Colorado Form 104CR Tax Credits for Individuals 2021

What is the Colorado Form 104CR Tax Credits For Individuals

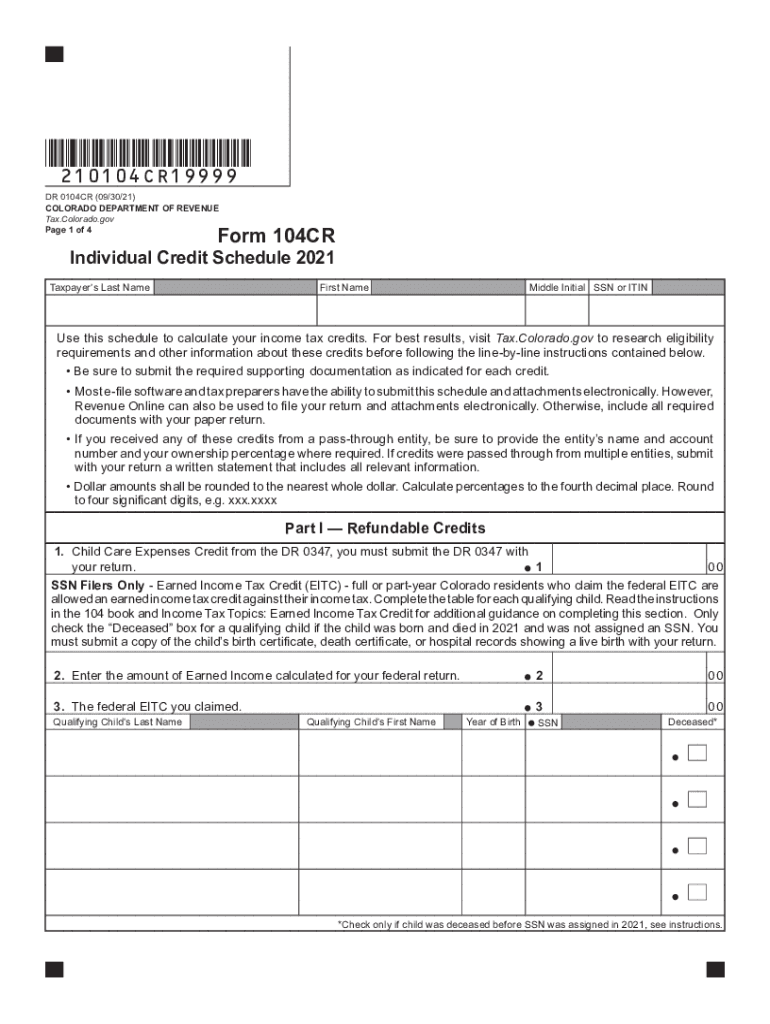

The Colorado Form 104CR is a tax credit form specifically designed for individuals who wish to claim various tax credits available in the state of Colorado. This form allows taxpayers to report their eligibility for credits that can reduce their overall tax liability. These credits may include those for low-income individuals, property taxes, and other specific circumstances that qualify under Colorado tax law. Understanding the purpose and scope of the 104CR form is essential for taxpayers looking to maximize their tax benefits while ensuring compliance with state regulations.

How to use the Colorado Form 104CR Tax Credits For Individuals

Using the Colorado Form 104CR involves several steps to ensure that all eligible credits are accurately claimed. Taxpayers should first gather all necessary documentation related to their income, property taxes, and any other relevant financial information. Once the required documents are ready, individuals can fill out the form by providing personal information, detailing income sources, and specifying the credits being claimed. It is crucial to review all entries for accuracy before submission, as errors can lead to delays or penalties.

Steps to complete the Colorado Form 104CR Tax Credits For Individuals

Completing the Colorado Form 104CR requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including income statements and property tax records.

- Download or obtain a copy of the Colorado Form 104CR.

- Fill out personal information, including your name, address, and Social Security number.

- Detail your income sources and any deductions you may qualify for.

- Identify and list the specific tax credits you are claiming.

- Double-check all entries for accuracy and completeness.

- Submit the completed form by the designated deadline.

Eligibility Criteria

To qualify for the credits listed on the Colorado Form 104CR, taxpayers must meet specific eligibility criteria. Generally, these criteria include income limits, residency requirements, and other conditions based on the type of credit being claimed. For example, some credits may be available only to low-income individuals or those who own property in Colorado. It is important for taxpayers to review the eligibility requirements carefully to ensure they qualify for the credits they intend to claim.

Form Submission Methods

The Colorado Form 104CR can be submitted through various methods, providing flexibility for taxpayers. Individuals may choose to file the form online, which is often the quickest method, or they can opt to mail a paper copy to the appropriate tax authority. In-person submissions may also be possible at designated tax offices. Each method has its own processing times and requirements, so it is advisable to consider the most convenient option based on individual circumstances.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado Form 104CR are crucial to ensure compliance and avoid penalties. Typically, the form must be submitted by the state tax filing deadline, which aligns with the federal tax deadline. Taxpayers should be aware of any extensions or specific dates that may apply to their situation, especially if they are claiming credits that require additional documentation. Keeping track of these important dates is essential for a smooth filing process.

Quick guide on how to complete colorado form 104cr tax credits for individuals

Manage Colorado Form 104CR Tax Credits For Individuals seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents swiftly without delays. Handle Colorado Form 104CR Tax Credits For Individuals on any platform using airSlate SignNow’s Android or iOS applications and simplify any paperwork process today.

How to modify and eSign Colorado Form 104CR Tax Credits For Individuals effortlessly

- Find Colorado Form 104CR Tax Credits For Individuals and click on Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature utilizing the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to retain your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Colorado Form 104CR Tax Credits For Individuals to guarantee outstanding communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado form 104cr tax credits for individuals

Create this form in 5 minutes!

How to create an eSignature for the colorado form 104cr tax credits for individuals

The way to make an e-signature for a PDF file online

The way to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an e-signature straight from your mobile device

The way to make an e-signature for a PDF file on iOS

The best way to make an e-signature for a PDF document on Android devices

People also ask

-

What is dr 0104cr and how does it work?

The dr 0104cr is a powerful tool designed within airSlate SignNow, enabling users to send and eSign documents effortlessly. It simplifies the document signing process, making it accessible to both businesses and individuals. By utilizing the dr 0104cr feature, you can enhance your workflow efficiency and streamline document management.

-

What are the pricing plans for dr 0104cr?

airSlate SignNow offers competitive pricing plans for dr 0104cr to cater to different business needs. You can choose from various tiers that provide flexibility based on your specific requirements for document signing and management. Each plan is designed to be cost-effective, ensuring you get the best value for your investment.

-

What features does dr 0104cr include?

The dr 0104cr comes equipped with a variety of features that enhance document handling, including customizable templates, advanced security options, and integration capabilities. Users can benefit from real-time tracking and notifications, ensuring efficient collaboration. With these features, dr 0104cr positions itself as an all-in-one solution for e-signing needs.

-

How can dr 0104cr benefit my business?

Incorporating dr 0104cr can signNowly improve your business operations by expediting the document signing process while ensuring compliance and security. It reduces paper usage and eliminates manual workflows, increasing productivity. By using airSlate SignNow's dr 0104cr, you can also enhance customer satisfaction through timely document transactions.

-

Can I integrate dr 0104cr with other tools?

Yes, dr 0104cr offers seamless integration with various tools and platforms, allowing for a smoother workflow. It is compatible with popular business applications, ensuring that your document processes align with existing systems. This integration capability is a key feature of airSlate SignNow, making dr 0104cr a versatile choice.

-

Is dr 0104cr mobile-friendly?

Absolutely! dr 0104cr is optimized for mobile devices, allowing you to send and eSign documents on the go. The mobile-friendly design ensures that you have access to all features and functionalities, making document management convenient and efficient wherever you are. Experience the flexibility of airSlate SignNow with dr 0104cr on any device.

-

What security measures are in place for dr 0104cr?

airSlate SignNow takes security seriously with dr 0104cr, implementing advanced encryption and authentication measures to protect your documents. Every document signed through dr 0104cr is secured, ensuring compliance with legal standards. Your sensitive information remains safe during the entire signing process.

Get more for Colorado Form 104CR Tax Credits For Individuals

- Warranty deed from six grantors to one grantee missouri form

- Deed individual trust 497313054 form

- Warranty deed trust to trust missouri form

- Ex husband divorce form

- Quitclaim deed four individuals to a limited liability company missouri form

- Mo warranty 497313058 form

- Heirship affidavit descent missouri form

- Affidavit error form

Find out other Colorado Form 104CR Tax Credits For Individuals

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free