DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule 2022

What is the DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule

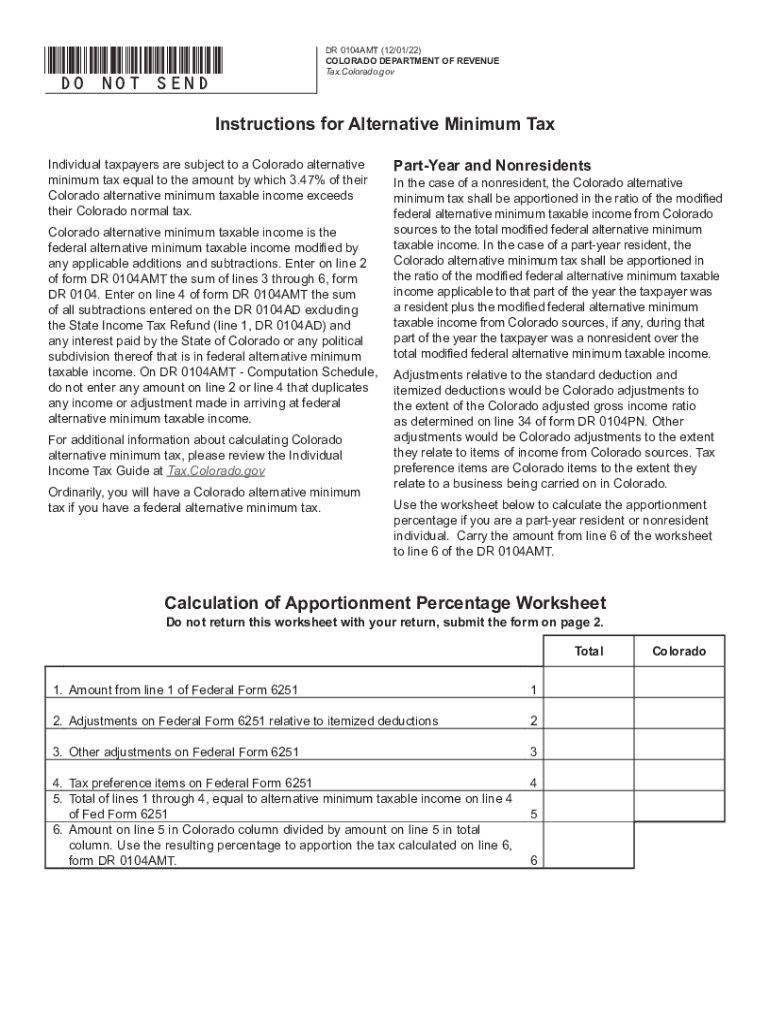

The DR 0104AMT is a form used by Colorado taxpayers to calculate their Alternative Minimum Tax (AMT) liability. This schedule is essential for individuals whose tax situation may require them to pay a minimum amount of tax, regardless of deductions or credits claimed on their standard tax return. The AMT ensures that taxpayers with higher incomes pay a fair share of taxes, even if they qualify for significant deductions. Understanding this form is crucial for accurate tax reporting and compliance.

Steps to complete the DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule

Completing the DR 0104AMT involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total income and adjustments to determine your AMT income.

- Identify applicable deductions and credits that may affect your AMT calculation.

- Fill out the form, ensuring all calculations are accurate and complete.

- Review the completed form for any errors before submission.

Legal use of the DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule

The DR 0104AMT is legally recognized as a valid document for calculating Alternative Minimum Tax in Colorado. To ensure compliance with state tax laws, it is important to use the form correctly and submit it along with your Colorado income tax return. The form must be filled out accurately to avoid potential legal issues or penalties. Utilizing this form helps maintain transparency and accountability in tax reporting.

Key elements of the DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule

Several key elements are included in the DR 0104AMT, which are vital for accurate completion:

- AMT Income: This is the income subject to the Alternative Minimum Tax, calculated after adjustments.

- Deductions: Specific deductions that can be claimed under AMT rules, which may differ from standard deductions.

- Tax Rates: The applicable AMT rates that determine the tax owed based on AMT income.

- Credits: Any credits that can reduce the AMT liability, which must be documented on the form.

How to obtain the DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule

The DR 0104AMT can be obtained through the Colorado Department of Revenue's official website. Taxpayers can download the form in PDF format, ensuring they have the most current version for their tax filings. Additionally, physical copies may be available at local tax offices or through certified tax professionals. It is important to ensure that you are using the correct year’s form to comply with current tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the DR 0104AMT coincide with the general Colorado income tax return deadlines. Typically, individual income tax returns are due by April 15 of each year. If you require additional time, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates is essential for timely compliance and to avoid unnecessary fees.

Quick guide on how to complete dr 0104amt 2022 colorado alternative minimum tax computation schedule

Effortlessly Prepare DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule on Any Device

The management of documents online has gained signNow popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delay. Manage DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and Electronically Sign DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule

- Locate DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to share your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns regarding lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any chosen device. Modify and electronically sign DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule and ensure superior communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 0104amt 2022 colorado alternative minimum tax computation schedule

Create this form in 5 minutes!

How to create an eSignature for the dr 0104amt 2022 colorado alternative minimum tax computation schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0104amt and how does it integrate with airSlate SignNow?

dr 0104amt is a streamlined feature offered within airSlate SignNow that simplifies document workflows. It allows users to eSign documents quickly and efficiently, ensuring that your business can manage agreements without the hassle of traditional methods.

-

Is dr 0104amt cost-effective for small businesses?

Yes, dr 0104amt is designed to be a cost-effective solution for small businesses looking to manage their documentation needs. With competitive pricing and scalable plans, airSlate SignNow enables you to leverage advanced eSigning features without breaking the bank.

-

What key features are included with dr 0104amt?

dr 0104amt incorporates several key features such as customizable templates, secure cloud storage, and real-time tracking of document status. These functionalities enhance the overall user experience and streamline the eSigning process for all parties involved.

-

Can dr 0104amt improve my team's productivity?

Absolutely! By utilizing dr 0104amt within airSlate SignNow, your team can focus more on core business tasks rather than getting bogged down with paperwork. The swift execution of document workflows increases efficiency, allowing for quicker decision-making.

-

Does airSlate SignNow with dr 0104amt offer integrations with other software?

Yes, airSlate SignNow integrates seamlessly with various software applications to enhance your workflow, including CRM and project management tools. This means you can utilize dr 0104amt alongside your existing systems without any disruptions.

-

How secure is the dr 0104amt eSigning process?

dr 0104amt ensures a highly secure eSigning process through advanced encryption and compliance with industry standards. Your sensitive documents remain protected throughout the signing process, giving you peace of mind while managing agreements.

-

Can I customize documents using dr 0104amt?

Yes, one of the benefits of utilizing dr 0104amt is its ability to allow users to customize documents to fit their specific needs. You can easily modify templates, add fields for information, and tailor your documents for various use cases.

Get more for DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule

- New home completed construction form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return texas form

- Assessment threatened endangered species form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return texas form

- Letter from tenant to landlord containing request for permission to sublease texas form

- Texas seller financing form

- Tx sublease form

- Tx contract resale form

Find out other DR 0104AMT Colorado Alternative Minimum Tax Computation Schedule

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template