MO 1040 Individual Income Tax Return Long Form

What is the MO 1040 Individual Income Tax Return Long Form

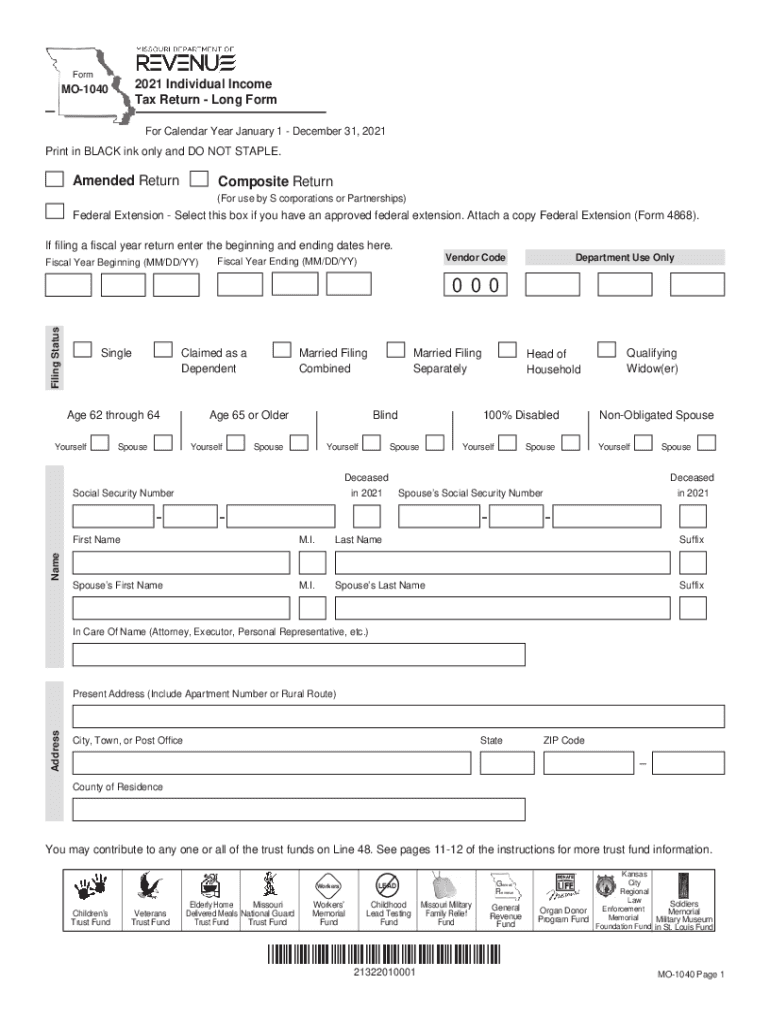

The MO 1040 Individual Income Tax Return Long Form is the official document used by residents of Missouri to report their annual income and calculate their state tax liability. This form is essential for individuals who need to provide detailed information about their income sources, deductions, and credits. It is designed to ensure compliance with Missouri tax laws and allows taxpayers to accurately report their financial situation to the state government.

How to use the MO 1040 Individual Income Tax Return Long Form

Using the MO 1040 Long Form involves several steps to ensure accurate completion. Taxpayers should first gather all necessary documentation, including W-2 forms, 1099 forms, and any records of deductions. After collecting these documents, individuals can begin filling out the form by entering personal information, income details, and applicable deductions. It is important to follow the instructions carefully to avoid errors that could lead to delays in processing or potential penalties.

Steps to complete the MO 1040 Individual Income Tax Return Long Form

Completing the MO 1040 Long Form requires a systematic approach. Here are the key steps:

- Gather Documentation: Collect all necessary income statements and receipts for deductions.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Input all sources of income, such as wages, interest, and dividends.

- Claim Deductions: Detail any deductions you are eligible for, such as medical expenses or charitable contributions.

- Calculate Tax Liability: Use the provided tax tables to determine your tax owed or refund due.

- Sign and Date: Ensure the form is signed and dated before submission.

Legal use of the MO 1040 Individual Income Tax Return Long Form

The legal use of the MO 1040 Long Form is governed by Missouri tax laws. To be considered valid, the form must be completed accurately and submitted by the designated filing deadline. Electronic signatures are permissible if they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. Ensuring that the form is signed and submitted correctly is crucial to avoid legal issues or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the MO 1040 Long Form typically align with federal tax deadlines. For most taxpayers, the deadline to submit the form is April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file without incurring penalties.

Required Documents

To complete the MO 1040 Long Form accurately, taxpayers must gather several key documents:

- W-2 forms from employers

- 1099 forms for additional income sources

- Records of any deductions, such as receipts for medical expenses

- Documentation for credits, like education expenses

Having these documents ready will facilitate a smoother filing process and help ensure that all income and deductions are reported correctly.

Quick guide on how to complete mo 1040 2021 individual income tax return long form

Prepare MO 1040 Individual Income Tax Return Long Form effortlessly on any device

Online document administration has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage MO 1040 Individual Income Tax Return Long Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign MO 1040 Individual Income Tax Return Long Form without hassle

- Find MO 1040 Individual Income Tax Return Long Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign MO 1040 Individual Income Tax Return Long Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo 1040 2021 individual income tax return long form

Create this form in 5 minutes!

How to create an eSignature for the mo 1040 2021 individual income tax return long form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO 1040 Individual Income Tax Return Long Form?

The MO 1040 Individual Income Tax Return Long Form is a comprehensive tax form used by Missouri residents to report their annual income and calculate their tax liability. It is designed for individuals with more complex financial situations, ensuring all deductions and credits are accurately claimed.

-

How can airSlate SignNow assist with the MO 1040 Individual Income Tax Return Long Form?

airSlate SignNow simplifies the process of completing and submitting the MO 1040 Individual Income Tax Return Long Form. By allowing users to eSign their documents securely, it removes the hassle of printing, signing, and scanning, making tax filing more efficient.

-

What features does airSlate SignNow offer for tax documents like the MO 1040 Individual Income Tax Return Long Form?

airSlate SignNow offers seamless eSigning solutions, document storage, and collaboration tools tailored to help manage tax documents such as the MO 1040 Individual Income Tax Return Long Form. Users can easily track document statuses and facilitate smooth communication across teams.

-

Is there a cost associated with using airSlate SignNow for the MO 1040 Individual Income Tax Return Long Form?

Yes, there may be a subscription fee to access airSlate SignNow's features for the MO 1040 Individual Income Tax Return Long Form. However, users can take advantage of various pricing plans tailored to fit different needs and budgets, ensuring cost-effectiveness.

-

What are the benefits of using airSlate SignNow for my MO 1040 Individual Income Tax Return Long Form?

Using airSlate SignNow for your MO 1040 Individual Income Tax Return Long Form streamlines the eSigning process, enhances document security, and reduces the turnaround time for approvals. The solution is user-friendly, saving you time so you can focus on other essential tasks.

-

Can airSlate SignNow integrate with accounting software when filing the MO 1040 Individual Income Tax Return Long Form?

Yes, airSlate SignNow offers integration capabilities with various accounting software tools, enhancing the efficiency of filing your MO 1040 Individual Income Tax Return Long Form. This ensures that your financial data is seamlessly connected, minimizing errors and saving time.

-

How does airSlate SignNow ensure the security of my MO 1040 Individual Income Tax Return Long Form?

airSlate SignNow prioritizes security by employing encryption technologies and robust authentication protocols to protect sensitive information on your MO 1040 Individual Income Tax Return Long Form. Your data is safe, ensuring peace of mind while accessing and signing documents digitally.

Get more for MO 1040 Individual Income Tax Return Long Form

Find out other MO 1040 Individual Income Tax Return Long Form

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure