New Jersey Amended Resident Income Tax Return, Form NJ 1040X 2024-2026

What is the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

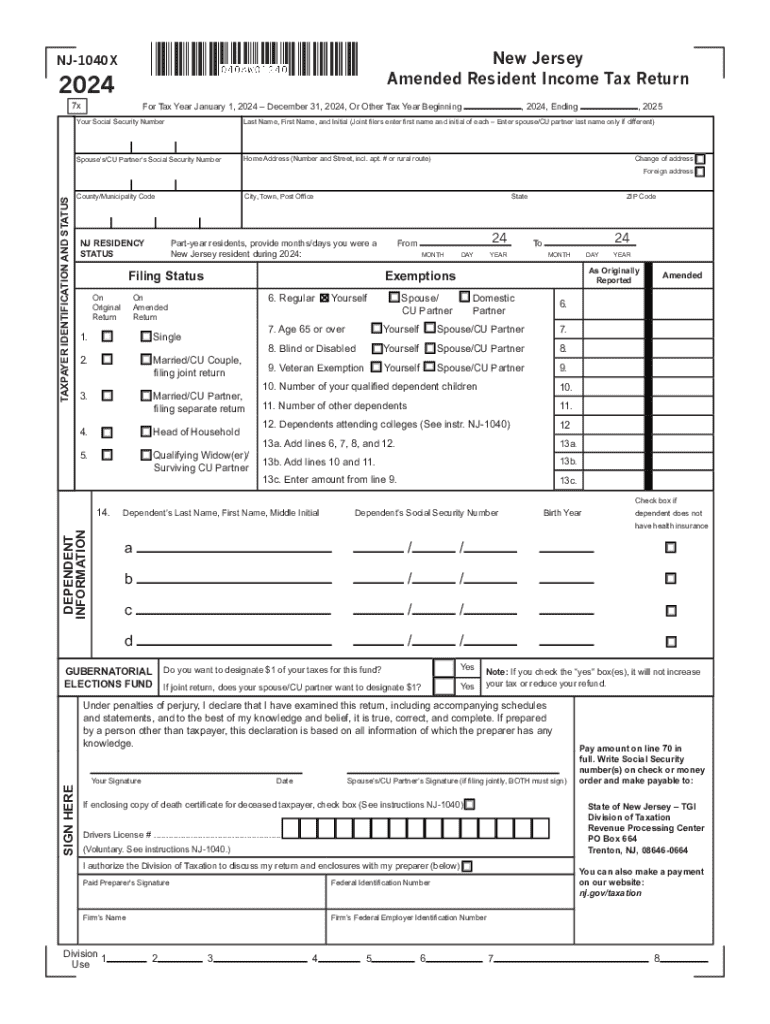

The New Jersey Amended Resident Income Tax Return, known as Form NJ 1040X, is designed for taxpayers who need to amend their previously filed New Jersey tax returns. This form allows individuals to correct errors, update information, or claim additional deductions or credits that were not included in the original submission. It is essential for ensuring that your tax records accurately reflect your financial situation and comply with state regulations.

How to use the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

To use Form NJ 1040X, start by obtaining the form from the New Jersey Division of Taxation website or other authorized sources. Fill out the form with the corrected information, ensuring that you clearly indicate the changes made from your original return. It is important to provide a detailed explanation of the amendments in the designated section of the form. Once completed, submit the form according to the provided instructions, either by mail or electronically if applicable.

Steps to complete the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

Completing Form NJ 1040X involves several key steps:

- Gather your original tax return and any relevant documents that support your amendments.

- Obtain Form NJ 1040X and read the instructions carefully.

- Fill out the form, ensuring all corrections are clearly marked and explained.

- Double-check your calculations and ensure all required fields are completed.

- Submit the amended return to the appropriate mailing address or through the designated online portal.

Required Documents

When filing Form NJ 1040X, certain documents may be necessary to support your amendments. These can include:

- Your original NJ tax return.

- Any W-2 or 1099 forms that reflect income changes.

- Receipts or documentation for deductions or credits being claimed.

- Any correspondence received from the New Jersey Division of Taxation regarding your original return.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for Form NJ 1040X. Generally, amended returns must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Keeping track of these dates ensures compliance and allows for timely processing of your amendments.

Legal use of the New Jersey Amended Resident Income Tax Return, Form NJ 1040X

Form NJ 1040X is legally recognized as the official method for amending a New Jersey tax return. It is important to use this form to ensure that your amendments are processed correctly and in accordance with state laws. Filing an amended return without using this form may lead to complications or delays in the processing of your tax records.

Create this form in 5 minutes or less

Find and fill out the correct new jersey amended resident income tax return form nj 1040x

Create this form in 5 minutes!

How to create an eSignature for the new jersey amended resident income tax return form nj 1040x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nj 1040x form and why do I need it?

The nj 1040x form is used to amend your New Jersey income tax return. If you discover errors or need to make changes to your original nj 1040, filing the nj 1040x allows you to correct those mistakes. It's essential for ensuring your tax records are accurate and up-to-date.

-

How can airSlate SignNow help me with my nj 1040x?

airSlate SignNow simplifies the process of preparing and submitting your nj 1040x form. With our easy-to-use platform, you can fill out, sign, and send your amended tax return securely. This streamlines the process, saving you time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for nj 1040x?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our cost-effective solutions ensure that you can manage your nj 1040x and other documents without breaking the bank. Check our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow offer for nj 1040x submissions?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for your nj 1040x forms. These tools enhance your workflow, making it easier to manage your tax documents efficiently. Plus, our platform is designed for user-friendliness.

-

Can I integrate airSlate SignNow with other software for my nj 1040x?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling your nj 1040x. Whether you use accounting software or document management systems, our platform can connect seamlessly to enhance your productivity.

-

What are the benefits of using airSlate SignNow for my nj 1040x?

Using airSlate SignNow for your nj 1040x provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely while allowing you to focus on other important tasks. Experience the convenience of digital document management.

-

How secure is my information when using airSlate SignNow for nj 1040x?

Security is a top priority at airSlate SignNow. When you use our platform for your nj 1040x, your information is protected with advanced encryption and secure storage solutions. We adhere to industry standards to ensure that your sensitive data remains confidential and secure.

Get more for New Jersey Amended Resident Income Tax Return, Form NJ 1040X

- How to reduce legal risk when firing an employeenolo form

- 31780 working and monitoring category d erroneous irs form

- Michigan buysell agreement transnation title agency form

- Termite report provision for contract for the sale and purchase of real property form

- Explanation of rights and plea of guilty forms

- California probate code 715an attorney may give written form

- Prevention of injuries california childcare health form

- Closing and distributing the estate county of alameda form

Find out other New Jersey Amended Resident Income Tax Return, Form NJ 1040X

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile