IRS Announces Tax Relief for Arkansas Victims of Severe 2022

Understanding the IRS Tax Relief for Arkansas Residents

The IRS has announced specific tax relief measures for residents of Arkansas affected by severe weather events. This relief is designed to assist individuals and businesses in navigating the financial impacts of such disasters. Key aspects include extended filing deadlines and potential waivers of penalties for late payments. It is essential for taxpayers to stay informed about these provisions to ensure compliance and maximize their benefits.

Steps to Claim IRS Tax Relief in Arkansas

To claim the IRS tax relief, individuals should follow these steps:

- Determine eligibility based on the specific disaster declaration.

- Review the updated filing deadlines and ensure all necessary documents are prepared.

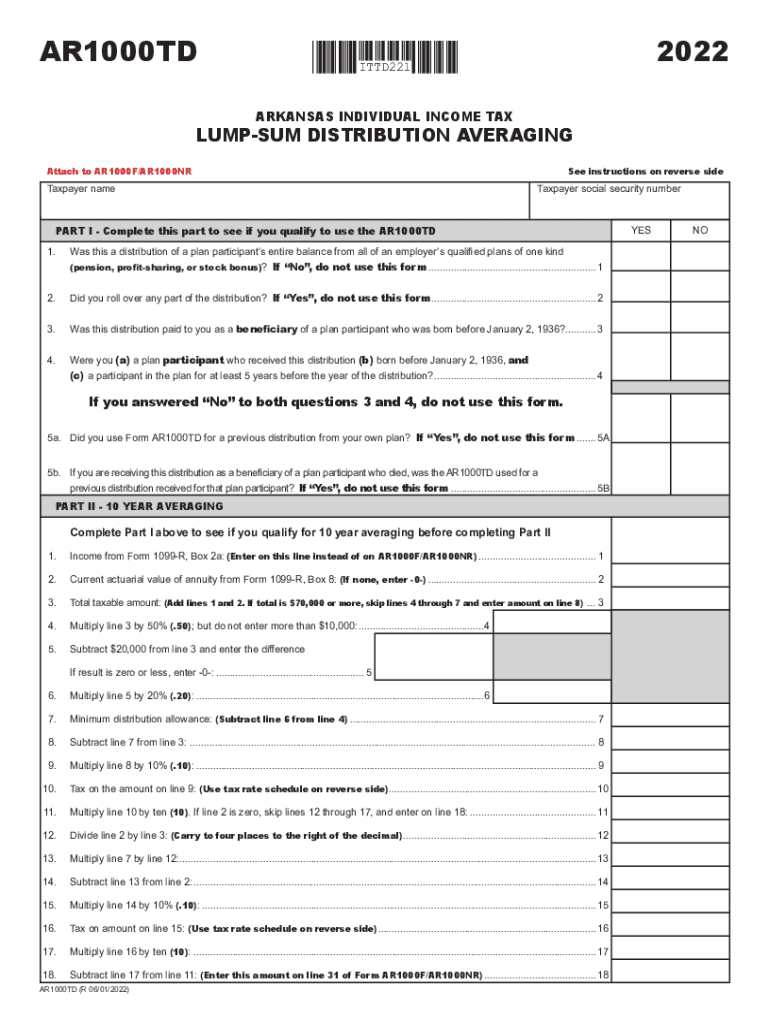

- Complete the required forms, including the 2022 AR1000TD, ensuring all information is accurate.

- Submit the forms electronically or via mail, depending on personal preference and requirements.

Required Documentation for Tax Relief Applications

When applying for tax relief, it is crucial to gather the necessary documentation. This may include:

- Proof of identity, such as a driver's license or Social Security number.

- Documentation of the disaster, including any official notices or declarations.

- Financial records that demonstrate the impact of the disaster on income or business operations.

Filing Deadlines for the 2022 AR1000TD Form

Taxpayers should be aware of the revised deadlines for filing the 2022 AR1000TD form. The IRS typically extends these deadlines for those affected by disasters, allowing additional time to submit necessary documentation without incurring penalties. It is advisable to regularly check the IRS website or consult with a tax professional for the most current information.

Legal Considerations for Tax Relief Eligibility

Eligibility for tax relief under IRS guidelines is contingent upon meeting specific legal criteria. Taxpayers must demonstrate that they reside or operate a business in the affected areas. Additionally, they should provide evidence of the financial impact resulting from the disaster. Understanding these legal requirements is vital for ensuring compliance and successfully obtaining relief.

Examples of Tax Relief Scenarios

Various scenarios illustrate how tax relief can benefit Arkansas residents. For instance, a small business owner who suffered property damage due to severe storms may qualify for penalties to be waived on late tax payments. Similarly, individuals who lost income during the disaster may find relief in extended filing deadlines, allowing them to stabilize their finances before submitting tax documents.

Quick guide on how to complete irs announces tax relief for arkansas victims of severe

Complete IRS Announces Tax Relief For Arkansas Victims Of Severe effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can access the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly and without interruptions. Manage IRS Announces Tax Relief For Arkansas Victims Of Severe on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest way to edit and eSign IRS Announces Tax Relief For Arkansas Victims Of Severe smoothly

- Obtain IRS Announces Tax Relief For Arkansas Victims Of Severe and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign IRS Announces Tax Relief For Arkansas Victims Of Severe and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs announces tax relief for arkansas victims of severe

Create this form in 5 minutes!

How to create an eSignature for the irs announces tax relief for arkansas victims of severe

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ar1000td and how does it work?

The ar1000td is a powerful document signing solution offered by airSlate SignNow. It simplifies the process of signing and managing documents electronically, enabling users to eSign documents securely and quickly. With its user-friendly interface, the ar1000td allows businesses to streamline their document workflows efficiently.

-

What are the key features of the ar1000td?

The ar1000td is equipped with a range of features designed to enhance document management. Key features include multi-party signing, template creation, and real-time tracking of document status. These functionalities empower businesses to accelerate their operations and improve turnaround times.

-

How much does the ar1000td cost?

Pricing for the ar1000td varies depending on the plan selected, but airSlate SignNow offers competitive rates to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need. Visit our pricing page for detailed information on the available plans.

-

What benefits does the ar1000td provide for businesses?

The ar1000td offers numerous benefits, including reduced paperwork, improved efficiency, and enhanced security for document transactions. By utilizing this solution, businesses can save time and resources, allowing staff to focus on core activities rather than administrative tasks. Additionally, the ar1000td ensures compliance with legal standards for eSignatures.

-

Is the ar1000td suitable for small businesses?

Absolutely! The ar1000td is designed with businesses of all sizes in mind, making it a perfect solution for small businesses as well. Its cost-effective pricing and intuitive features allow small enterprises to adopt electronic signing without breaking the bank.

-

What integrations are available with the ar1000td?

The ar1000td seamlessly integrates with various applications to enhance your workflow. Popular integrations include CRM systems, cloud storage services, and project management tools. This creates a more connected experience, allowing users to manage all their documents in one place.

-

Can I use the ar1000td on mobile devices?

Yes, the ar1000td is fully functional on mobile devices, making it easy to eSign documents on the go. Whether you are using a smartphone or tablet, you can access all the features of the ar1000td from anywhere, ensuring you never miss a signing opportunity.

Get more for IRS Announces Tax Relief For Arkansas Victims Of Severe

- Legal last will and testament form for married person with adult children texas

- Texas legal will form

- Texas minor form

- Texas codicil form

- Legal last will and testament form for married person with adult and minor children from prior marriage texas

- Legal last will and testament form for married person with adult and minor children texas

- Tx wills form

- Texas widow form

Find out other IRS Announces Tax Relief For Arkansas Victims Of Severe

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer