Cf 1040 Lansing Form

What is the CF 1040 Lansing?

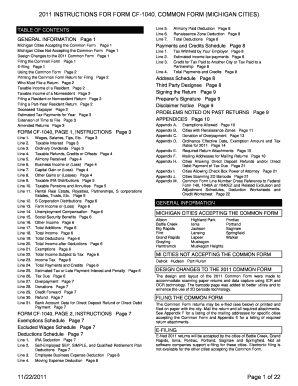

The CF 1040 Lansing is a tax form specifically designed for residents of Lansing, Michigan, to report their income and calculate their tax obligations. This form is part of the city of Lansing tax forms and is essential for local tax compliance. It is used by individuals to declare their earnings, claim deductions, and determine their tax liability to the city. Understanding the CF 1040 is crucial for ensuring accurate tax reporting and avoiding potential penalties.

How to Complete the CF 1040 Lansing

Completing the CF 1040 Lansing involves several steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total income, followed by any applicable deductions. Finally, calculate your tax liability and ensure that you sign and date the form before submission.

Legal Use of the CF 1040 Lansing

The CF 1040 Lansing is legally binding when completed and submitted according to the guidelines set forth by the city of Lansing. To ensure its validity, the form must be filled out accurately, and all required signatures must be provided. Additionally, eSignatures are recognized as legally valid under U.S. law, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the CF 1040 Lansing to avoid penalties. Typically, the form must be submitted by April 15 of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended. Keeping track of these important dates ensures timely compliance with local tax regulations.

Required Documents for CF 1040 Lansing

To accurately complete the CF 1040 Lansing, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses

- Any other relevant income documentation

Having these documents on hand will streamline the completion process and help ensure that all income is reported accurately.

Form Submission Methods

The CF 1040 Lansing can be submitted through various methods to accommodate different preferences. Residents may choose to file the form online through secure e-filing options, mail it directly to the city tax office, or deliver it in person. Each method has its own advantages, with online submission typically offering the fastest processing time.

Penalties for Non-Compliance

Failure to file the CF 1040 Lansing by the deadline can result in penalties, including fines and interest on any unpaid taxes. It is essential to comply with local tax laws to avoid these consequences. Understanding the importance of timely filing and accurate reporting can help residents maintain good standing with the city of Lansing.

Quick guide on how to complete form cf 1040

Easily Prepare form cf 1040 on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage cf 1040 across any platform with airSlate SignNow's Android or iOS applications, and enhance any document-related process today.

How to Modify and eSign cf 1040 lansing Effortlessly

- Find cf1040 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign city of lansing tax forms and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to cf 1040 instructions

Create this form in 5 minutes!

How to create an eSignature for the cf 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask cf1040

-

What is the cf 1040 form and why is it important?

The cf 1040 form is a crucial document used for filing individual income taxes in the United States. It enables taxpayers to report their income, claim deductions, and calculate their tax obligations. Understanding the cf 1040 is essential for compliance and taking advantage of possible tax refunds.

-

How can airSlate SignNow help with the cf 1040 form?

airSlate SignNow simplifies the process of completing and eSigning the cf 1040 form. Users can easily upload the form, fill it out electronically, and securely send it for eSignature. This streamlines the tax preparation process, reducing errors and saving valuable time.

-

What features does airSlate SignNow offer for handling the cf 1040?

airSlate SignNow provides features like secure document storage, customizable templates for the cf 1040 form, and automated reminders for signatures. These tools ensure that your tax documents are managed efficiently, and you stay organized throughout tax season.

-

Is airSlate SignNow a cost-effective solution for managing the cf 1040?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses and individuals handling the cf 1040. With flexible pricing plans and no hidden fees, it offers excellent value for users seeking efficient document signing and management.

-

Can I integrate airSlate SignNow with other applications for my cf 1040 workflow?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and more. This means you can manage all aspects of your cf 1040 workflow in one place, enhancing productivity and collaboration.

-

What security measures does airSlate SignNow have for the cf 1040 form?

airSlate SignNow prioritizes security with advanced encryption and secure access controls for the cf 1040 form. These measures protect sensitive information and ensure your documents are safe throughout the signing process.

-

How does using airSlate SignNow improve the filing process for the cf 1040?

Using airSlate SignNow enhances the filing process for the cf 1040 by providing an intuitive interface and real-time status tracking. This minimizes the risk of delays and helps users stay on schedule during the busy tax season.

Get more for city of lansing tax forms

Find out other form cf 1040

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy