Revenue Ky GovForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach a Copy 2021

What is the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy

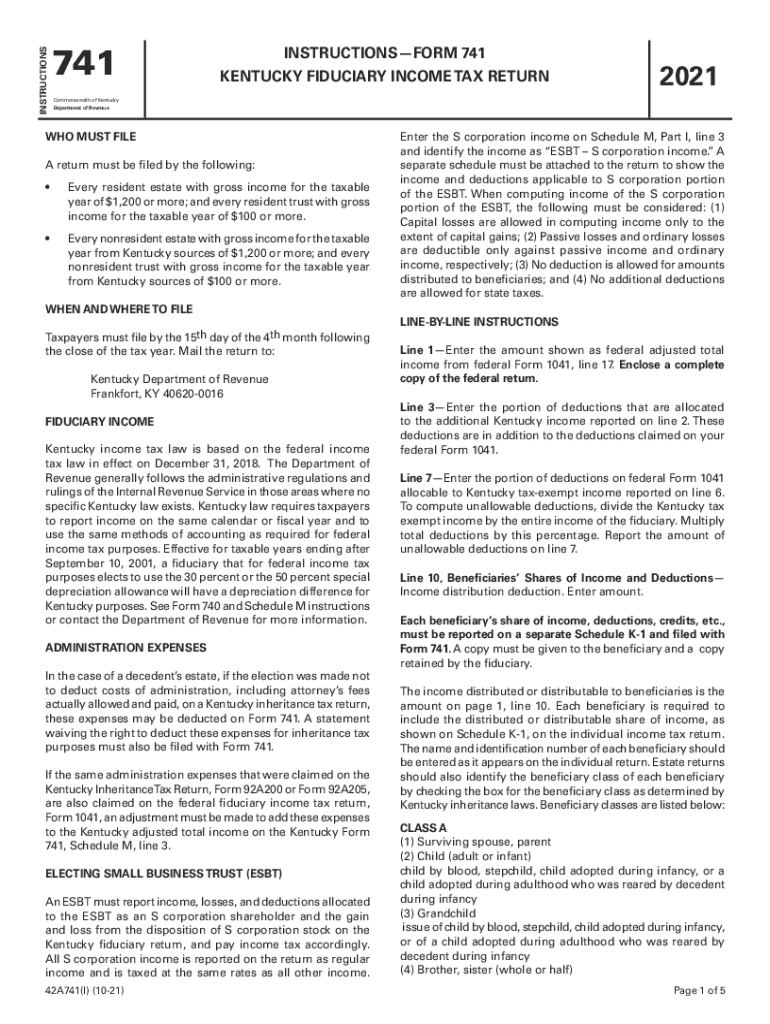

The Revenue ky govForms200242A741Form 741 is a specific form used for filing the Kentucky fiduciary income tax return. This form is designed for estates and trusts that generate income within the state of Kentucky. It is essential for reporting income, deductions, and credits applicable to the fiduciary entity. The form must be completed accurately to ensure compliance with state tax regulations.

Steps to complete the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy

Completing the Revenue ky govForms200242A741Form 741 involves several key steps:

- Gather necessary financial documents, including income statements and expense records for the estate or trust.

- Fill out the form by entering the required information, such as the fiduciary’s name, address, and tax identification number.

- Report all income earned by the estate or trust, including dividends, interest, and other sources.

- Deduct allowable expenses and any credits that apply to the fiduciary entity.

- Review the completed form for accuracy before submission.

- Attach any required documentation, such as a copy of the federal return if applicable.

Legal use of the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy

The Revenue ky govForms200242A741Form 741 is legally binding when filled out correctly and submitted in accordance with Kentucky tax laws. It serves as an official record of the fiduciary's income and tax obligations. To ensure its legal validity, the form must be signed by the fiduciary or an authorized representative. Compliance with all relevant tax regulations is crucial to avoid penalties.

Required Documents for the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy

When preparing to complete the Revenue ky govForms200242A741Form 741, specific documents are necessary to support the information provided on the form. These documents typically include:

- Income statements for the estate or trust

- Records of expenses incurred during the tax year

- Previous year’s tax returns, if applicable

- Any documentation supporting deductions and credits claimed

Filing Deadlines / Important Dates for the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy

It is important to be aware of the filing deadlines associated with the Revenue ky govForms200242A741Form 741. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is usually due by April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

How to obtain the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy

The Revenue ky govForms200242A741Form 741 can be obtained through the Kentucky Department of Revenue’s official website. The form is available for download in PDF format, allowing users to print and complete it manually. Additionally, the form can be filled out electronically using approved software, which may streamline the filing process.

Quick guide on how to complete revenuekygovforms200242a741form 741 kentucky fiduciary income tax return attach a copy

Finish Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy easily on any device

Digital document management has become widely adopted by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy on any device using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

Ways to edit and eSign Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy effortlessly

- Locate Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device of your choice. Modify and eSign Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenuekygovforms200242a741form 741 kentucky fiduciary income tax return attach a copy

Create this form in 5 minutes!

How to create an eSignature for the revenuekygovforms200242a741form 741 kentucky fiduciary income tax return attach a copy

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy?

The Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy is a tax form used for reporting fiduciary income in Kentucky. It is crucial for estates and trusts to accurately file their income tax returns to comply with state regulations. Using this form ensures proper documentation of income and deductions associated with fiduciary entities.

-

How can airSlate SignNow help with the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN?

airSlate SignNow offers a streamlined solution for eSigning and sending the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy. Our platform simplifies document management, allowing users to quickly gather signatures and securely send tax forms without the hassle of traditional paperwork.

-

Is there a pricing plan for using airSlate SignNow for the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs. Our cost-effective subscription options ensure that you can sign and manage documents, including the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy, without breaking the bank. You can choose a plan that best suits your frequency of use and required features.

-

Can airSlate SignNow integrate with other software for filing the Revenue ky govForms200242A741Form 741?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy. This allows you to streamline your processes, ensuring that your tax documents are easily accessible and manageable within your existing systems.

-

What benefits does airSlate SignNow offer for handling tax documents like form 741?

airSlate SignNow helps businesses efficiently manage and organize tax documents like the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy. Benefits include reducing paperwork, enhancing collaboration, and ensuring legal compliance with secure eSigning. With our platform, you can complete tax tasks faster and more reliably.

-

Is it easy to eSign the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN using your platform?

Yes, eSigning the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy with airSlate SignNow is straightforward and user-friendly. Simply upload the document, add the necessary fields, and request signatures from the required parties in an intuitive interface that simplifies the signing process.

-

How secure is using airSlate SignNow for sensitive tax documents?

Security is a top priority at airSlate SignNow. When dealing with sensitive tax documents like the Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy, we ensure that all data is encrypted, and our platform complies with industry-leading security standards. You can trust us to keep your tax information safe and confidential.

Get more for Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy

Find out other Revenue ky govForms200242A741Form 741 KENTUCKY FIDUCIARY INCOME TAX RETURN Attach A Copy

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT