DR 0104CR, Individual Credit Schedule 2024-2026

What is the DR 0104CR, Individual Credit Schedule

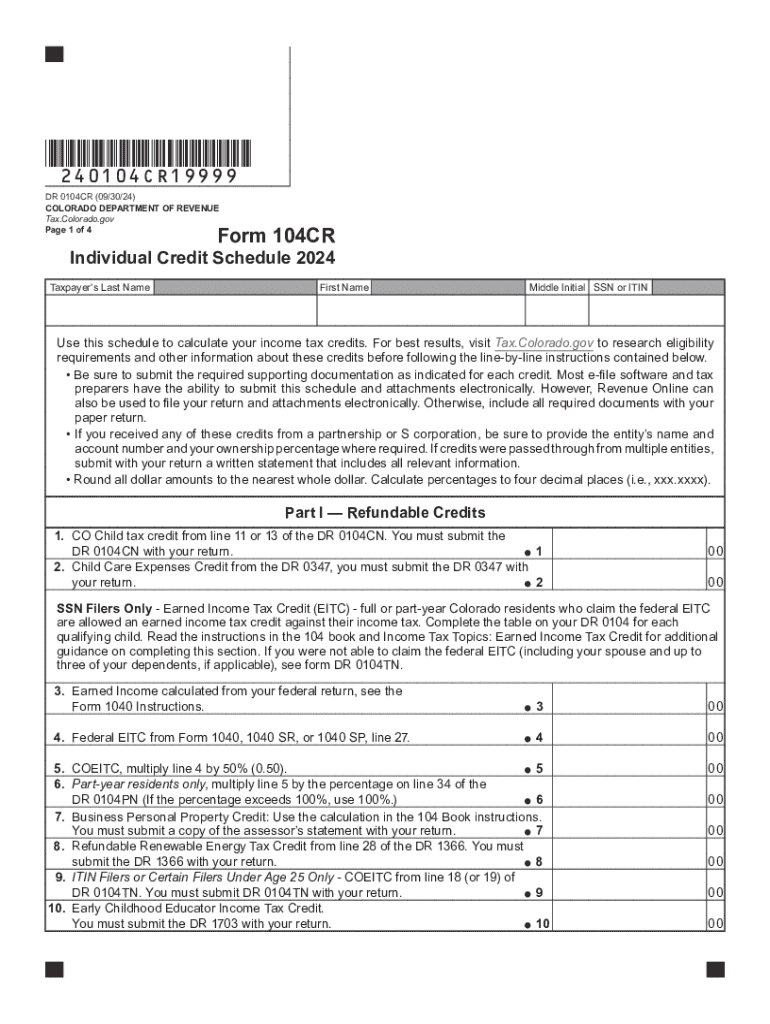

The DR 0104CR, also known as the Individual Credit Schedule, is a form used by Colorado taxpayers to claim various tax credits. This schedule is specifically designed to complement the Colorado Individual Income Tax Return, allowing individuals to report their eligibility for credits that can reduce their overall tax liability. The form includes information on credits such as the Earned Income Tax Credit, Child Tax Credit, and other state-specific credits that may apply to taxpayers based on their circumstances.

How to use the DR 0104CR, Individual Credit Schedule

To effectively use the DR 0104CR, taxpayers should first gather all necessary documentation related to their income and potential credits. The form requires specific details about the taxpayer's situation, including income levels, dependents, and any qualifying expenses. After filling out the form, it must be attached to the main Colorado income tax return. This ensures that the credits claimed are properly accounted for when calculating the total tax owed or refund expected.

Steps to complete the DR 0104CR, Individual Credit Schedule

Completing the DR 0104CR involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and records of any qualifying expenses.

- Review the instructions for the DR 0104CR to understand eligibility for specific credits.

- Fill out the form, providing accurate information regarding income, dependents, and credits being claimed.

- Double-check the completed form for accuracy and completeness.

- Attach the DR 0104CR to your Colorado income tax return before submission.

Eligibility Criteria

Eligibility for claiming credits on the DR 0104CR depends on several factors, including income level, filing status, and the number of dependents. Taxpayers must meet specific income thresholds to qualify for certain credits, such as the Earned Income Tax Credit. Additionally, some credits may have age or residency requirements. It is important for taxpayers to review the eligibility criteria outlined in the form instructions to determine which credits they can claim.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the DR 0104CR. Typically, the Colorado income tax return, including the DR 0104CR, is due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also note any extensions that may apply and ensure that all forms are submitted on time to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The DR 0104CR can be submitted through various methods, providing flexibility for taxpayers. Individuals can file their Colorado income tax return, including the DR 0104CR, online through approved e-filing services. Alternatively, taxpayers may choose to mail their completed forms to the appropriate state tax office. In-person submissions are also accepted at designated locations, allowing for direct interaction with tax officials if needed.

Create this form in 5 minutes or less

Find and fill out the correct dr 0104cr individual credit schedule

Create this form in 5 minutes!

How to create an eSignature for the dr 0104cr individual credit schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0104cr and how does it relate to airSlate SignNow?

dr 0104cr is a specific document type that can be efficiently managed using airSlate SignNow. This platform allows users to send, sign, and store dr 0104cr documents securely, streamlining the entire process for businesses.

-

How much does airSlate SignNow cost for managing dr 0104cr documents?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those focused on dr 0104cr documents. You can choose from monthly or annual subscriptions, ensuring you get the best value for your investment.

-

What features does airSlate SignNow provide for dr 0104cr document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning specifically for dr 0104cr documents. These tools enhance efficiency and ensure compliance with legal standards.

-

What are the benefits of using airSlate SignNow for dr 0104cr?

Using airSlate SignNow for dr 0104cr offers numerous benefits, including faster turnaround times, reduced paper usage, and improved document security. This solution empowers businesses to operate more efficiently and sustainably.

-

Can airSlate SignNow integrate with other software for dr 0104cr management?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for dr 0104cr documents. This includes CRM systems, cloud storage services, and productivity tools, making it a versatile choice.

-

Is airSlate SignNow user-friendly for handling dr 0104cr documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage dr 0104cr documents. The intuitive interface ensures that users can quickly learn how to send and sign documents without extensive training.

-

How secure is airSlate SignNow for dr 0104cr document transactions?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect dr 0104cr document transactions. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for DR 0104CR, Individual Credit Schedule

Find out other DR 0104CR, Individual Credit Schedule

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document