Restoration of a Substantial Amount Held under Claim of 2023-2026

What is the Restoration of a Substantial Amount Held Under Claim Of

The Restoration of a Substantial Amount Held Under Claim Of refers to a legal process where funds that have been previously claimed or held by the state are returned to the rightful owner. This process is particularly relevant for individuals or entities who have had their assets frozen or seized due to legal disputes, tax issues, or other claims. Understanding this process is crucial for those looking to regain access to their funds and navigate the complexities of the legal system.

How to Use the Restoration of a Substantial Amount Held Under Claim Of

To effectively utilize the Restoration of a Substantial Amount Held Under Claim Of, individuals must first gather all relevant documentation that supports their claim. This includes proof of ownership, any correspondence with the state regarding the claim, and legal documents that outline the circumstances of the seizure. Once the necessary information is compiled, the claimant should follow the specific procedures outlined by the state, which may involve submitting a formal request or petition to the appropriate authority.

Steps to Complete the Restoration of a Substantial Amount Held Under Claim Of

Completing the Restoration of a Substantial Amount Held Under Claim Of involves several key steps:

- Gather necessary documentation, including proof of ownership and legal correspondence.

- Review state-specific guidelines to understand the requirements for submission.

- Prepare and submit a formal request or petition to the designated authority.

- Follow up with the authority to ensure that the claim is being processed.

- Respond to any requests for additional information or documentation promptly.

Legal Use of the Restoration of a Substantial Amount Held Under Claim Of

The legal use of the Restoration of a Substantial Amount Held Under Claim Of is primarily concerned with the rightful return of assets to individuals or entities who have been adversely affected by legal claims. This process ensures that individuals are not unjustly deprived of their property and provides a legal framework for resolving disputes over asset ownership. It is essential for claimants to understand their rights and the legal implications of their claims to navigate this process effectively.

Eligibility Criteria

Eligibility for the Restoration of a Substantial Amount Held Under Claim Of typically depends on several factors, including:

- The nature of the claim that led to the asset being held.

- Proof of ownership or entitlement to the funds.

- Compliance with any legal requirements set forth by the state.

Individuals must demonstrate that they meet these criteria to successfully reclaim their assets.

Required Documents

When initiating the Restoration of a Substantial Amount Held Under Claim Of, certain documents are generally required, including:

- Proof of ownership, such as titles, deeds, or account statements.

- Legal documents that outline the circumstances surrounding the claim.

- Any correspondence with the state or relevant authorities regarding the claim.

Having these documents ready can streamline the process and improve the chances of a successful restoration.

Quick guide on how to complete restoration of a substantial amount held under claim of

Effortlessly Prepare Restoration Of A Substantial Amount Held Under Claim Of on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Restoration Of A Substantial Amount Held Under Claim Of on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Restoration Of A Substantial Amount Held Under Claim Of with Ease

- Locate Restoration Of A Substantial Amount Held Under Claim Of and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Restoration Of A Substantial Amount Held Under Claim Of to maintain excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct restoration of a substantial amount held under claim of

Create this form in 5 minutes!

How to create an eSignature for the restoration of a substantial amount held under claim of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

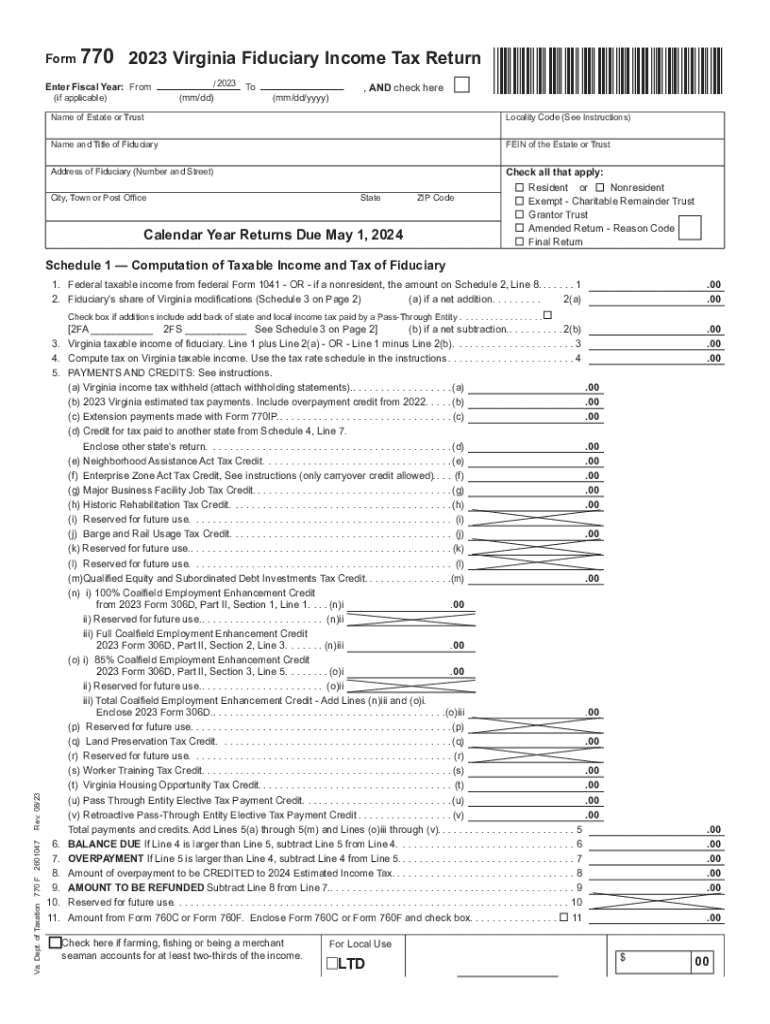

What is the 2023 Virginia 770 and how can it benefit my business?

The 2023 Virginia 770 is designed to streamline document management through eSigning and secure file sharing. Businesses can save time and reduce paper waste by utilizing this cost-effective solution, making it easier to manage contracts and agreements efficiently.

-

How much does airSlate SignNow cost for the 2023 Virginia 770?

Pricing for the 2023 Virginia 770 varies based on the plan you choose, with options to suit different business needs. airSlate SignNow offers competitive rates, and you can also access a variety of features at no extra cost, ensuring you get the best value for your investment.

-

What key features does the 2023 Virginia 770 offer?

The 2023 Virginia 770 includes features such as customizable templates, document tracking, and online payments, enhancing your overall signing process. These capabilities ensure a seamless experience for both senders and signers, empowering businesses to operate more effectively.

-

Is the 2023 Virginia 770 compliant with legal regulations?

Yes, the 2023 Virginia 770 complies with all relevant eSigning laws, including the ESIGN Act and UETA. This compliance guarantees that your electronic signatures are legally binding, providing peace of mind for businesses operating in Virginia and beyond.

-

Can the 2023 Virginia 770 integrate with other software systems?

Absolutely! The 2023 Virginia 770 offers integrations with popular tools such as Google Drive, Salesforce, and Microsoft Office. This flexibility allows businesses to streamline their workflows and enhance productivity by connecting their existing systems.

-

What are the benefits of using the 2023 Virginia 770 for small businesses?

The 2023 Virginia 770 is particularly beneficial for small businesses, as it offers cost-effective solutions and easy scalability. With features that simplify document handling and signing processes, small businesses can save time and reduce operational costs signNowly.

-

How can I get support if I encounter issues with the 2023 Virginia 770?

If you experience any issues with the 2023 Virginia 770, airSlate SignNow provides comprehensive support options, including 24/7 customer service and an extensive help center. Our dedicated support team is always ready to assist you with any concerns you may have.

Get more for Restoration Of A Substantial Amount Held Under Claim Of

- The residential form

- Blank sales agreement real estate form

- Oklahoma real estate sale contract form

- Oklahoma land contract form

- Free oregon rental lease agreements residential eforms

- Reason for a roommate agreement and 9 things to include form

- Sample initial agency disclosure pamphlet oregongov form

- Notice of clients trust account ampamp authorization to examine form

Find out other Restoration Of A Substantial Amount Held Under Claim Of

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free