Mississippi Form 80 315i Re Forestation Tax Credit 2021

What is the Mississippi Form 80 315i Reforestation Tax Credit

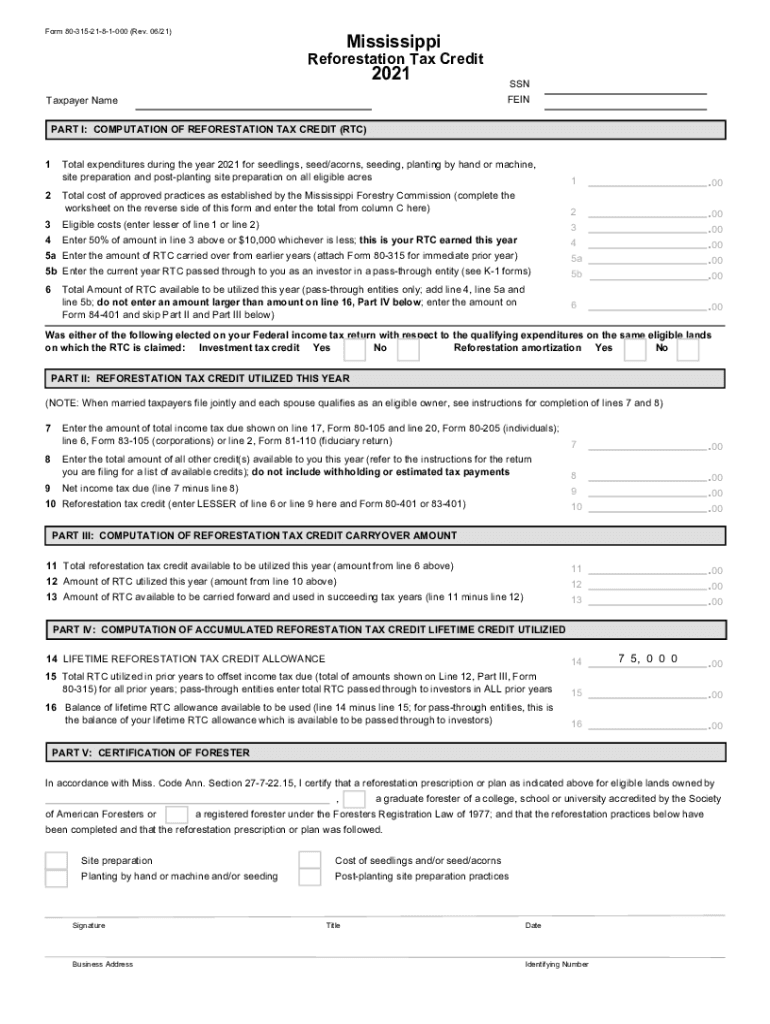

The Mississippi Form 80 315i Reforestation Tax Credit is a state-specific tax incentive designed to encourage landowners to engage in reforestation activities. This credit allows individuals and businesses to receive a tax benefit for expenses incurred in the reforestation of eligible lands. The primary goal of this initiative is to promote environmental sustainability and enhance forest resources within the state. By providing financial relief, the Mississippi government aims to support landowners in their efforts to restore and maintain forested areas.

Steps to Complete the Mississippi Form 80 315i Reforestation Tax Credit

Completing the Mississippi Form 80 315i involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your reforestation activities, including receipts for expenses. Next, fill out the form by providing your personal information, details about the land, and a breakdown of the costs associated with the reforestation efforts. It is essential to follow the instructions carefully to avoid errors that could delay processing. Once completed, review the form for accuracy before submitting it to the appropriate state agency.

Eligibility Criteria

To qualify for the Mississippi Form 80 315i Reforestation Tax Credit, applicants must meet specific eligibility criteria. This includes being a landowner engaged in reforestation activities on eligible lands within Mississippi. The reforestation must comply with state regulations and guidelines. Additionally, the expenses claimed must be directly related to the reforestation process, such as costs for seedlings, planting, and maintenance. It is crucial to maintain thorough records of all expenditures to substantiate the claim when filing.

Required Documents

When applying for the Mississippi Form 80 315i Reforestation Tax Credit, certain documents are required to support your application. These typically include:

- Receipts for all expenses incurred during the reforestation process.

- Proof of land ownership, such as a deed or property tax records.

- A detailed description of the reforestation activities undertaken.

Having these documents organized and readily available will facilitate a smoother application process and help ensure compliance with state requirements.

Form Submission Methods

The Mississippi Form 80 315i can be submitted through various methods, providing flexibility for applicants. Individuals may choose to file the form online, which is often the quickest method. Alternatively, the form can be mailed to the appropriate state agency or submitted in person at designated offices. It is important to verify the submission method and address to ensure timely processing of the tax credit application.

Legal Use of the Mississippi Form 80 315i Reforestation Tax Credit

The legal framework surrounding the Mississippi Form 80 315i Reforestation Tax Credit is governed by state tax laws. To ensure the validity of the tax credit, applicants must adhere to the guidelines set forth by the Mississippi Department of Revenue. This includes compliance with all relevant regulations regarding reforestation practices and the documentation of expenses. Utilizing the form legally not only secures the tax credit but also contributes to the state's environmental goals.

Quick guide on how to complete mississippi form 80 315i re forestation tax credit

Prepare Mississippi Form 80 315i Re forestation Tax Credit effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and safely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Manage Mississippi Form 80 315i Re forestation Tax Credit on any platform using airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign Mississippi Form 80 315i Re forestation Tax Credit with ease

- Find Mississippi Form 80 315i Re forestation Tax Credit and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and then click on the Done button to store your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mississippi Form 80 315i Re forestation Tax Credit to ensure optimal communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mississippi form 80 315i re forestation tax credit

Create this form in 5 minutes!

How to create an eSignature for the mississippi form 80 315i re forestation tax credit

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an e-signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is ms 80 315 and how does it relate to airSlate SignNow?

The ms 80 315 is a part of airSlate SignNow's comprehensive eSignature solution that enables businesses to manage document workflows efficiently. This feature enhances your ability to send, sign, and track documents securely in a cost-effective manner.

-

How does airSlate SignNow pricing for ms 80 315 compare to other eSignature solutions?

The pricing for ms 80 315 with airSlate SignNow is competitively positioned, offering affordable plans that cater to businesses of all sizes. Compared to other eSignature solutions, you can enjoy greater value with advanced features at lower costs.

-

What key features does ms 80 315 offer in airSlate SignNow?

The ms 80 315 includes features like customizable templates, advanced security measures, and real-time tracking of document statuses. These features streamline the signing process and improve overall efficiency for users.

-

How can ms 80 315 benefit my business?

Utilizing ms 80 315 within airSlate SignNow can signNowly enhance your document handling capabilities. It reduces turnaround time, improves compliance, and enhances the overall customer experience through quick and secure document transactions.

-

Can ms 80 315 integrate with other software solutions?

Yes, ms 80 315 is designed to seamlessly integrate with various business applications, enhancing workflow automation. This interoperability allows you to connect with your existing software suite easily.

-

Is ms 80 315 suitable for small businesses?

Absolutely! ms 80 315 within airSlate SignNow is particularly well-suited for small businesses looking for an affordable yet powerful eSignature solution. Its user-friendly interface and various pricing plans ensure accessibility for all business sizes.

-

What kind of support is available for users of ms 80 315?

airSlate SignNow offers extensive support for users of ms 80 315, including email assistance, live chat, and a comprehensive knowledge base. This ensures that users can effectively navigate the platform and resolve any issues quickly.

Get more for Mississippi Form 80 315i Re forestation Tax Credit

Find out other Mississippi Form 80 315i Re forestation Tax Credit

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template