially known as the Colorado Individual Income Tax Credit Schedule, is used by taxpayers in Colorado to claim various tax credits. These credits can significantly reduce the overall tax liability for individuals and families. The form is essential for ensuring that taxpayers receive the benefits they are entitled to under Colorado tax law.

Steps to Complete the 104CR Form

Completing the 104CR form involves several key steps:

- Gather necessary documents, including your income statements and previous tax returns.

- Review the eligibility criteria for the credits you wish to claim.

- Fill out the form accurately, ensuring all information matches your supporting documents.

- Double-check calculations to avoid errors that could delay processing.

- Submit the completed form along with your state tax return.

Eligibility Criteria for the 104CR Form

To qualify for the credits listed on the 104CR form, taxpayers must meet specific eligibility requirements. Common criteria include:

- Residency in Colorado for the tax year.

- Filing a Colorado individual income tax return.

- Meeting income limits set by the state for certain credits.

- Providing documentation to support claims for each credit.

Legal Use of the 104CR Form

The 104CR form is legally binding when filled out correctly and submitted in accordance with Colorado tax regulations. It is important to ensure compliance with all state laws to avoid penalties. The form must be signed and dated by the taxpayer to validate the claims made within it.

Form Submission Methods

Taxpayers can submit the 104CR form through various methods:

- Online submission via the Colorado Department of Revenue's website.

- Mailing a physical copy of the form to the appropriate tax office.

- In-person submission at designated tax offices.

Filing Deadlines for the 104CR Form

It is crucial to be aware of the filing deadlines for the 104CR form to avoid late penalties. The standard deadline for submitting the form is typically the same as the federal tax return deadline, which is usually April 15. However, extensions may apply, so it is advisable to check the Colorado Department of Revenue's official guidelines for any updates.

Quick guide on how to complete individual income taxdepartment of revenue tax colorado

Complete Individual Income TaxDepartment Of Revenue Tax Colorado effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without hindrances. Manage Individual Income TaxDepartment Of Revenue Tax Colorado on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest method to modify and eSign Individual Income TaxDepartment Of Revenue Tax Colorado without stress

- Find Individual Income TaxDepartment Of Revenue Tax Colorado and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to preserve your alterations.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost files, tiring form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign Individual Income TaxDepartment Of Revenue Tax Colorado and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income taxdepartment of revenue tax colorado

Create this form in 5 minutes!

How to create an eSignature for the individual income taxdepartment of revenue tax colorado

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0104cr and how does it relate to airSlate SignNow?

The dr 0104cr is a specific form that can be electronically signed using the airSlate SignNow platform. This feature allows businesses to handle important documents efficiently, ensuring they meet compliance requirements while streamlining their workflow.

-

What are the pricing options for using airSlate SignNow with dr 0104cr?

airSlate SignNow offers various pricing plans that cater to different business needs, including options to use the dr 0104cr form. You can choose from monthly or yearly subscriptions to find the best value for your usage.

-

What key features does airSlate SignNow provide for dr 0104cr documents?

AirSlate SignNow includes features like customizable templates, advanced security settings, and real-time tracking for dr 0104cr documents. These tools enhance the signing experience, making it easier for businesses to manage their documents.

-

How can airSlate SignNow benefit my organization when using the dr 0104cr form?

Using airSlate SignNow for dr 0104cr forms can signNowly increase your organization's efficiency by reducing the time spent on document processing. It enables quick eSigning and document management, leading to faster transactions and improved customer satisfaction.

-

Is airSlate SignNow compatible with other software when using dr 0104cr?

Yes, airSlate SignNow offers seamless integrations with various popular software, enabling users to easily work with dr 0104cr forms. This compatibility allows for a more fluid workflow, connecting with CRMs, cloud storage, and more.

-

Can multiple users access and sign dr 0104cr documents simultaneously?

Absolutely! With airSlate SignNow, multiple users can access and sign dr 0104cr documents simultaneously. This collaborative feature helps streamline the signing process, reducing bottlenecks in document completion.

-

What security measures does airSlate SignNow implement for dr 0104cr forms?

AirSlate SignNow ensures the security of dr 0104cr forms through robust encryption, multi-factor authentication, and strict compliance with industry standards. These measures safeguard sensitive information, providing peace of mind for users.

Get more for Individual Income TaxDepartment Of Revenue Tax Colorado

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant texas form

- Sample rent increase business letter form

- Seller temporary texas form

- Texas letter services form

- Temporary lease agreement to prospective buyer of residence prior to closing texas form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction texas form

- Texas incomplete construction form

- Letter from landlord to tenant returning security deposit less deductions texas form

Find out other Individual Income TaxDepartment Of Revenue Tax Colorado

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter