Tree Growth Tax Law Information Be Woods Wise Maine Gov 2022

Understanding the Tree Growth Tax Law Information Be Woods Wise Maine Gov

The Tree Growth Tax Law Information Be Woods Wise Maine Gov is a vital resource for landowners and forestry professionals in Maine. This law provides tax benefits to those who maintain their land as a tree growth area, promoting sustainable forestry practices. The law aims to encourage the preservation of Maine's forest resources while providing financial incentives for landowners. Understanding the specifics of this law is crucial for anyone looking to benefit from the associated tax reductions.

Steps to Complete the Tree Growth Tax Law Information Be Woods Wise Maine Gov

Completing the Tree Growth Tax Law Information Be Woods Wise Maine Gov involves several steps to ensure compliance and eligibility for tax benefits. First, landowners should gather necessary documentation, including proof of ownership and a management plan for the forested area. Next, fill out the required forms accurately, ensuring all information is current and complete. Once the forms are filled out, submit them to the appropriate local authority by the specified deadline. It is advisable to keep copies of all submitted documents for your records.

Legal Use of the Tree Growth Tax Law Information Be Woods Wise Maine Gov

The legal use of the Tree Growth Tax Law Information Be Woods Wise Maine Gov hinges on compliance with state regulations. The information provided must be accurate and reflect the current status of the property. Misrepresentation can lead to penalties, including the loss of tax benefits. It is essential to stay informed about any changes in legislation that may affect eligibility or requirements, ensuring that all practices align with legal standards.

Eligibility Criteria for the Tree Growth Tax Law Information Be Woods Wise Maine Gov

To qualify for the benefits under the Tree Growth Tax Law Information Be Woods Wise Maine Gov, landowners must meet specific eligibility criteria. The property must be at least ten acres in size and primarily used for growing trees. Additionally, landowners must submit a forest management plan that outlines the intended use and maintenance of the land. Regular updates to this plan may be required to maintain eligibility for tax reductions.

Required Documents for the Tree Growth Tax Law Information Be Woods Wise Maine Gov

When applying for the Tree Growth Tax Law Information Be Woods Wise Maine Gov, several documents are required to support the application. These include proof of land ownership, a detailed forest management plan, and any previous tax documents related to the property. It is important to ensure that all documents are current and accurately reflect the land's use to avoid delays in processing.

Filing Deadlines for the Tree Growth Tax Law Information Be Woods Wise Maine Gov

Filing deadlines for the Tree Growth Tax Law Information Be Woods Wise Maine Gov are crucial for landowners to adhere to in order to receive tax benefits. Typically, applications must be submitted by April 1st of the tax year to qualify for the upcoming tax assessment. Late submissions may result in penalties or the loss of tax benefits, making it essential to be aware of and comply with these deadlines.

Examples of Using the Tree Growth Tax Law Information Be Woods Wise Maine Gov

Examples of using the Tree Growth Tax Law Information Be Woods Wise Maine Gov can illustrate its benefits. For instance, a landowner who maintains a forested area primarily for timber production can reduce their property tax burden significantly. Another example is a landowner who participates in conservation efforts, using the tax benefits to support sustainable forestry practices while preserving the natural habitat. These examples highlight the law's role in promoting responsible land management and financial savings.

Quick guide on how to complete tree growth tax law information be woods wise mainegov

Prepare Tree Growth Tax Law Information Be Woods Wise Maine gov effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Tree Growth Tax Law Information Be Woods Wise Maine gov from any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Tree Growth Tax Law Information Be Woods Wise Maine gov with ease

- Obtain Tree Growth Tax Law Information Be Woods Wise Maine gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Tree Growth Tax Law Information Be Woods Wise Maine gov and guarantee excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tree growth tax law information be woods wise mainegov

Create this form in 5 minutes!

How to create an eSignature for the tree growth tax law information be woods wise mainegov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

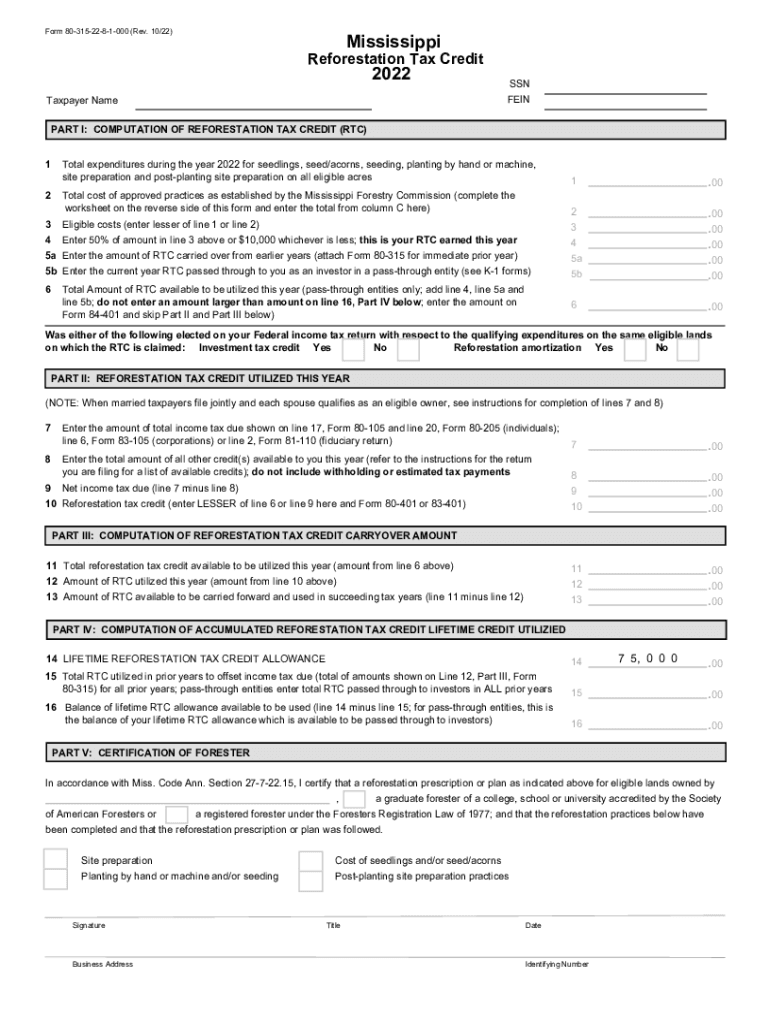

What is ms 80 315 and how does it relate to airSlate SignNow?

The ms 80 315 is a powerful feature within the airSlate SignNow platform, designed to enhance the efficiency of document signing and management. This feature streamlines the e-signature process, making it easier for businesses to get documents signed quickly and securely.

-

How much does airSlate SignNow cost for users of ms 80 315?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those utilizing the ms 80 315 feature. Pricing varies depending on the number of users and the features selected, ensuring flexibility and affordability for all customers.

-

What are the main benefits of using ms 80 315 in airSlate SignNow?

Using the ms 80 315 in airSlate SignNow provides several benefits, including improved workflow efficiency, reduced turnaround time for document signing, and enhanced security measures. Businesses can save time and resources while ensuring compliance with legal standards.

-

Does airSlate SignNow with ms 80 315 support mobile devices?

Absolutely! The airSlate SignNow platform with ms 80 315 is fully optimized for mobile devices, allowing users to send and eSign documents on-the-go. This mobile compatibility enhances accessibility, ensuring you can manage documents anytime, anywhere.

-

What features are included with ms 80 315 in airSlate SignNow?

The ms 80 315 feature offers a range of functionalities, including customizable templates, advanced real-time tracking, and automated reminders for signers. These features enhance the overall user experience by simplifying document management workflows.

-

Can ms 80 315 be integrated with other software?

Yes, airSlate SignNow equipped with ms 80 315 can easily integrate with various third-party applications, including CRM systems, cloud storage solutions, and productivity tools. This seamless integration helps in creating a streamlined workflow across different platforms.

-

Is customer support available for users of ms 80 315?

Yes, airSlate SignNow provides robust customer support for all users, including those using the ms 80 315 feature. Our support team is accessible through multiple channels to assist with any questions or technical issues that may arise.

Get more for Tree Growth Tax Law Information Be Woods Wise Maine gov

- Satisfaction of deed of trust mortgage by corporate lender texas form

- Satisfaction of deed of trust mortgage individual lender or holder texas form

- Texas property deed form

- Partial release of property from deed of trust for individual texas form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy texas form

- Warranty deed for parents to child with reservation of life estate texas form

- Texas joint tenancy form

- Warranty deed for separate or joint property to joint tenancy texas form

Find out other Tree Growth Tax Law Information Be Woods Wise Maine gov

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple