22330010001 Missouri Department of Revenue Mo Gov 2022

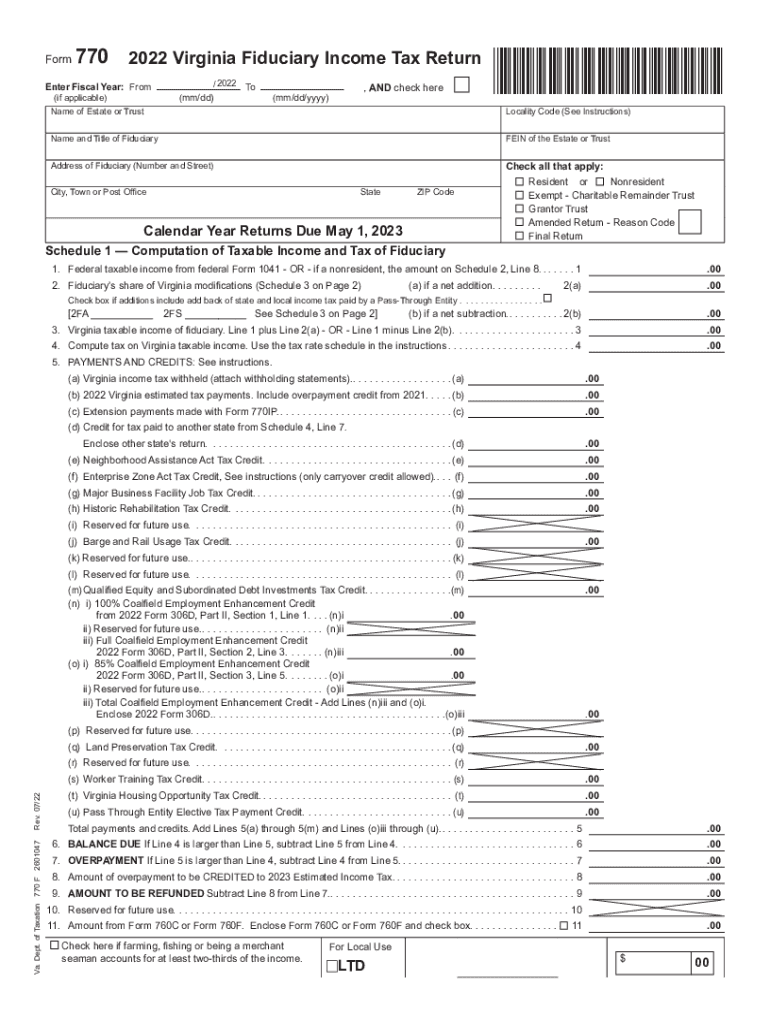

Understanding the 2022 Virginia Form 770

The 2022 Virginia Form 770 is a crucial document for individuals filing their state income tax returns. This form is specifically designed for residents of Virginia and is used to report income, calculate tax liabilities, and determine eligibility for various credits and deductions. It is essential for taxpayers to accurately complete this form to ensure compliance with state tax laws and to avoid any potential penalties.

Key Elements of the 2022 Virginia Form 770

The form includes several key sections that taxpayers must complete. These sections typically cover personal information, income sources, adjustments to income, and tax credits. Understanding these elements is vital for accurately reporting income and calculating the correct tax amount owed. Additionally, the form requires taxpayers to provide information about any dependents, which can impact the overall tax liability.

Steps to Complete the 2022 Virginia Form 770

Completing the 2022 Virginia Form 770 involves several important steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out the personal information section accurately, including your name, address, and Social Security number.

- Report all sources of income in the appropriate sections, ensuring that all amounts are correctly entered.

- Apply any eligible deductions or credits, which can reduce your taxable income or tax liability.

- Review the completed form for accuracy before submission.

Filing Deadlines for the 2022 Virginia Form 770

It is important for taxpayers to be aware of the filing deadlines associated with the 2022 Virginia Form 770. Typically, the deadline for submitting this form is May 1 of the following year. However, if May 1 falls on a weekend or holiday, the deadline may be extended to the next business day. Timely filing is essential to avoid penalties and interest on any unpaid taxes.

Form Submission Methods for the 2022 Virginia Form 770

Taxpayers have multiple options for submitting the 2022 Virginia Form 770. The form can be filed electronically through various tax software programs, which often provide guided assistance. Alternatively, taxpayers can choose to print the completed form and mail it to the appropriate Virginia Department of Taxation address. In-person submissions may also be possible at designated tax offices.

Penalties for Non-Compliance with the 2022 Virginia Form 770

Failure to file the 2022 Virginia Form 770 on time or inaccuracies in reporting can result in penalties. The Virginia Department of Taxation may impose late filing fees, interest on unpaid taxes, and other penalties for non-compliance. It is crucial for taxpayers to ensure that their forms are accurate and submitted by the deadline to avoid these consequences.

Quick guide on how to complete 22330010001 missouri department of revenue mogov 627319943

Complete 22330010001 Missouri Department Of Revenue Mo gov effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage 22330010001 Missouri Department Of Revenue Mo gov on any platform using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign 22330010001 Missouri Department Of Revenue Mo gov with ease

- Locate 22330010001 Missouri Department Of Revenue Mo gov and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 22330010001 Missouri Department Of Revenue Mo gov and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 22330010001 missouri department of revenue mogov 627319943

Create this form in 5 minutes!

How to create an eSignature for the 22330010001 missouri department of revenue mogov 627319943

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 Virginia 770 and how does it integrate with airSlate SignNow?

The 2022 Virginia 770 is a tax form used for reporting various state taxes in Virginia. AirSlate SignNow offers seamless integration for eSigning and sending your completed 2022 Virginia 770 documents, making the process efficient and straightforward.

-

How much does using airSlate SignNow for the 2022 Virginia 770 cost?

AirSlate SignNow provides a cost-effective solution for eSigning your 2022 Virginia 770. Our pricing plans are designed to fit businesses of all sizes, ensuring you can manage your document workflows without breaking the bank.

-

Can airSlate SignNow help me manage multiple 2022 Virginia 770 forms at once?

Yes, airSlate SignNow allows you to manage multiple 2022 Virginia 770 forms simultaneously. With our user-friendly interface, you can easily send, eSign, and organize your documents, boosting productivity and efficiency.

-

What features does airSlate SignNow offer for the 2022 Virginia 770?

AirSlate SignNow includes features tailored for the 2022 Virginia 770, such as customizable templates, secure storage, and real-time tracking. These features simplify the eSigning process, making it easier for you to handle your tax forms.

-

Is airSlate SignNow secure for handling the 2022 Virginia 770?

Absolutely! AirSlate SignNow employs industry-standard security measures, including encryption and secure access, ensuring that your 2022 Virginia 770 and other sensitive documents are protected at all times.

-

How can I access my completed 2022 Virginia 770 using airSlate SignNow?

After eSigning your 2022 Virginia 770 using airSlate SignNow, you can easily access your completed documents in your account dashboard. Our platform allows for quick retrieval and organization of all your signed forms.

-

Does airSlate SignNow offer support for the 2022 Virginia 770?

Yes, airSlate SignNow provides comprehensive customer support for users dealing with the 2022 Virginia 770. Our team is available to answer any questions and help you navigate the eSigning process efficiently.

Get more for 22330010001 Missouri Department Of Revenue Mo gov

Find out other 22330010001 Missouri Department Of Revenue Mo gov

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word