Printable Mississippi Form 80 315 Re Forestation Tax Credit 2020

What is the Printable Mississippi Form 80 315 Reforestation Tax Credit

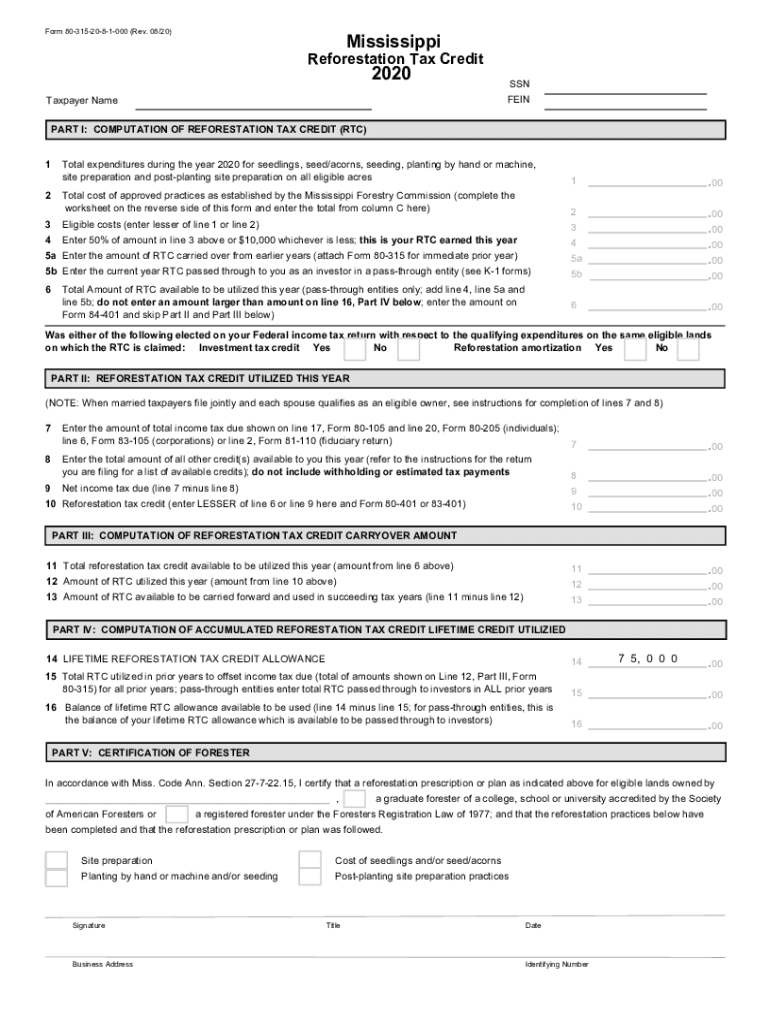

The Printable Mississippi Form 80 315 is a tax credit application designed for landowners who engage in reforestation activities. This form allows eligible taxpayers to claim a credit against their state income tax for expenses incurred in planting trees on their property. The reforestation tax credit aims to encourage sustainable forestry practices and enhance environmental conservation efforts in Mississippi. By utilizing this form, landowners can contribute to the state's ecological health while benefiting financially through tax savings.

Steps to Complete the Printable Mississippi Form 80 315 Reforestation Tax Credit

Completing the Printable Mississippi Form 80 315 involves several key steps to ensure accuracy and compliance with state regulations. Start by gathering all necessary documentation related to your reforestation activities, including receipts for tree purchases and planting expenses. Next, fill out the form by providing your personal information, including your Social Security number and address. Be sure to report the total amount spent on eligible reforestation activities in the designated section. After completing the form, review it thoroughly for any errors before submission. Finally, retain a copy for your records, as it may be needed for future reference or audits.

Eligibility Criteria for the Printable Mississippi Form 80 315 Reforestation Tax Credit

To qualify for the reforestation tax credit using the Printable Mississippi Form 80 315, landowners must meet specific eligibility criteria. First, the reforestation activities must be conducted on land that is classified as forest land. Additionally, the trees must be planted for commercial purposes, and the expenses claimed must be directly related to the planting and establishment of the trees. It is essential to keep detailed records of all expenditures and ensure that the reforestation efforts comply with state forestry guidelines. Landowners who do not meet these criteria may not be eligible for the tax credit.

How to Obtain the Printable Mississippi Form 80 315 Reforestation Tax Credit

The Printable Mississippi Form 80 315 can be obtained through several channels. Landowners can access the form directly from the Mississippi Department of Revenue's official website, where it is available for download in PDF format. Additionally, physical copies of the form may be available at local tax offices or forestry extension offices throughout the state. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Legal Use of the Printable Mississippi Form 80 315 Reforestation Tax Credit

The legal use of the Printable Mississippi Form 80 315 is governed by state tax laws and regulations. To ensure compliance, landowners must adhere to the guidelines set forth by the Mississippi Department of Revenue regarding eligible expenses and reforestation practices. Proper documentation and record-keeping are crucial, as they provide evidence of the reforestation activities undertaken. Failure to comply with these regulations may result in penalties or disqualification from receiving the tax credit.

Form Submission Methods for the Printable Mississippi Form 80 315 Reforestation Tax Credit

Submitting the Printable Mississippi Form 80 315 can be done through various methods, allowing flexibility for landowners. The form can be submitted electronically via the Mississippi Department of Revenue's online portal, which provides a streamlined process for filing. Alternatively, landowners may choose to mail the completed form to the designated address provided on the form itself. In-person submissions may also be accepted at local tax offices, offering another option for those who prefer direct interaction. Regardless of the method chosen, it is important to keep a copy of the submitted form for personal records.

Quick guide on how to complete printable 2020 mississippi form 80 315 re forestation tax credit

Effortlessly Prepare Printable Mississippi Form 80 315 Re forestation Tax Credit on Any Device

Digital document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Printable Mississippi Form 80 315 Re forestation Tax Credit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric activity today.

Simplified Method to Alter and eSign Printable Mississippi Form 80 315 Re forestation Tax Credit

- Locate Printable Mississippi Form 80 315 Re forestation Tax Credit and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Point out relevant sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature with the Sign tool, which requires only seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Forget about losing or misplacing documents, tedious form searching, or mistakes necessitating new document printouts. airSlate SignNow caters to all your document management requirements within a few clicks from your chosen device. Edit and eSign Printable Mississippi Form 80 315 Re forestation Tax Credit and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 mississippi form 80 315 re forestation tax credit

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 mississippi form 80 315 re forestation tax credit

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the ms 80 315 functionality in airSlate SignNow?

The ms 80 315 functionality within airSlate SignNow allows users to efficiently send and eSign documents electronically. This feature streamlines the document workflow, reducing the time spent on traditional signing methods. With user-friendly tools, the ms 80 315 capability ensures that all parties can easily complete signatures and manage documents without hassle.

-

How much does airSlate SignNow with ms 80 315 cost?

airSlate SignNow offers competitive pricing plans that are suitable for various business needs, including those looking to utilize the ms 80 315 features. The pricing is designed to be cost-effective, providing value for the investment made in securing electronic signatures and document management. Check our site for details on the latest pricing options tailored to fit your business.

-

What are the key benefits of using ms 80 315 in airSlate SignNow?

Utilizing the ms 80 315 features in airSlate SignNow provides multiple benefits, including increased efficiency and reduced paper usage. Customers also experience faster turnaround times on document processing and improved compliance with digital signatures. Overall, ms 80 315 enhances user experience by making the signing process quicker and more secure.

-

Can I integrate airSlate SignNow with other applications while using ms 80 315?

Yes, airSlate SignNow, with its ms 80 315 functionality, allows for seamless integrations with various applications and platforms. This capability helps businesses automate workflows and synchronize data across different systems efficiently. Explore our integration options to discover how ms 80 315 can enhance your existing processes.

-

Is ms 80 315 compliant with industry regulations?

The ms 80 315 functionality in airSlate SignNow meets industry standards for electronic signatures, ensuring compliance with legal regulations such as eIDAS and ESIGN Act. This compliance provides users with assurance that their documents are legally binding and secure. Trust in airSlate SignNow to keep your business aligned with industry requirements.

-

What types of documents can I sign using ms 80 315?

With the ms 80 315 features in airSlate SignNow, users can sign a variety of documents including contracts, agreements, and forms. The platform supports numerous file formats, making it versatile for different business needs. Whether for personal or professional use, the ms 80 315 functionality caters to all your signing requirements.

-

How user-friendly is airSlate SignNow's ms 80 315 for new users?

The ms 80 315 functionality in airSlate SignNow is designed with user-friendliness in mind, even for those who are new to electronic signing. The intuitive interface allows users to navigate easily through the signing process without prior experience. Many new users have reported a smooth onboarding process while utilizing ms 80 315.

Get more for Printable Mississippi Form 80 315 Re forestation Tax Credit

Find out other Printable Mississippi Form 80 315 Re forestation Tax Credit

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online