VA 770 Fill Out Tax Template OnlineUS Legal 2021

Understanding the 2021 Form 770

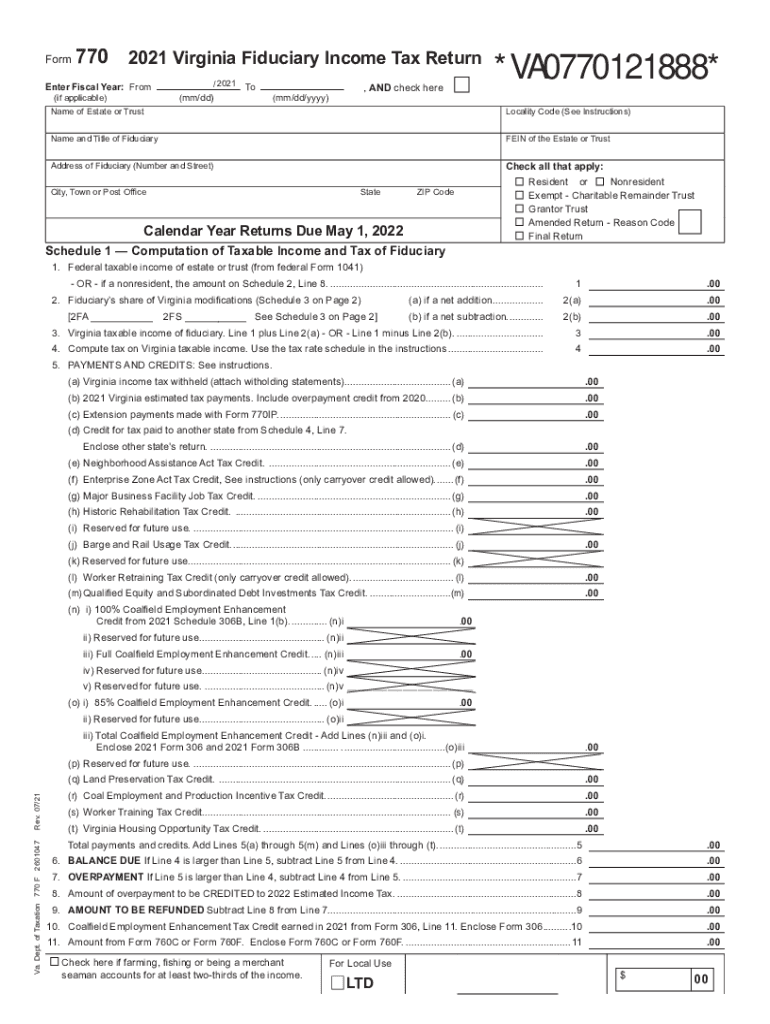

The 2021 Form 770 is a crucial document for Virginia taxpayers, specifically designed for fiduciaries handling income tax returns. This form is utilized to report income, deductions, and credits applicable to estates and trusts. It is essential for ensuring compliance with state tax regulations and for accurately calculating tax liabilities.

Steps to Complete the 2021 Form 770

Filling out the 2021 Virginia Form 770 involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill in the identification section with the fiduciary's name, address, and taxpayer identification number.

- Report all sources of income, including interest, dividends, and capital gains.

- Claim any applicable deductions and credits to reduce taxable income.

- Review the completed form for accuracy before submission.

Required Documents for the 2021 Form 770

To successfully complete the 2021 Form 770, certain documents are necessary:

- Income statements for the estate or trust, including K-1 forms.

- Documentation for any deductions claimed, such as receipts and invoices.

- Previous tax returns, if applicable, to ensure consistency in reporting.

Filing Deadlines for the 2021 Form 770

Timely submission of the 2021 Form 770 is crucial to avoid penalties. The filing deadline typically aligns with the due date for federal income tax returns, which is usually April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable to check for any state-specific extensions or changes.

Legal Use of the 2021 Form 770

The 2021 Virginia Form 770 is legally binding when filled out correctly and submitted to the state tax authorities. It must be signed by the fiduciary, and any supporting documentation should be included to substantiate the information provided. Compliance with state tax laws ensures that the fiduciary is acting within legal parameters, avoiding potential penalties.

Digital vs. Paper Version of the 2021 Form 770

Taxpayers have the option to complete the 2021 Form 770 either digitally or on paper. The digital version offers advantages such as ease of use, automatic calculations, and faster submission. However, some may prefer the traditional paper method for its tangible nature. Regardless of the method chosen, ensuring accuracy and compliance with submission guidelines is essential.

Quick guide on how to complete va 770 2019 2021 fill out tax template onlineus legal

Prepare VA 770 Fill Out Tax Template OnlineUS Legal seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to access the correct template and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without any hold-ups. Manage VA 770 Fill Out Tax Template OnlineUS Legal on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign VA 770 Fill Out Tax Template OnlineUS Legal effortlessly

- Obtain VA 770 Fill Out Tax Template OnlineUS Legal and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign VA 770 Fill Out Tax Template OnlineUS Legal and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct va 770 2019 2021 fill out tax template onlineus legal

Create this form in 5 minutes!

How to create an eSignature for the va 770 2019 2021 fill out tax template onlineus legal

How to generate an e-signature for your PDF file in the online mode

How to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the 2021 Form 770 and why is it important?

The 2021 Form 770 is a tax document used for various tax-related purposes, particularly pertinent for businesses. Completing this form accurately ensures compliance with state and federal laws, which can save you time and potential penalties down the line.

-

How can airSlate SignNow help with completing the 2021 Form 770?

airSlate SignNow allows users to easily upload, edit, and eSign the 2021 Form 770 online. Our platform enhances efficiency by streamlining the signing process, ensuring that all parties can complete the document swiftly and securely.

-

What features does airSlate SignNow offer for using the 2021 Form 770?

Our platform offers features like templates, document tracking, and customizable workflows specifically designed for the 2021 Form 770. These tools simplify the documentation process and enhance collaboration among signers.

-

Is there a cost associated with using airSlate SignNow for the 2021 Form 770?

Yes, airSlate SignNow has several pricing plans tailored to different needs, starting at affordable rates. Our pricing is competitive, providing excellent value for businesses looking to manage their 2021 Form 770 efficiently.

-

Can I integrate airSlate SignNow with other software for the 2021 Form 770?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRMs and project management tools, making it easy to incorporate the 2021 Form 770 into your existing workflows. This integration enhances productivity and ensures all documents are easily accessible.

-

What are the benefits of eSigning the 2021 Form 770 with airSlate SignNow?

eSigning the 2021 Form 770 with airSlate SignNow offers numerous benefits, including speed, security, and ease of use. Our platform keeps your documents organized and provides a legally binding signature, helping to expedite your business processes.

-

How secure is using airSlate SignNow for the 2021 Form 770?

Security is a top priority at airSlate SignNow. Our platform employs robust encryption protocols to protect sensitive data associated with the 2021 Form 770, ensuring your information remains confidential and secure at all times.

Get more for VA 770 Fill Out Tax Template OnlineUS Legal

- Bill of sale for watercraft or boat arizona form

- Bill of sale of automobile and odometer statement for as is sale arizona form

- Construction contract cost plus or fixed fee arizona form

- Painting contract for contractor arizona form

- Trim carpenter contract for contractor arizona form

- Fencing contract for contractor arizona form

- Hvac contract for contractor arizona form

- Landscape contract for contractor arizona form

Find out other VA 770 Fill Out Tax Template OnlineUS Legal

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract