Printable Colorado Form 104CR Tax Credits for Individuals 2021

What is the Printable Colorado Form 104CR Tax Credits For Individuals

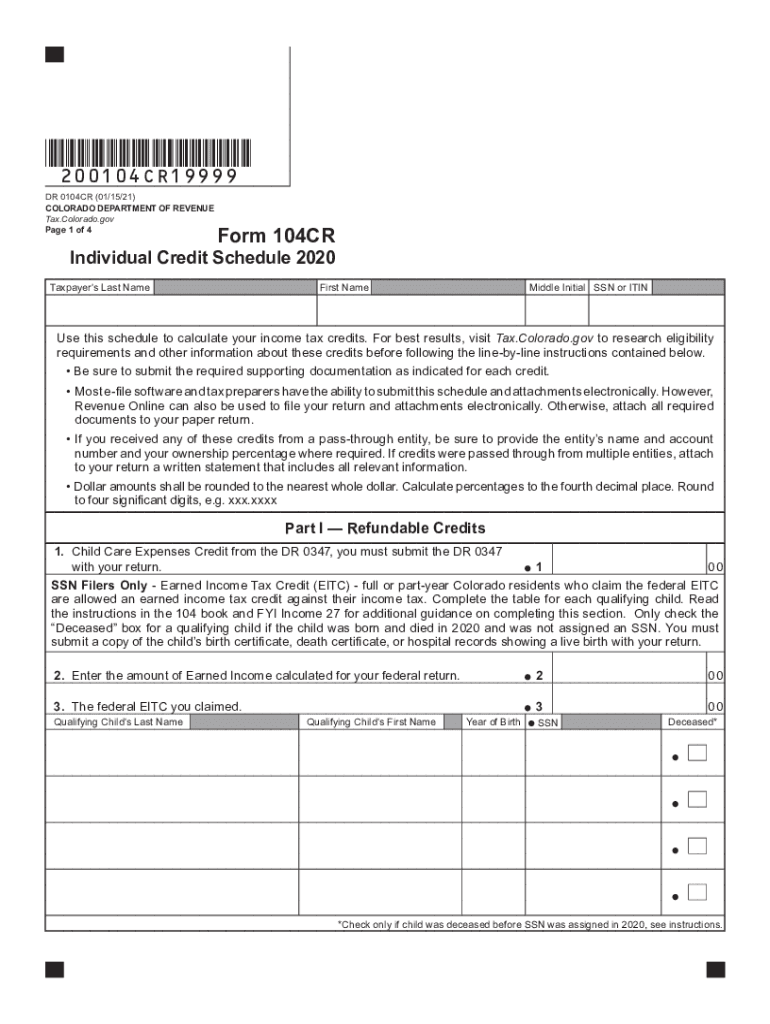

The Printable Colorado Form 104CR is specifically designed for individuals seeking to claim tax credits in the state of Colorado. This form allows taxpayers to report their eligibility for various tax credits, which can significantly reduce their overall tax liability. The credits available may include those for low-income earners, property taxes, and other specific situations defined by the state. Understanding the purpose and function of this form is essential for maximizing potential tax benefits.

How to Use the Printable Colorado Form 104CR Tax Credits For Individuals

Using the Printable Colorado Form 104CR involves several straightforward steps. First, ensure you have the latest version of the form, which can be downloaded from the Colorado Department of Revenue website. Next, gather all necessary documentation, including income statements and any previous tax returns, to accurately complete the form. Carefully fill out each section, ensuring that all information is accurate and complete to avoid delays in processing. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference.

Steps to Complete the Printable Colorado Form 104CR Tax Credits For Individuals

Completing the Printable Colorado Form 104CR requires attention to detail. Follow these steps for a smooth process:

- Download the form from the Colorado Department of Revenue website.

- Review the instructions included with the form to understand eligibility requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any other relevant financial details as required.

- Claim the applicable tax credits by following the guidelines provided in the form.

- Double-check all entries for accuracy before submission.

Legal Use of the Printable Colorado Form 104CR Tax Credits For Individuals

The Printable Colorado Form 104CR is legally binding when completed and submitted according to the state's regulations. To ensure its legal standing, it is crucial to adhere to the guidelines set forth by the Colorado Department of Revenue. This includes providing accurate information and meeting all eligibility criteria for the credits being claimed. Additionally, the form must be signed and dated by the taxpayer, affirming that the information provided is true and complete to the best of their knowledge.

Eligibility Criteria

To qualify for the tax credits available on the Printable Colorado Form 104CR, individuals must meet specific eligibility criteria. These criteria typically include income limits, residency requirements, and other factors defined by the Colorado Department of Revenue. It is essential to review these requirements carefully before completing the form to ensure that you qualify for the credits you intend to claim. Failing to meet these criteria may result in a denial of the claimed credits.

Form Submission Methods

The Printable Colorado Form 104CR can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to submit their forms electronically through the Colorado Department of Revenue's online portal, ensuring faster processing times.

- Mail: For those preferring traditional methods, the completed form can be printed and mailed to the appropriate address provided on the form.

- In-Person: Individuals may also have the option to submit the form in person at designated state offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete printable 2020 colorado form 104cr tax credits for individuals

Complete Printable Colorado Form 104CR Tax Credits For Individuals seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Printable Colorado Form 104CR Tax Credits For Individuals on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The simplest way to adjust and eSign Printable Colorado Form 104CR Tax Credits For Individuals effortlessly

- Obtain Printable Colorado Form 104CR Tax Credits For Individuals and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Printable Colorado Form 104CR Tax Credits For Individuals and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 colorado form 104cr tax credits for individuals

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 colorado form 104cr tax credits for individuals

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is dr 0104cr and how can it benefit my business?

The dr 0104cr is an essential feature of airSlate SignNow that streamlines document signing and management. By utilizing dr 0104cr, businesses can save time and reduce errors, enhancing overall efficiency in document workflows.

-

How much does it cost to use dr 0104cr with airSlate SignNow?

Pricing for airSlate SignNow varies based on the subscription plan chosen, but dr 0104cr functionality is included in all plans. This competitive pricing ensures that businesses can leverage the benefits of dr 0104cr without breaking the bank.

-

Can I integrate dr 0104cr with other applications?

Yes, dr 0104cr can seamlessly integrate with various applications, enhancing your document management ecosystem. By connecting with popular tools like Google Drive and Salesforce, airSlate SignNow makes it easy to incorporate dr 0104cr into your existing workflows.

-

What features does dr 0104cr offer to enhance document security?

dr 0104cr provides multiple layers of security for your documents, including encryption and custom password protection. With airSlate SignNow, you can rest assured that your sensitive information remains secure and only accessed by authorized individuals.

-

Is dr 0104cr user-friendly for small businesses?

Absolutely! dr 0104cr is designed with user experience in mind, making it highly accessible for small businesses. The intuitive interface of airSlate SignNow ensures that users can easily send and eSign documents without extensive training.

-

Does dr 0104cr offer mobile compatibility?

Yes, dr 0104cr is fully compatible with mobile devices, providing on-the-go access to document signing. This ensures that users can manage and sign documents anytime, anywhere, making airSlate SignNow a flexible solution for today’s mobile workforce.

-

What kind of support is available for dr 0104cr users?

airSlate SignNow offers comprehensive support for all users of dr 0104cr, including tutorials, FAQs, and dedicated customer service. The support team is readily available to assist with any queries, ensuring a smooth experience.

Get more for Printable Colorado Form 104CR Tax Credits For Individuals

- Child health record form

- Form cms 2786t 072018 form cms 2786t 072018

- Cms 10287medicare quality of care complaint cms 10287 medicare quality of care complaint fillable pdf form

- Central line checklist form

- Fillable your information your rights our responsibilities

- Model notices of privacy practices questions and hhsgov form

- Healthcare associated infections california department of form

- Categora de aprendizaje form

Find out other Printable Colorado Form 104CR Tax Credits For Individuals

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement