State and Local Tax Weekly for October 27 and November 3 2023

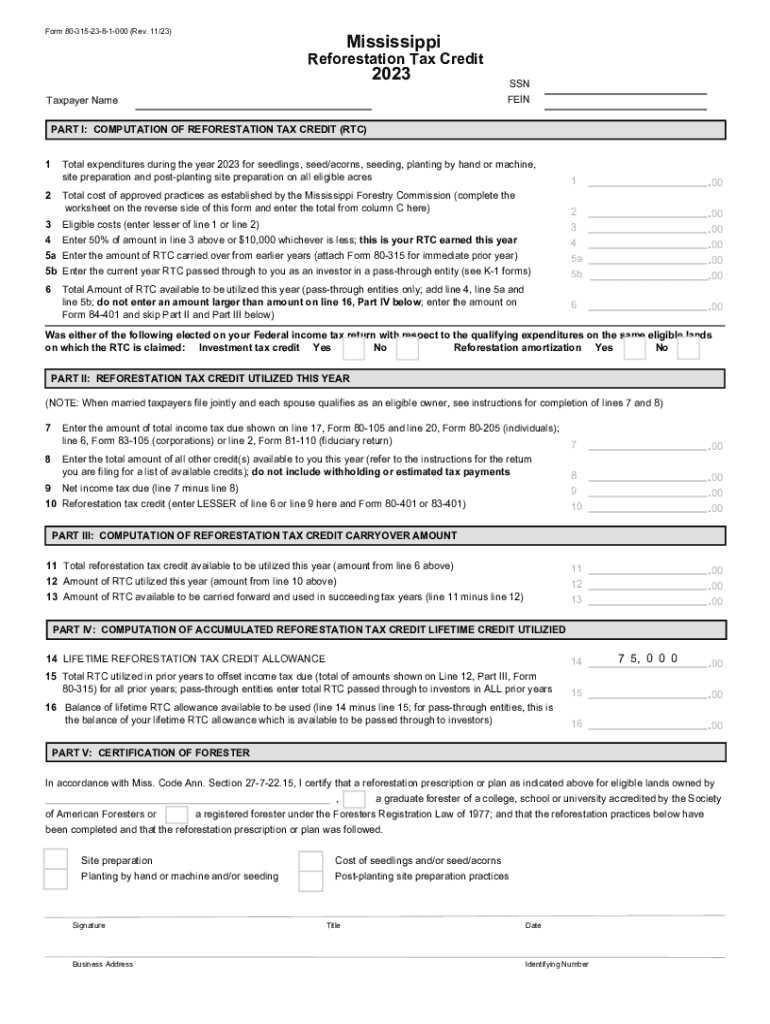

Understanding the ms 80 315 Form

The ms 80 315 form is a crucial document used in the context of state and local taxes. It serves to report various tax-related information, ensuring compliance with local regulations. This form is essential for individuals and businesses alike, as it helps in accurately documenting taxable income and deductions. Understanding its purpose can aid in effective tax planning and compliance.

Steps to Complete the ms 80 315 Form

Completing the ms 80 315 form involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the form with accurate information, ensuring that all sections are completed as required.

- Review the completed form for any errors or omissions to avoid potential penalties.

- Submit the form by the specified deadline, either electronically or via mail, as per the guidelines.

Required Documents for the ms 80 315 Form

To successfully complete the ms 80 315 form, certain documents are necessary:

- Income statements, such as W-2s or 1099s, to report earnings.

- Receipts and records of deductible expenses to substantiate claims.

- Previous tax returns for reference and accuracy.

Filing Deadlines for the ms 80 315 Form

Timely submission of the ms 80 315 form is critical to avoid penalties. The filing deadlines typically align with the tax year, and it is essential to be aware of specific dates to ensure compliance. For most individuals and businesses, the deadline falls on April 15 of the following year, but it may vary based on specific circumstances or extensions.

Legal Use of the ms 80 315 Form

The ms 80 315 form is legally recognized for reporting state and local taxes. Accurate completion and submission of this form are essential for maintaining compliance with tax laws. Failure to file or inaccuracies can lead to penalties, including fines or audits. Understanding the legal implications of the form helps in navigating the complexities of tax obligations.

Common Scenarios for Using the ms 80 315 Form

The ms 80 315 form is applicable in various taxpayer scenarios, including:

- Self-employed individuals who need to report their income and expenses.

- Small business owners who must document their earnings and applicable deductions.

- Individuals with multiple sources of income, ensuring all earnings are reported accurately.

Penalties for Non-Compliance with the ms 80 315 Form

Failure to comply with the requirements of the ms 80 315 form can result in significant penalties. These may include financial fines, interest on unpaid taxes, and potential audits by tax authorities. Understanding these penalties emphasizes the importance of accurate and timely filing to avoid complications.

Quick guide on how to complete state and local tax weekly for october 27 and november 3

Effortlessly Prepare State And Local Tax Weekly For October 27 And November 3 on Any Device

The management of online documents has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without delays. Administer State And Local Tax Weekly For October 27 And November 3 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to Alter and Electronically Sign State And Local Tax Weekly For October 27 And November 3 with Ease

- Find State And Local Tax Weekly For October 27 And November 3 and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you'd like to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign State And Local Tax Weekly For October 27 And November 3 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state and local tax weekly for october 27 and november 3

Create this form in 5 minutes!

How to create an eSignature for the state and local tax weekly for october 27 and november 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ms 80 315 and how does it relate to airSlate SignNow?

The term ms 80 315 refers to a specific feature set within airSlate SignNow that enhances document management and eSigning capabilities. Using ms 80 315, businesses can streamline their document workflows, ensuring security and compliance while saving time on administrative tasks.

-

How does airSlate SignNow pricing work for users interested in ms 80 315?

airSlate SignNow offers competitive pricing plans that include access to features like ms 80 315. Users can choose from various subscription levels tailored to their needs, ensuring that they find a cost-effective solution that fits their budget and operational requirements.

-

What are the key benefits of using ms 80 315 via airSlate SignNow?

Utilizing ms 80 315 on airSlate SignNow allows businesses to signNowly reduce document turnaround times and improve overall efficiency. This feature empowers users to easily create, send, and sign documents, making it an invaluable tool for enhancing productivity and customer service.

-

Can I integrate ms 80 315 with other software applications?

Yes, airSlate SignNow supports numerous integrations that include ms 80 315, allowing seamless connections with popular CRM, accounting, and project management tools. This integration capability ensures that you can incorporate eSigning and document management into your existing workflows without disruption.

-

Is there a trial period available for exploring ms 80 315 features?

Absolutely! airSlate SignNow offers a trial period enabling users to explore the functionalities of ms 80 315 without any commitment. During the trial, you can experience the ease of use and effectiveness of airSlate SignNow's eSigning capabilities firsthand.

-

What types of documents can I manage with ms 80 315 on airSlate SignNow?

With ms 80 315, you can manage a wide range of documents including contracts, agreements, and forms relevant to various industries. The flexibility of airSlate SignNow allows users to customize templates according to their specific documentation needs, ensuring compliance and efficiency.

-

How secure is the ms 80 315 feature in airSlate SignNow?

Security is a top priority for airSlate SignNow, including the ms 80 315 feature. It employs advanced encryption methods and compliance with industry regulations to ensure that all documents and user data are protected, giving businesses peace of mind while managing sensitive information.

Get more for State And Local Tax Weekly For October 27 And November 3

- Form ccc902

- Wyoming oil form

- Of change alaska form

- Sample disclosure statement commerce alaska form

- Form rh 313r legal structure of applicant if applicant is a corporation complete items 1 through 4 adph

- Department of finance and administration office of arkansas dfa form

- Arkansas vendor maintenance form

- Printable timber contract form

Find out other State And Local Tax Weekly For October 27 And November 3

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself