Arkansas State Tax Filing 2023

Understanding Arkansas State Tax Filing

The Arkansas State Tax Filing process is essential for residents and businesses to comply with state tax laws. This process involves submitting tax returns to the Arkansas Department of Finance and Administration (DFA) to report income and calculate tax liabilities. Understanding the nuances of this filing is crucial for accurate reporting and avoiding penalties.

Steps to Complete the Arkansas State Tax Filing

Completing the Arkansas State Tax Filing involves several steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for deductions.

- Calculate your taxable income by subtracting allowable deductions from your total income.

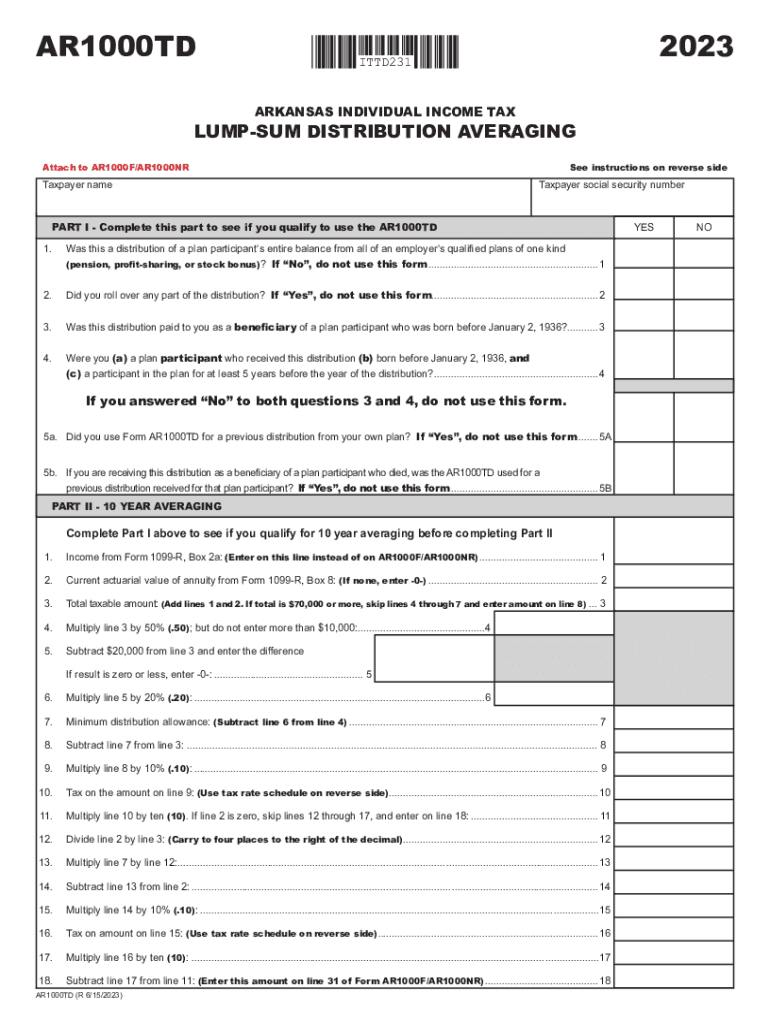

- Fill out the appropriate tax forms, such as the AR1000TD form, ensuring all information is accurate.

- Review your completed return for errors before submission.

- Submit your tax return by the deadline, either electronically or via mail.

Required Documents for Arkansas State Tax Filing

When preparing to file your Arkansas state taxes, it is important to have the following documents ready:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income, such as rental income or dividends.

- Documentation for deductions, including receipts for medical expenses, charitable contributions, and mortgage interest.

- Any previous year tax returns, which can provide useful information for the current filing.

Legal Use of the Arkansas State Tax Filing

The Arkansas State Tax Filing is legally required for individuals and entities earning income within the state. Filing ensures compliance with state tax laws and helps maintain public services funded by tax revenues. Failure to file can result in penalties, interest on unpaid taxes, and potential legal action.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for Arkansas state taxes to avoid penalties. Typically, the deadline for individual income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, estimated tax payments are due quarterly, with specific dates set by the Arkansas DFA.

Form Submission Methods for Arkansas State Tax Filing

Arkansas residents have several options for submitting their state tax forms:

- Online submission through the Arkansas DFA website, which often allows for faster processing.

- Mailing paper forms to the appropriate address provided by the DFA.

- In-person submission at local DFA offices, which may offer assistance for complex filings.

Eligibility Criteria for Arkansas State Tax Filing

Eligibility to file Arkansas state taxes generally includes individuals who earn income within the state. This includes wages, self-employment income, and investment income. Additionally, certain exemptions may apply, such as for low-income earners or specific age groups, which can affect the requirement to file.

Quick guide on how to complete arkansas state tax filing

Complete Arkansas State Tax Filing effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents swiftly without interruptions. Manage Arkansas State Tax Filing on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Arkansas State Tax Filing without effort

- Find Arkansas State Tax Filing and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you want to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Arkansas State Tax Filing and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansas state tax filing

Create this form in 5 minutes!

How to create an eSignature for the arkansas state tax filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is AR income averaging?

AR income averaging is a financial strategy that helps businesses distribute their income over a period of time to manage tax liabilities more effectively. By utilizing AR income averaging, firms can potentially lower their taxable income in higher-earning years, providing more financial stability.

-

How can airSlate SignNow assist with AR income averaging?

AirSlate SignNow streamlines the documentation process for AR income averaging by allowing businesses to easily send, sign, and manage essential forms electronically. This ensures that your tax documents related to AR income averaging are handled efficiently, saving time and reducing errors.

-

What features does airSlate SignNow offer for managing AR income averaging documents?

AirSlate SignNow provides key features like templates, automated workflows, and secure storage, which are highly beneficial for managing AR income averaging documents. These features ensure that your documentation is organized, accessible, and compliant with the necessary regulations.

-

Is there a cost associated with using airSlate SignNow for AR income averaging?

Yes, there is a cost associated with using airSlate SignNow; however, it remains a cost-effective solution compared to traditional methods. The pricing plans are structured to cater to various business sizes and include features that can signNowly streamline your AR income averaging processes.

-

Can I integrate airSlate SignNow with other accounting software for AR income averaging?

Absolutely! AirSlate SignNow seamlessly integrates with popular accounting software applications, making it easy to manage your AR income averaging tasks along with your financial data. This integration enhances efficiency, allowing you to focus on making informed financial decisions.

-

What are the benefits of using airSlate SignNow for AR income averaging?

Using airSlate SignNow for AR income averaging offers numerous benefits such as improved accuracy, faster turnaround times, and reduced operational costs. By digitizing your documentation process, you can achieve greater efficiency and ensure compliance with tax regulations.

-

Is airSlate SignNow secure for handling sensitive AR income averaging information?

Yes, airSlate SignNow employs robust security measures, including encryption and user authentication, to protect sensitive information related to AR income averaging. This ensures that your tax documents remain confidential and secure throughout the signing process.

Get more for Arkansas State Tax Filing

- Mineral deed for texas fill online printable fillable blank form

- Exhibit s form of special warrantly deed austintexasgov

- Oil gas and mineral deed sale form

- Trust to an individual two trustees form

- State of texas to wit form

- Warrant unto form

- Trust to two 2 individual form

- Special warranty deed for husband ampamp wife to llc keyt forms

Find out other Arkansas State Tax Filing

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online