DR 0104AMT, Colorado Alternative Minimum Tax Computation Schedule If You Are Using a Screen Reader or Other Assistive Technology 2024-2026

Understanding the Colorado DR 0104AMT

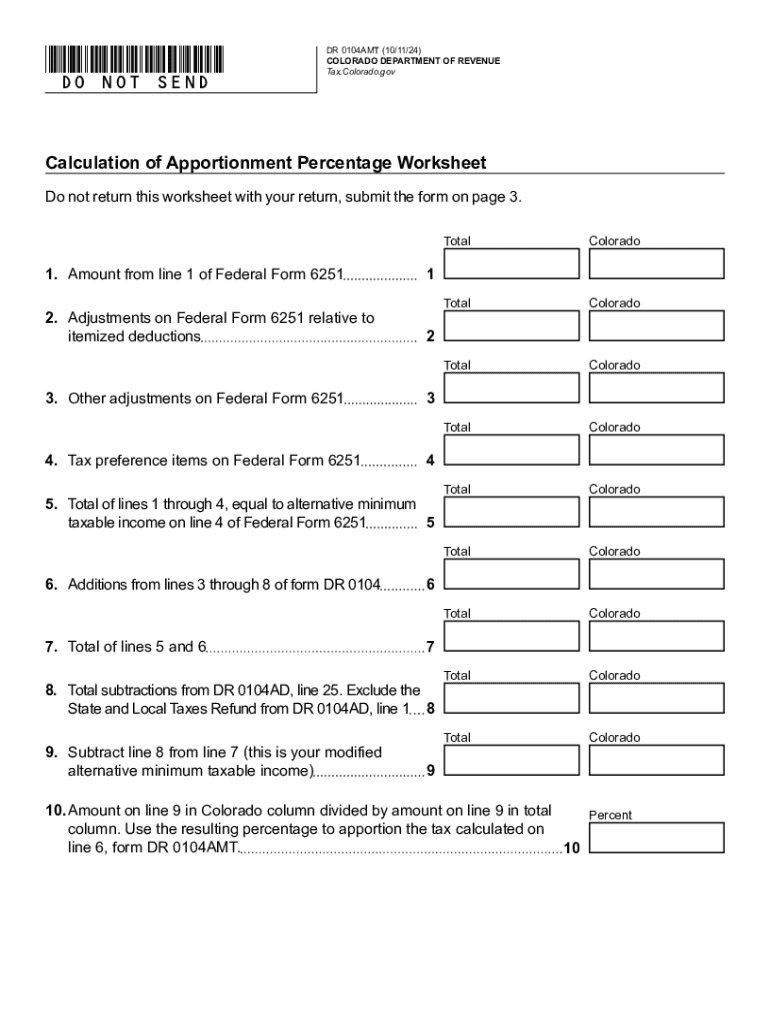

The Colorado DR 0104AMT is the Alternative Minimum Tax Computation Schedule used by taxpayers in Colorado. This form is essential for individuals who may be subject to the alternative minimum tax, which ensures that taxpayers pay at least a minimum amount of tax, regardless of deductions or credits. The DR 0104AMT calculates the alternative minimum taxable income and the corresponding tax owed. It is important for taxpayers to understand their liabilities under this tax structure, as it can affect overall tax obligations significantly.

Steps to Complete the DR 0104AMT

Completing the Colorado DR 0104AMT involves several key steps:

- Gather necessary financial documents, including income statements and deduction records.

- Calculate your alternative minimum taxable income by adjusting your regular taxable income with specific add-backs and deductions.

- Use the form to compute the alternative minimum tax based on the calculated income.

- Review the form for accuracy before submission.

Each step is crucial to ensure compliance with Colorado tax laws and to avoid potential penalties.

Key Elements of the DR 0104AMT

The DR 0104AMT includes several important elements that taxpayers must be aware of:

- Taxpayer identification information, including Social Security numbers.

- Details of income sources and adjustments specific to alternative minimum tax calculations.

- Calculation sections for both the alternative minimum taxable income and the resulting tax due.

- Instructions for filing and any necessary attachments.

Understanding these elements can help taxpayers accurately complete the form and ensure all required information is provided.

Filing Deadlines for the DR 0104AMT

Taxpayers must be aware of the deadlines for filing the Colorado DR 0104AMT to avoid penalties. Generally, the form is due on the same date as the federal tax return, which is typically April fifteenth. However, if taxpayers file for an extension, they should ensure that the DR 0104AMT is submitted by the extended deadline to remain compliant with state tax laws.

Legal Use of the DR 0104AMT

The DR 0104AMT is legally required for certain taxpayers in Colorado who meet specific income thresholds. Failing to file this form when required can result in penalties and interest on unpaid taxes. Taxpayers should familiarize themselves with the legal implications of the alternative minimum tax and ensure they file the form correctly to avoid legal issues.

Examples of Using the DR 0104AMT

Consider a taxpayer with a high income who has significant deductions. This individual may find that their regular tax liability is reduced to a level below the minimum tax threshold. In such cases, the DR 0104AMT becomes crucial as it recalculates the tax liability to ensure compliance with the minimum tax requirement. Understanding these scenarios can help taxpayers anticipate their tax obligations more effectively.

Create this form in 5 minutes or less

Find and fill out the correct dr 0104amt colorado alternative minimum tax computation schedule if you are using a screen reader or other assistive technology

Create this form in 5 minutes!

How to create an eSignature for the dr 0104amt colorado alternative minimum tax computation schedule if you are using a screen reader or other assistive technology

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is colorado dr 0104amt and how does it benefit my business?

Colorado dr 0104amt is a powerful feature within airSlate SignNow that streamlines the document signing process. It allows businesses to send and eSign documents quickly and securely, enhancing efficiency and reducing turnaround times. By utilizing colorado dr 0104amt, you can improve your workflow and ensure that important documents are handled promptly.

-

How much does airSlate SignNow with colorado dr 0104amt cost?

The pricing for airSlate SignNow, including the colorado dr 0104amt feature, is designed to be cost-effective for businesses of all sizes. We offer various subscription plans that cater to different needs, ensuring you only pay for what you use. For detailed pricing information, please visit our pricing page.

-

What features are included with colorado dr 0104amt?

Colorado dr 0104amt includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance your document management experience and ensure that you can easily send and eSign documents. With colorado dr 0104amt, you can also integrate with other tools to streamline your processes.

-

Can I integrate colorado dr 0104amt with other software?

Yes, colorado dr 0104amt can be seamlessly integrated with various software applications, including CRM systems and project management tools. This integration allows for a more cohesive workflow, enabling you to manage documents alongside your existing processes. Check our integrations page for a full list of compatible applications.

-

Is colorado dr 0104amt secure for sensitive documents?

Absolutely! Colorado dr 0104amt prioritizes security, employing advanced encryption and compliance with industry standards to protect your sensitive documents. You can trust that your data is safe while using airSlate SignNow. Our commitment to security ensures that your business can operate with confidence.

-

How does colorado dr 0104amt improve document turnaround times?

Colorado dr 0104amt signNowly reduces document turnaround times by allowing users to send and eSign documents instantly. With features like automated reminders and real-time notifications, you can keep track of the signing process and ensure timely completion. This efficiency helps your business maintain momentum and meet deadlines.

-

What types of documents can I manage with colorado dr 0104amt?

With colorado dr 0104amt, you can manage a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different business needs. Whether you need to send a simple form or a complex contract, colorado dr 0104amt has you covered.

Get more for DR 0104AMT, Colorado Alternative Minimum Tax Computation Schedule If You Are Using A Screen Reader Or Other Assistive Technology

Find out other DR 0104AMT, Colorado Alternative Minimum Tax Computation Schedule If You Are Using A Screen Reader Or Other Assistive Technology

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors