Schedule NEC Form 1040 NR Tax on Income Not Effectively Connected with a U S Trade or Business 2022

What is the Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business

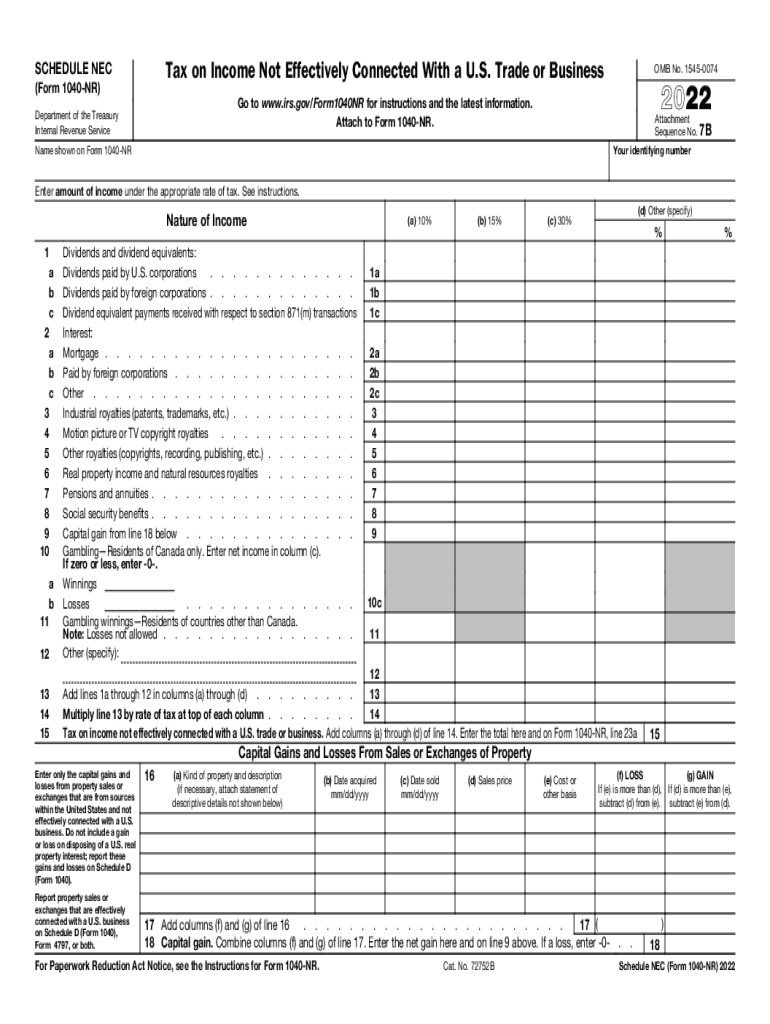

The Schedule NEC (Non-Effectively Connected) Form 1040 NR is a tax document used by non-resident aliens to report income that is not effectively connected with a U.S. trade or business. This form is essential for individuals who earn income in the United States but do not have a permanent establishment here. The income reported on this schedule may include dividends, interest, and royalties, which are subject to different tax rates compared to income that is effectively connected with a trade or business.

Steps to complete the Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business

Completing the Schedule NEC Form 1040 NR involves several steps to ensure accuracy and compliance with IRS regulations:

- Gather necessary information: Collect all relevant income documents, including Forms 1042-S, W-2, or any other statements reflecting U.S. source income.

- Fill out personal information: Enter your name, address, and taxpayer identification number (TIN) at the top of the form.

- Report income: List all income sources that fall under the non-effectively connected category. Be sure to include the amounts and any applicable deductions.

- Calculate tax liability: Use the appropriate tax rates to determine your tax owed based on the income reported.

- Sign and date the form: Ensure that you sign and date the form before submission, as this validates your declaration.

Legal use of the Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business

The Schedule NEC Form 1040 NR is legally binding when completed correctly and submitted to the IRS. It is crucial to adhere to all IRS guidelines to avoid penalties. Non-resident aliens must ensure that they report their income accurately and comply with tax obligations to maintain legal standing in the United States. The form must be filed annually, and any discrepancies can lead to audits or other legal consequences.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule NEC Form 1040 NR. These guidelines include instructions on what types of income must be reported, how to calculate tax owed, and deadlines for submission. It is essential to refer to the IRS instructions for the most current information, as tax laws and requirements can change annually. Following these guidelines ensures compliance and minimizes the risk of errors.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule NEC Form 1040 NR are typically aligned with the general tax filing dates for non-resident aliens. Generally, the deadline for submitting the form is April fifteenth of the year following the tax year in question. If you are unable to file by this date, you may request an extension, but it is important to understand that this does not extend the time to pay any taxes owed.

Required Documents

When completing the Schedule NEC Form 1040 NR, certain documents are required to substantiate the income reported. These may include:

- Forms 1042-S, which report U.S. source income paid to foreign persons.

- W-2 forms for any wages earned.

- Any other documentation that supports the income claims, such as bank statements or contracts.

Having these documents ready can facilitate a smoother filing process and ensure that all income is accurately reported.

Quick guide on how to complete 2022 schedule nec form 1040 nr tax on income not effectively connected with a us trade or business

Complete Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers a wonderful eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The optimal method to edit and eSign Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business seamlessly

- Obtain Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Compose your eSignature using the Sign feature, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to retain your changes.

- Choose your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Adjust and eSign Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business to guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 schedule nec form 1040 nr tax on income not effectively connected with a us trade or business

Create this form in 5 minutes!

How to create an eSignature for the 2022 schedule nec form 1040 nr tax on income not effectively connected with a us trade or business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the internal revenue service schedule a?

The internal revenue service schedule a is a form used by taxpayers to itemize deductions on their federal income tax return. By utilizing this schedule, you can potentially reduce your taxable income and maximize your tax refund. It's essential to accurately fill out this form to ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with the internal revenue service schedule a?

airSlate SignNow streamlines the eSigning and document management process for your internal revenue service schedule a. With our easy-to-use platform, you can securely send, sign, and store your tax documents online. This not only saves time but also enhances the accuracy and reliability of your submissions.

-

What are the pricing options for airSlate SignNow when handling tax forms like the internal revenue service schedule a?

airSlate SignNow offers various pricing plans designed to accommodate different business needs, including handling important forms like the internal revenue service schedule a. Each plan includes features like unlimited document sends and integrations with popular apps, allowing you to choose one that fits your budget and requirements.

-

Does airSlate SignNow provide templates for the internal revenue service schedule a?

Yes, airSlate SignNow offers customizable templates that can be tailored for use with the internal revenue service schedule a. These templates help ensure that you have all the required fields and information to simplify your filing process. You can easily modify them to fit your specific needs.

-

Is airSlate SignNow compliant with IRS regulations for the internal revenue service schedule a?

Absolutely, airSlate SignNow is designed with compliance in mind, ensuring that all electronic signatures and documents meet IRS regulations for the internal revenue service schedule a. This provides peace of mind knowing that your submissions are legally binding and accepted by the IRS.

-

Can I integrate airSlate SignNow with accounting software to manage the internal revenue service schedule a?

Yes, airSlate SignNow seamlessly integrates with various accounting software that can help you manage your internal revenue service schedule a. This integration streamlines your workflow, allowing for efficient document management and ensuring that all your tax-related processes are interconnected.

-

What security measures are in place for documents related to the internal revenue service schedule a?

airSlate SignNow prioritizes the security of your documents, including those related to the internal revenue service schedule a. We implement advanced encryption, secure access controls, and audit trails to protect your sensitive information throughout the signing and storage process.

Get more for Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business

Find out other Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement