State & Local Tax Forms & Instructions 2022

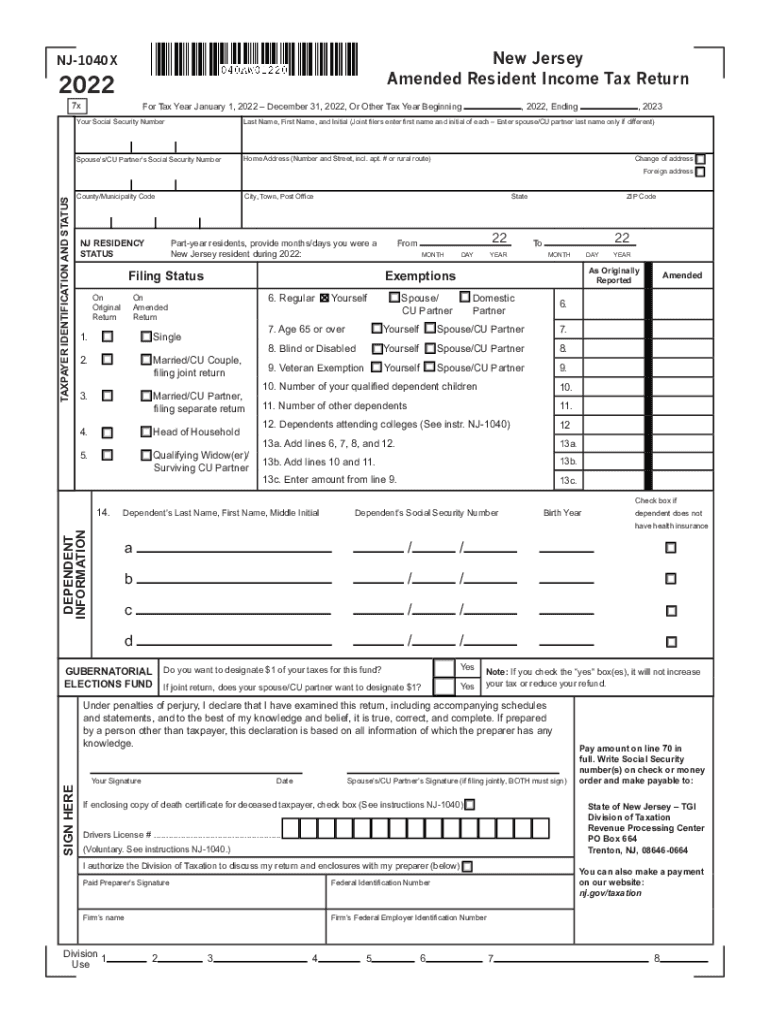

What is the 1040x 2022 form?

The 1040x 2022 form is an amended U.S. federal tax return used by individuals to correct errors on their original Form 1040. This form allows taxpayers to make changes to their filing status, income, deductions, or credits. It is essential for ensuring that the tax return accurately reflects the taxpayer's financial situation and complies with IRS regulations.

Steps to complete the 1040x 2022 form

Completing the 1040x 2022 form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant documentation, including your original Form 1040 and any supporting documents related to the changes you are making. Follow these steps:

- Clearly indicate the year of the tax return you are amending at the top of the form.

- Fill out the sections that require changes, providing the correct information in the appropriate boxes.

- Explain the reason for the amendment in Part III of the form.

- Calculate any additional tax owed or refund due based on the changes made.

- Sign and date the form before submitting it.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the 1040x 2022 form. Generally, taxpayers have up to three years from the original filing deadline to submit an amended return. For the 2022 tax year, the deadline is typically April 15, 2026. However, if you are claiming a refund, it is advisable to file the amendment as soon as possible to avoid missing the deadline.

Legal use of the 1040x 2022 form

The 1040x 2022 form must be used in compliance with IRS guidelines to ensure its legal validity. This includes accurately reporting all changes and providing necessary documentation to support the amendments. Failure to adhere to these guidelines may result in penalties or delays in processing the amended return.

Required Documents

When filing the 1040x 2022 form, certain documents are necessary to support your claims. These may include:

- Your original Form 1040 and any schedules filed with it.

- Documentation for any additional income or deductions you are claiming.

- Copies of any relevant tax forms, such as W-2s or 1099s.

- Any correspondence from the IRS related to the original return.

Form Submission Methods

The 1040x 2022 form can be submitted through various methods. Taxpayers have the option to file the form electronically or by mail. If filing electronically, ensure that you are using compatible tax software that supports the 1040x form. For those opting for mail submission, send the completed form to the address specified in the instructions, based on your state of residence.

Quick guide on how to complete 2022 state ampamp local tax forms ampamp instructions

Complete State & Local Tax Forms & Instructions effortlessly on any gadget

Online document management has gained popularity among enterprises and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage State & Local Tax Forms & Instructions on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign State & Local Tax Forms & Instructions without hassle

- Find State & Local Tax Forms & Instructions and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or mistakes that require creating new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device of your choice. Alter and eSign State & Local Tax Forms & Instructions and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 state ampamp local tax forms ampamp instructions

Create this form in 5 minutes!

How to create an eSignature for the 2022 state ampamp local tax forms ampamp instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040x 2022 form?

The 1040x 2022 form is used to amend your federal tax return. If you need to correct errors on your original 1040 form or want to claim additional deductions or credits, you will need this form. Completing the 1040x 2022 form ensures that your tax records are accurate and up to date.

-

How can airSlate SignNow help with the 1040x 2022 form?

airSlate SignNow simplifies the process of sending and electronically signing the 1040x 2022 form. Our platform allows you to easily upload, edit, and share your forms, ensuring a smooth and efficient workflow. You can also track the status of your documents to stay informed.

-

Is there a cost associated with using airSlate SignNow for the 1040x 2022 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs, including individuals and businesses. Each plan provides access to essential features that make handling documents like the 1040x 2022 form cost-effective. You can choose a plan that fits your budget and needs.

-

What features does airSlate SignNow offer for handling the 1040x 2022 form?

airSlate SignNow offers several features to streamline your 1040x 2022 form process, including template creation, digital signatures, and document tracking. Our user-friendly interface allows users to customize forms and automate workflows, making tax filing easier than ever. Additionally, you can securely store your documents in the cloud.

-

Can I integrate airSlate SignNow with other tools for the 1040x 2022 form?

Absolutely! airSlate SignNow integrates seamlessly with popular software and applications. This allows you to connect your existing tools and make the process of managing your 1040x 2022 form and other tax documents even more efficient.

-

How secure is my information when using the 1040x 2022 form on airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and stringent security measures to protect your information when you are completing the 1040x 2022 form. You can trust that your data remains confidential and secure throughout the signing process.

-

What are the benefits of eSigning the 1040x 2022 form with airSlate SignNow?

eSigning the 1040x 2022 form with airSlate SignNow offers various advantages, including time-saving features and the ability to sign documents from anywhere. It eliminates the need for printing, scanning, or mailing, which can be especially beneficial during tax season. Our service enhances efficiency and helps you meet deadlines effortlessly.

Get more for State & Local Tax Forms & Instructions

Find out other State & Local Tax Forms & Instructions

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template