Mathematics and Politics Strategy Voting Power and Proof 2022

Understanding the Louisiana 210R Tax Form

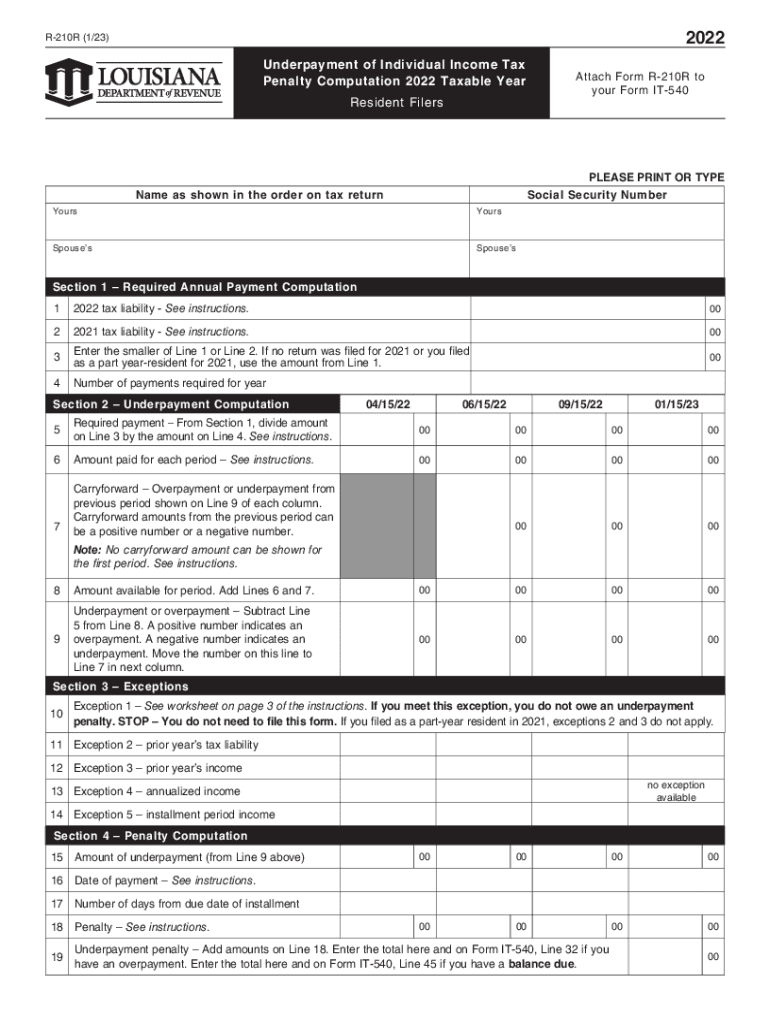

The Louisiana 210R tax form, also known as the Louisiana Revenue 210R, is used to report underpayment of state income tax. This form is essential for taxpayers who owe additional tax due to insufficient withholding or estimated payments. Filing the 210R helps ensure compliance with Louisiana tax laws and avoids potential penalties.

Key Elements of the Louisiana 210R Form

The Louisiana 210R form requires specific information to be filled out accurately. Key elements include:

- Taxpayer Information: Name, address, and Social Security number.

- Income Details: Total income for the year and any tax withheld.

- Underpayment Calculation: The amount of tax owed due to underpayment.

- Signature: A signature certifying the accuracy of the information provided.

Filing Deadlines for the Louisiana 210R

Timely filing of the Louisiana 210R is crucial to avoid penalties. The form is typically due on the same date as the annual income tax return. Taxpayers should keep track of important deadlines to ensure compliance and avoid interest charges on any amounts owed.

Penalties for Non-Compliance with the Louisiana 210R

Failure to file the Louisiana 210R form or pay the owed tax can result in significant penalties. These may include:

- Late Filing Penalty: A percentage of the unpaid tax amount for each month the form is late.

- Interest Charges: Accumulated interest on the unpaid tax amount.

- Legal Action: In severe cases, the state may take legal action to recover owed taxes.

Form Submission Methods for the Louisiana 210R

Taxpayers can submit the Louisiana 210R form through various methods:

- Online Submission: Many taxpayers prefer to file electronically for convenience and speed.

- Mail: The form can be printed and mailed to the appropriate state tax office.

- In-Person: Taxpayers may also choose to file the form in person at designated tax offices.

Examples of Taxpayer Scenarios for the Louisiana 210R

Different taxpayer scenarios may influence the need to file the Louisiana 210R form. Common examples include:

- Self-Employed Individuals: Those who do not have taxes withheld from their income may find themselves underpaying.

- Retirees: Individuals receiving pension income may need to adjust their withholding to avoid underpayment.

- Students: Part-time workers may not have sufficient withholding, leading to a potential tax liability.

Quick guide on how to complete mathematics and politics strategy voting power and proof

Prepare Mathematics And Politics Strategy Voting Power And Proof seamlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Mathematics And Politics Strategy Voting Power And Proof on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to alter and eSign Mathematics And Politics Strategy Voting Power And Proof effortlessly

- Find Mathematics And Politics Strategy Voting Power And Proof and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key parts of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you prefer to send your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Mathematics And Politics Strategy Voting Power And Proof and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mathematics and politics strategy voting power and proof

Create this form in 5 minutes!

How to create an eSignature for the mathematics and politics strategy voting power and proof

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Louisiana 210R tax form used for?

The Louisiana 210R tax form is primarily used to report and pay tax for certain Louisiana residents and businesses. It provides important information on tax liabilities and credits, ensuring compliance with state tax regulations in Louisiana.

-

How can airSlate SignNow help with the Louisiana 210R tax process?

airSlate SignNow offers an easy-to-use platform for creating, signing, and managing documents like the Louisiana 210R tax form. By streamlining the eSigning process, businesses can ensure timely submissions and reduce the risk of errors in their tax filings.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, ensuring that users can find a cost-effective solution for managing documents, including the Louisiana 210R tax form. Each plan provides unique features that allow for efficient document handling and eSigning.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, allowing users to create templates, set signing orders, and securely store completed Louisiana 210R tax forms. These tools enhance the overall efficiency of the tax filing process.

-

Can I integrate airSlate SignNow with other applications for tax compliance?

Absolutely! airSlate SignNow can seamlessly integrate with various applications and software that enhance tax compliance, making it easier for users to manage the Louisiana 210R tax form alongside their other financial documents. This integration helps streamline workflows and improve productivity.

-

What are the benefits of using airSlate SignNow for tax purposes?

Using airSlate SignNow for tax purposes, including the Louisiana 210R tax form, offers businesses numerous benefits such as faster document turnaround, enhanced security features, and reduced administrative burdens. These advantages can lead to signNow time and cost savings during the tax filing process.

-

Is airSlate SignNow compliant with Louisiana tax regulations?

Yes, airSlate SignNow is designed to comply with Louisiana tax regulations, including those pertaining to the Louisiana 210R tax form. The platform prioritizes security and adherence to legal standards, ensuring that users can confidently manage their tax documents.

Get more for Mathematics And Politics Strategy Voting Power And Proof

Find out other Mathematics And Politics Strategy Voting Power And Proof

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document