IL 1040 X Instructions Illinois Department of Revenue 2023-2026

Understanding the Louisiana Revenue 210R Form

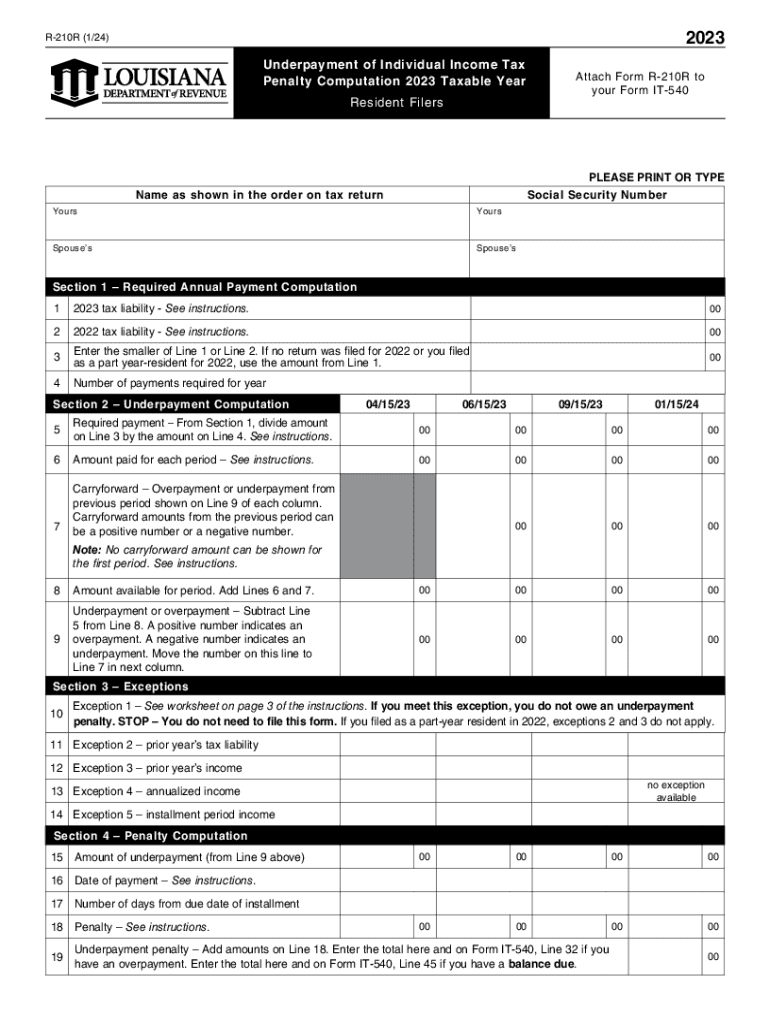

The Louisiana Revenue 210R form is specifically designed for taxpayers who need to report underpayment of their estimated tax. This form is essential for individuals and businesses who may have not paid enough tax throughout the year, thus incurring a penalty. Understanding the purpose and requirements of this form is crucial for compliance and to avoid unnecessary penalties.

Steps to Complete the Louisiana Revenue 210R Form

Filling out the Louisiana Revenue 210R form involves several steps:

- Begin by gathering your financial records, including income statements and prior tax returns.

- Calculate your total tax liability for the year to determine if you have underpaid.

- Fill out the personal information section accurately, including your name, address, and Social Security number.

- Provide the details of your estimated tax payments made throughout the year.

- Calculate the penalty amount based on the underpayment and include it in the designated section.

- Review the form for accuracy before submission.

Legal Use of the Louisiana Revenue 210R Form

The Louisiana Revenue 210R form serves a legal purpose in tax compliance. It allows taxpayers to report any underpayment of estimated taxes to the Louisiana Department of Revenue. Filing this form correctly ensures that taxpayers adhere to state tax laws and can mitigate penalties associated with underpayment.

Penalties for Non-Compliance

Failing to file the Louisiana Revenue 210R form or inaccurately reporting your underpayment can result in significant penalties. The state may impose fines based on the amount of tax owed and the duration of the underpayment. It is essential to file this form timely to avoid accruing additional fees and interest on unpaid taxes.

Obtaining the Louisiana Revenue 210R Form

The Louisiana Revenue 210R form can be easily obtained from the Louisiana Department of Revenue's official website. It is available in both printable and fillable formats, allowing taxpayers to complete the form digitally or by hand. Ensure you are using the most current version of the form to comply with the latest tax regulations.

Filing Methods for the Louisiana Revenue 210R Form

Taxpayers can submit the Louisiana Revenue 210R form through various methods:

- Online submission via the Louisiana Department of Revenue's e-filing system.

- Mailing a completed paper form to the designated address provided on the form.

- In-person submission at local Department of Revenue offices, if applicable.

Examples of Using the Louisiana Revenue 210R Form

Consider a scenario where a self-employed individual realizes they have not paid enough estimated tax throughout the year. By completing the Louisiana Revenue 210R form, they can report their underpayment and calculate the penalty. This proactive approach helps in managing their tax obligations effectively and prevents further complications with the state tax authority.

Quick guide on how to complete il 1040 x instructions illinois department of revenue

Easily prepare IL 1040 X Instructions Illinois Department Of Revenue on any device

The online management of documents has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary forms and securely keep them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage IL 1040 X Instructions Illinois Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and electronically sign IL 1040 X Instructions Illinois Department Of Revenue effortlessly

- Locate IL 1040 X Instructions Illinois Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools designed specifically by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and bears the same legal validity as a conventional handwritten signature.

- Verify the details and then hit the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from your preferred device. Modify and electronically sign IL 1040 X Instructions Illinois Department Of Revenue and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 1040 x instructions illinois department of revenue

Create this form in 5 minutes!

How to create an eSignature for the il 1040 x instructions illinois department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Louisiana Revenue 210R and how does it relate to airSlate SignNow?

Louisiana Revenue 210R is a document used by businesses to report state income and is essential for maintaining compliance. airSlate SignNow simplifies the process of filling out and eSigning this form, making it easy for Louisiana businesses to manage their tax documentation efficiently.

-

How much does it cost to use airSlate SignNow for filing Louisiana Revenue 210R?

airSlate SignNow offers various pricing plans designed to fit different business needs, starting from a competitive rate to ensure accessibility for all users. With these plans, you can seamlessly eSign and send your Louisiana Revenue 210R without any hidden fees.

-

What features does airSlate SignNow provide for managing Louisiana Revenue 210R?

airSlate SignNow offers features like electronic signatures, document templates, and real-time tracking that streamline the process of managing Louisiana Revenue 210R. These tools ensure a user-friendly experience from document preparation to eSigning.

-

Can I integrate airSlate SignNow with my accounting software for Louisiana Revenue 210R?

Yes, airSlate SignNow offers integrations with various accounting software systems, allowing for easy access to your financial documents, including Louisiana Revenue 210R. This integration helps keep your workflow efficient by syncing important data across platforms.

-

What are the benefits of using airSlate SignNow for Louisiana Revenue 210R?

Using airSlate SignNow for Louisiana Revenue 210R offers signNow benefits, such as enhanced security, quicker turnaround times, and reduced paperwork. It ensures that your tax documentation is not only compliant but also easy to manage.

-

Is it easy to eSign Louisiana Revenue 210R using airSlate SignNow?

Absolutely! airSlate SignNow provides a straightforward interface for eSigning Louisiana Revenue 210R, making the process fast and efficient. You can eSign from any device, which enhances convenience for all users.

-

How does airSlate SignNow ensure the security of my Louisiana Revenue 210R documents?

airSlate SignNow employs advanced security measures such as encryption and secure cloud storage to protect your Louisiana Revenue 210R documents. This commitment to security ensures that your sensitive data remains safe throughout the signing process.

Get more for IL 1040 X Instructions Illinois Department Of Revenue

- Bankruptcy fundamentals and advanced bankruptcy institute form

- 2019 bankruptcy forms for south dakotaupsolve

- Submit an order innovative abstract ampamp title form

- Notary public south dakota secretary of state form

- County of state of south dakota and described form

- Dakota being of sound and disposing mind and memory do hereby make publish and declare this to be form

- Officer personally appeared known to me or proved to me on the form

- Sd do 10 form

Find out other IL 1040 X Instructions Illinois Department Of Revenue

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will