New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X 2020

What is the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

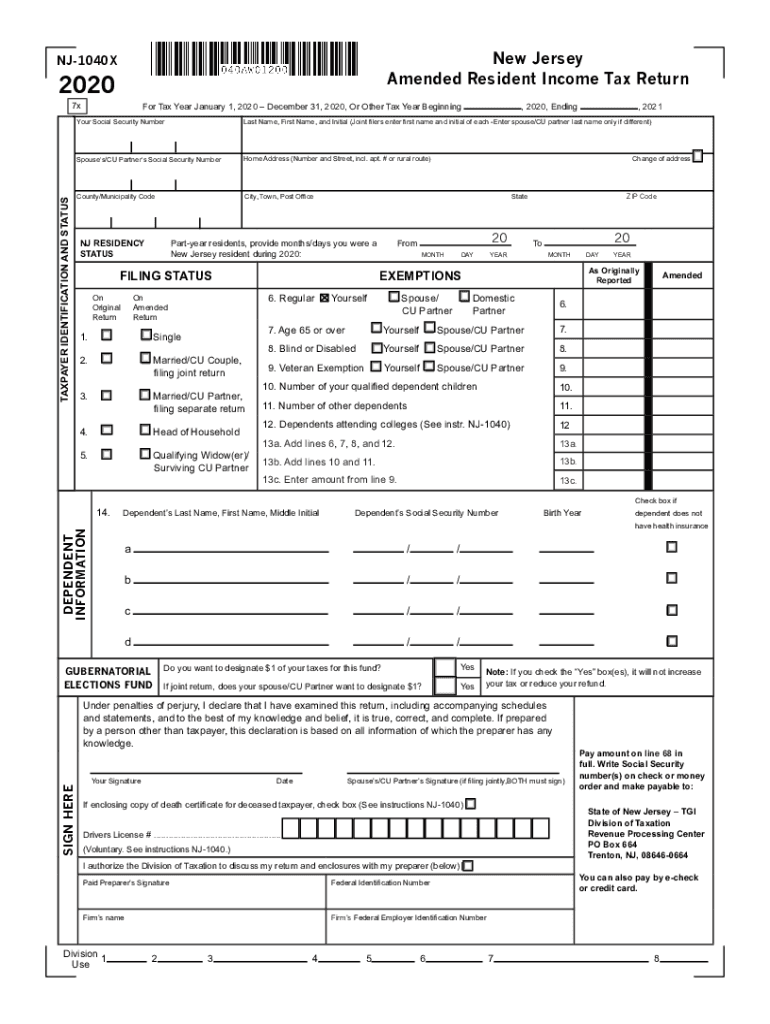

The New Jersey Amended Resident Income Tax Return, known as Form NJ 1040X, is a document used by individuals to amend their previously filed New Jersey income tax returns. This form allows taxpayers to correct errors, report additional income, or claim deductions and credits that were not included in the original submission. It is essential for ensuring that your tax records are accurate and up to date, which can help avoid potential penalties or issues with the state tax authorities.

Steps to complete the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

Completing the New Jersey Form 1040X involves several key steps. First, gather all relevant documents, including your original tax return and any supporting documents for the changes you wish to make. Next, accurately fill out the form, ensuring that you provide the correct information for both the original amounts and the amended amounts. It is crucial to explain the reasons for the amendments in the designated section of the form. Once completed, review the form thoroughly for accuracy before submitting it.

How to obtain the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

Form NJ 1040X can be obtained through the New Jersey Division of Taxation's website, where it is available for download in PDF format. Alternatively, taxpayers may request a physical copy by contacting the Division of Taxation directly. It is advisable to ensure you have the most current version of the form to avoid any issues during the filing process.

Legal use of the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

The New Jersey Form 1040X is legally recognized for amending previously filed tax returns. When properly completed and submitted, it serves as an official document that can rectify any discrepancies in your tax filings. To be considered valid, the form must be signed and dated by the taxpayer, and it should comply with all relevant state tax laws and regulations.

Key elements of the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

Key elements of Form NJ 1040X include sections for reporting personal information, details of the original return, and the amended amounts. Additionally, there are spaces for explanations regarding the changes being made. It is important to provide clear and concise information to facilitate the processing of your amended return.

Filing Deadlines / Important Dates

When filing Form NJ 1040X, it is important to be aware of the deadlines. Generally, amended returns must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Adhering to these deadlines ensures that your amendments are processed in a timely manner and helps avoid potential penalties.

Form Submission Methods (Online / Mail / In-Person)

Form NJ 1040X can be submitted through various methods. Taxpayers have the option to file the form electronically if they are using compatible tax software. Alternatively, the form can be mailed to the New Jersey Division of Taxation. In-person submissions may also be possible at designated tax offices, although it is advisable to check current procedures and availability due to varying circumstances.

Quick guide on how to complete 2020 new jersey amended resident income tax return form nj 1040x 2020 new jersey amended resident income tax return form nj

Complete New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related operations today.

The easiest method to edit and eSign New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X effortlessly

- Find New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and bears the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to record your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and eSign New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 new jersey amended resident income tax return form nj 1040x 2020 new jersey amended resident income tax return form nj

Create this form in 5 minutes!

How to create an eSignature for the 2020 new jersey amended resident income tax return form nj 1040x 2020 new jersey amended resident income tax return form nj

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the new jersey form 1040x used for?

The new jersey form 1040x is used to amend a previously filed New Jersey tax return. Whether you need to correct your filing status, income, or deductions, this form helps you update your records with the New Jersey Division of Taxation.

-

How can I fill out the new jersey form 1040x?

Filling out the new jersey form 1040x involves providing your personal information, outlining the changes you need to make, and calculating any additional taxes or refunds. Ensure you have your previous tax return on hand to accurately complete the form.

-

Is there a fee associated with filing the new jersey form 1040x?

There is no fee for filing the new jersey form 1040x itself; however, if you owe additional taxes, you will need to pay those amounts by the due date to avoid penalties and interest.

-

How long does it take to process the new jersey form 1040x?

Typically, the New Jersey Division of Taxation processes the new jersey form 1040x within 8 to 12 weeks. This time frame can vary depending on the volume of submissions and the complexity of your amendments.

-

Can airSlate SignNow help me with the new jersey form 1040x?

Yes, airSlate SignNow provides a simple and efficient way to prepare and sign your new jersey form 1040x. With our user-friendly platform, you can easily fill out the form and send it for eSignature, ensuring a smooth filing process.

-

What features does airSlate SignNow offer for handling the new jersey form 1040x?

airSlate SignNow offers features like template creation, secure cloud storage, and automatic reminders, which are particularly useful for managing the new jersey form 1040x. Our platform streamlines the process, making it more accessible and efficient.

-

Are there integrations available for submitting the new jersey form 1040x through airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to import your information directly into the new jersey form 1040x. This integration simplifies the process, helping you save time and reduce errors.

Get more for New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X

Find out other New Jersey Amended Resident Income Tax Return, Form NJ 1040X New Jersey Amended Resident Income Tax Return, Form NJ 1040X

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement