Banking Corporation Tax Forms Nyc Gov

What is the Banking Corporation Tax Forms Nyc gov

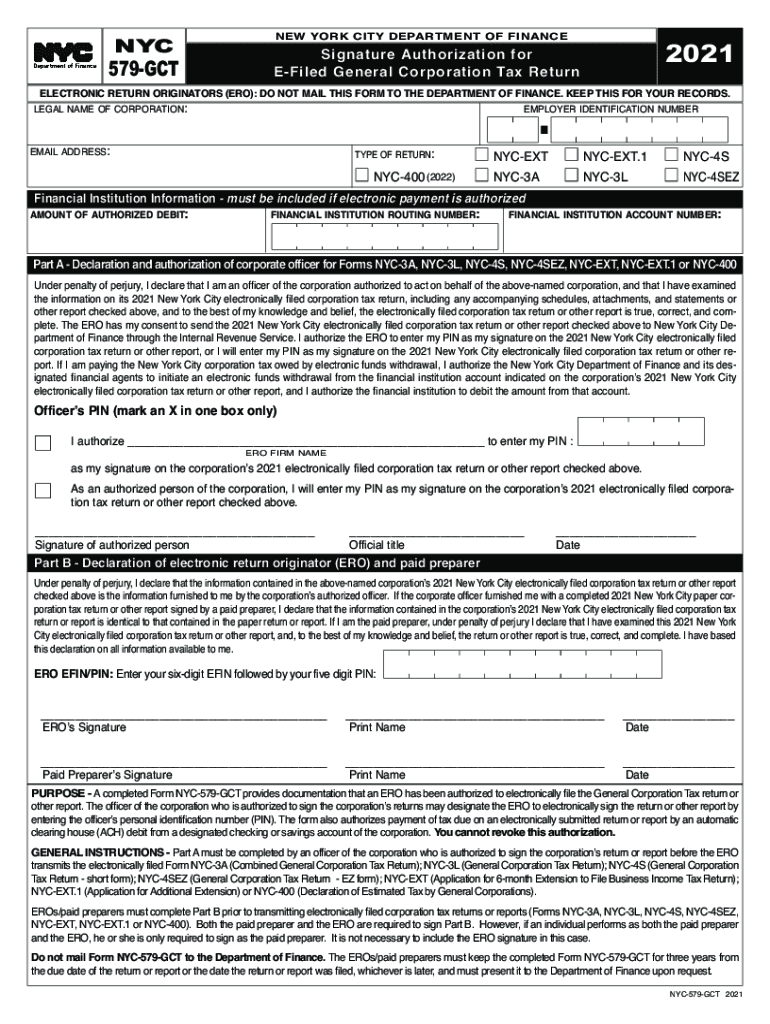

The Banking Corporation Tax Forms Nyc gov are essential documents required for financial institutions operating in New York City to report their income and calculate their tax obligations. These forms are part of the city's tax regulations and ensure that banks and other financial entities comply with local tax laws. The forms encompass various reporting requirements, including income, deductions, and credits applicable to banking corporations.

How to use the Banking Corporation Tax Forms Nyc gov

Using the Banking Corporation Tax Forms Nyc gov involves several steps to ensure accurate reporting and compliance. First, gather all necessary financial records, including income statements and balance sheets. Next, access the forms through the official NYC government website or authorized platforms. Complete the forms by providing accurate financial data, ensuring all calculations are correct. Finally, submit the completed forms either electronically or via traditional mail, depending on the submission guidelines provided by the NYC Department of Finance.

Steps to complete the Banking Corporation Tax Forms Nyc gov

Completing the Banking Corporation Tax Forms Nyc gov requires attention to detail. Follow these steps:

- Review the form instructions carefully to understand the requirements.

- Collect all relevant financial documents, including previous tax returns and current financial statements.

- Fill out the form accurately, ensuring all figures are correct and correspond to your financial records.

- Double-check your calculations to avoid errors that could lead to penalties.

- Sign and date the form where required, ensuring compliance with eSignature laws if submitting electronically.

- Submit the form by the specified deadline to avoid late fees.

Legal use of the Banking Corporation Tax Forms Nyc gov

The legal use of the Banking Corporation Tax Forms Nyc gov is crucial for ensuring compliance with New York City's tax regulations. These forms must be completed accurately and submitted on time to avoid penalties. The forms serve as official documents that can be used in legal contexts, such as audits or disputes with tax authorities. It is essential to maintain copies of submitted forms and any supporting documentation for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Banking Corporation Tax Forms Nyc gov are critical to avoid penalties. Generally, forms are due on the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically means a deadline of March 15. It is advisable to check the NYC Department of Finance website for any updates or changes to these dates, as well as for information on extensions if needed.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Banking Corporation Tax Forms Nyc gov. Corporations can file electronically through the NYC Department of Finance's online portal, which is often the quickest method. Alternatively, forms can be mailed to the appropriate address provided in the instructions. In-person submissions may also be possible at designated city offices, but it is recommended to verify current procedures and availability due to potential changes in operations.

Quick guide on how to complete 2020 banking corporation tax forms nycgov

Complete Banking Corporation Tax Forms Nyc gov seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Banking Corporation Tax Forms Nyc gov on any platform using the airSlate SignNow Android or iOS applications and streamline any document-based task today.

The easiest way to modify and eSign Banking Corporation Tax Forms Nyc gov effortlessly

- Find Banking Corporation Tax Forms Nyc gov and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Banking Corporation Tax Forms Nyc gov and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 banking corporation tax forms nycgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Banking Corporation Tax Forms Nyc gov, and who needs them?

Banking Corporation Tax Forms Nyc gov are tax documents required for banking corporations operating in New York City. These forms help ensure compliance with local tax regulations and are essential for businesses that fall under the jurisdiction of the NYC Department of Finance.

-

How can airSlate SignNow help with Banking Corporation Tax Forms Nyc gov?

airSlate SignNow offers a seamless solution for managing and eSigning your Banking Corporation Tax Forms Nyc gov. Our platform streamlines the document workflow, allowing you to quickly prepare, send, and sign necessary tax documents without the hassle of printing or mailing.

-

What features does airSlate SignNow offer for tax document management?

With airSlate SignNow, you gain access to features such as customizable templates, in-app signing, and document tracking. These capabilities enhance the efficiency of handling Banking Corporation Tax Forms Nyc gov, ensuring that you stay organized and compliant.

-

Is airSlate SignNow cost-effective for small businesses dealing with Banking Corporation Tax Forms Nyc gov?

Yes, airSlate SignNow provides a cost-effective solution suitable for small businesses. Our flexible pricing plans cater to various needs, allowing you to create, manage, and sign Banking Corporation Tax Forms Nyc gov without breaking your budget.

-

Can I integrate airSlate SignNow with other software for my Banking Corporation Tax Forms Nyc gov?

Absolutely! airSlate SignNow allows integrations with various software solutions to enhance your document workflow. This means you can easily link your financial systems or accounting software to better manage your Banking Corporation Tax Forms Nyc gov.

-

How secure is airSlate SignNow when handling Banking Corporation Tax Forms Nyc gov?

Security is a top priority at airSlate SignNow. Our platform employs industry-standard encryption and security protocols to protect your sensitive information, ensuring that your Banking Corporation Tax Forms Nyc gov are kept safe during the entire eSigning process.

-

What is the process to start using airSlate SignNow for Banking Corporation Tax Forms Nyc gov?

Starting with airSlate SignNow is simple. Sign up for an account, choose the appropriate pricing plan, and begin creating or uploading your Banking Corporation Tax Forms Nyc gov. Our user-friendly interface makes it easy to get started almost immediately.

Get more for Banking Corporation Tax Forms Nyc gov

Find out other Banking Corporation Tax Forms Nyc gov

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself