Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet 2019

What is the Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet

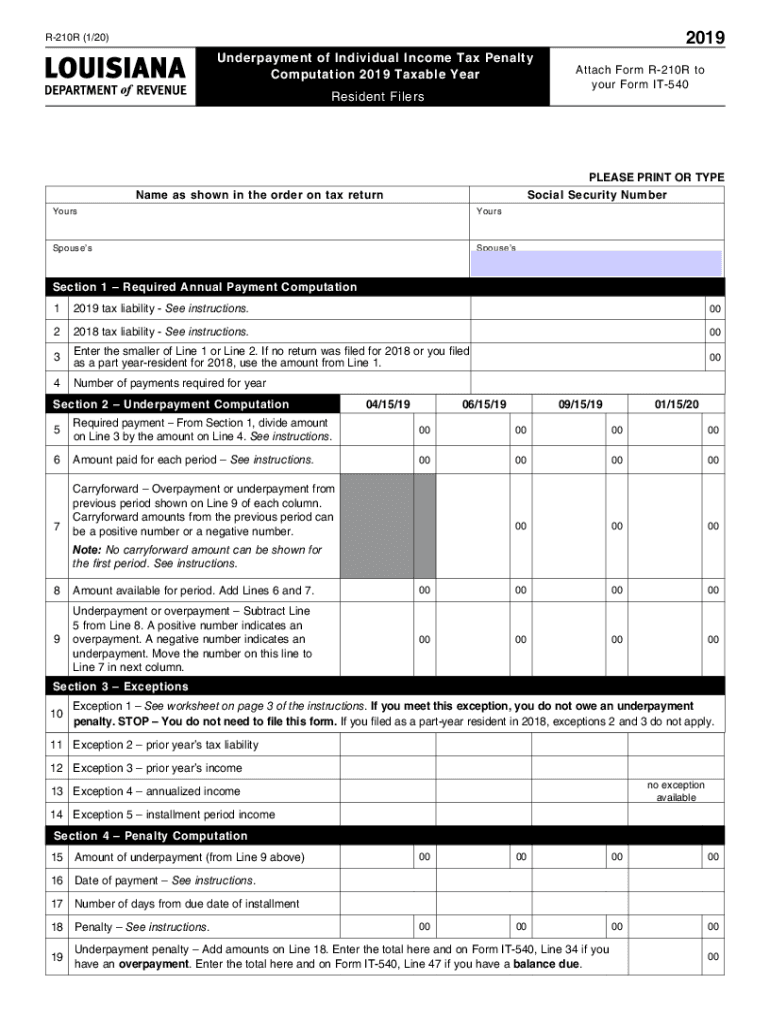

The Louisiana Form R 210R is a tax form used by residents to calculate any penalties associated with underpayment of state income tax. This worksheet is essential for taxpayers who may not have paid enough throughout the year, either through withholding or estimated payments. It helps determine the amount of penalty owed to the state, ensuring compliance with Louisiana tax laws. Understanding this form is crucial for accurate tax reporting and avoiding unnecessary penalties.

How to use the Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet

Using the Louisiana Form R 210R involves several straightforward steps. First, gather your income information and any tax payments made during the year. Next, complete the form by entering your total income, tax liability, and the amount you have already paid. The worksheet will guide you through the calculations needed to determine if you owe a penalty for underpayment. It is important to follow the instructions carefully to ensure accuracy.

Steps to complete the Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet

To complete the Louisiana Form R 210R, follow these steps:

- Begin by entering your total income for the year on the designated line.

- Calculate your total tax liability based on your income.

- Document the total amount of tax payments you have made, including withholdings and estimated payments.

- Use the provided formulas to determine if your payments were sufficient.

- If applicable, calculate the penalty amount based on the underpayment.

- Review the completed form for accuracy before submission.

Key elements of the Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet

The key elements of the Louisiana Form R 210R include fields for reporting total income, tax liability, and payments made. Additionally, the form outlines the calculations necessary to assess any penalties for underpayment. Understanding these components is vital for ensuring that you accurately report your tax situation and comply with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Louisiana Form R 210R coincide with the state income tax return deadlines. Typically, this form must be submitted by May fifteenth of the year following the tax year in question. It is important to stay informed about any changes to deadlines, as late submissions may result in additional penalties.

Penalties for Non-Compliance

Failure to comply with the requirements of the Louisiana Form R 210R can lead to significant penalties. If you underreport your income or fail to pay the correct amount of tax, the state may impose fines or interest on the unpaid balance. Understanding the potential consequences of non-compliance can help motivate accurate and timely tax reporting.

Quick guide on how to complete printable 2020 louisiana form r 210r resident underpayment penalty computation worksheet

Prepare Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet effortlessly on any device

Digital document administration has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet with ease

- Find Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet and click Get Form to initiate the process.

- Use the tools we offer to submit your form.

- Mark pertinent parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device of your choice. Modify and electronically sign Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 louisiana form r 210r resident underpayment penalty computation worksheet

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 louisiana form r 210r resident underpayment penalty computation worksheet

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is r 210r and how does it work with airSlate SignNow?

r 210r is a powerful feature within airSlate SignNow that allows businesses to streamline their document signing process. It simplifies sending, signing, and managing documents electronically, ensuring a smooth workflow. With r 210r, users can easily track document status and receive notifications, enhancing overall efficiency.

-

How much does it cost to use the r 210r feature in airSlate SignNow?

The pricing for airSlate SignNow, including the r 210r feature, is competitively structured to fit various business needs. Subscription plans typically start with a monthly fee, offering different tiers based on user requirements and features. To find the most suitable plan for your business and the r 210r feature, visit our pricing page.

-

What are the key features of r 210r in airSlate SignNow?

The r 210r feature includes customizable templates, advanced security options, and real-time tracking. Users can benefit from mobile capabilities, allowing them to sign documents on-the-go. Additionally, integration with other business applications enhances workflow by automating repetitive tasks.

-

How can r 210r improve my business operations?

Implementing r 210r through airSlate SignNow can signNowly reduce the time spent on paperwork. By digitizing the signing process, businesses can eliminate delays and improve turnaround times. This efficiency leads to better customer satisfaction and a more agile business model.

-

Is r 210r easy to integrate with other software?

Yes, r 210r is designed to seamlessly integrate with various software applications. This integration capability allows businesses to enhance their existing workflows without disrupting established processes. Users can easily connect r 210r with CRM systems, productivity tools, and more.

-

What benefits does r 210r offer for remote teams?

For remote teams, r 210r offers the convenience of signing documents from anywhere, at any time. This flexibility ensures that remote employees can assist in critical signing processes without needing to be in an office. The secure, digital approach of r 210r also protects sensitive information during transmissions.

-

Can I customize documents using the r 210r feature?

Absolutely! The r 210r feature in airSlate SignNow allows users to create customized documents tailored to their specific needs. Users can add their logos, adjust fields, and set signing orders to ensure that the document meets their business requirements perfectly.

Get more for Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet

Find out other Printable Louisiana Form R 210R Resident Underpayment Penalty Computation Worksheet

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document