Sample Form W 8ECI Harding & Associates Tax Services

What is the Sample Form W-8ECI Harding & Associates Tax Services

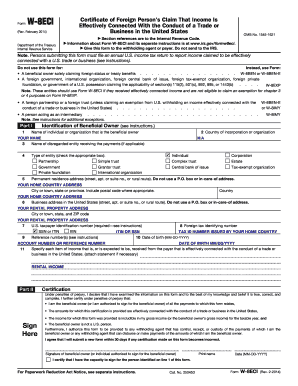

The Sample Form W-8ECI is a tax document used by foreign entities to certify that income received from U.S. sources is effectively connected with the conduct of a trade or business in the United States. This form is essential for foreign businesses that wish to avoid withholding tax on income that is connected to their operations in the U.S. By submitting this form, entities can ensure compliance with U.S. tax regulations and potentially reduce their tax liabilities.

How to use the Sample Form W-8ECI Harding & Associates Tax Services

To effectively use the Sample Form W-8ECI, foreign entities must complete the form accurately and submit it to the withholding agent or payer of the income. This process involves providing essential information such as the entity's name, address, and taxpayer identification number. It is crucial to ensure that all details are correct to avoid delays in processing and to ensure proper tax treatment.

Steps to complete the Sample Form W-8ECI Harding & Associates Tax Services

Completing the Sample Form W-8ECI involves several key steps:

- Gather necessary information, including the entity's legal name and address.

- Provide the entity's U.S. taxpayer identification number, if applicable.

- Indicate the type of income being received and confirm that it is effectively connected with a U.S. trade or business.

- Sign and date the form to certify that the information provided is accurate and complete.

Legal use of the Sample Form W-8ECI Harding & Associates Tax Services

The legal use of the Sample Form W-8ECI is governed by U.S. tax laws. Foreign entities must ensure that the form is completed correctly to maintain compliance with Internal Revenue Service (IRS) regulations. This ensures that the income received is treated appropriately for tax purposes and helps avoid potential penalties for non-compliance.

Key elements of the Sample Form W-8ECI Harding & Associates Tax Services

Key elements of the Sample Form W-8ECI include:

- Entity name and address

- U.S. taxpayer identification number

- Type of income being received

- Certification of effectively connected income

- Signature and date

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Sample Form W-8ECI. These guidelines outline the necessary information required, the circumstances under which the form should be used, and the importance of keeping the form up to date. Entities must refer to the latest IRS publications to ensure compliance with any changes in tax laws or regulations.

Quick guide on how to complete sample form w 8eci harding amp associates tax services

Effortlessly Prepare Sample Form W 8ECI Harding & Associates Tax Services on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and without delays. Manage Sample Form W 8ECI Harding & Associates Tax Services across any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Sample Form W 8ECI Harding & Associates Tax Services with Ease

- Find Sample Form W 8ECI Harding & Associates Tax Services and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive data using tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your edits.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Sample Form W 8ECI Harding & Associates Tax Services and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample form w 8eci harding amp associates tax services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sample Form W 8ECI Harding & Associates Tax Services?

The Sample Form W 8ECI Harding & Associates Tax Services is a specific tax form used to provide information about income connected with a trade or business in the United States. This form helps foreign persons declare their eligibility for reduced withholding rates on income effectively, ensuring compliance with tax regulations.

-

How can I access the Sample Form W 8ECI Harding & Associates Tax Services?

You can easily access the Sample Form W 8ECI Harding & Associates Tax Services through our user-friendly platform. Simply sign up for airSlate SignNow, navigate to the forms section, and locate the template to get started with signing and sending documents seamlessly.

-

Is there a cost associated with using the Sample Form W 8ECI Harding & Associates Tax Services?

Using the Sample Form W 8ECI Harding & Associates Tax Services on airSlate SignNow is part of our subscription plans. We offer competitive pricing that allows you to eSign documents and streamline your workflow cost-effectively, tailored to fit the needs of businesses of any size.

-

What features does airSlate SignNow offer for managing the Sample Form W 8ECI Harding & Associates Tax Services?

airSlate SignNow provides a variety of features for managing the Sample Form W 8ECI Harding & Associates Tax Services, including customizable templates, easy eSignature options, and secure cloud storage. These tools help you efficiently prepare and send forms while maintaining compliance and tracking progress effortlessly.

-

Can I integrate the Sample Form W 8ECI Harding & Associates Tax Services with other applications?

Yes, airSlate SignNow offers robust integration capabilities with various applications. Users can seamlessly connect their existing software solutions with the Sample Form W 8ECI Harding & Associates Tax Services to enhance productivity and streamline their documentation workflows.

-

What are the benefits of using the Sample Form W 8ECI Harding & Associates Tax Services via airSlate SignNow?

Utilizing the Sample Form W 8ECI Harding & Associates Tax Services through airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and improved compliance with tax regulations. You can sign and manage documents anywhere, anytime, which simplifies the tax filing process.

-

Is the Sample Form W 8ECI Harding & Associates Tax Services legally compliant?

Absolutely, the Sample Form W 8ECI Harding & Associates Tax Services is designed to meet all legal standards for tax documentation. By using our platform, businesses can rest assured that they are adhering to IRS regulations for foreign income reporting.

Get more for Sample Form W 8ECI Harding & Associates Tax Services

- 3rd quarter payroll tax booklet the city of newark new ci newark nj form

- Hle application form download

- Declaration of compliance form 30258205

- Babysitter schedule form

- Practitioner services appendices table of contents form

- Child enrollment form for day care homes child enrollment form for day care homes

- Md divorce forms pdf fill out ampamp sign online

- Treasurer and depository form

Find out other Sample Form W 8ECI Harding & Associates Tax Services

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA