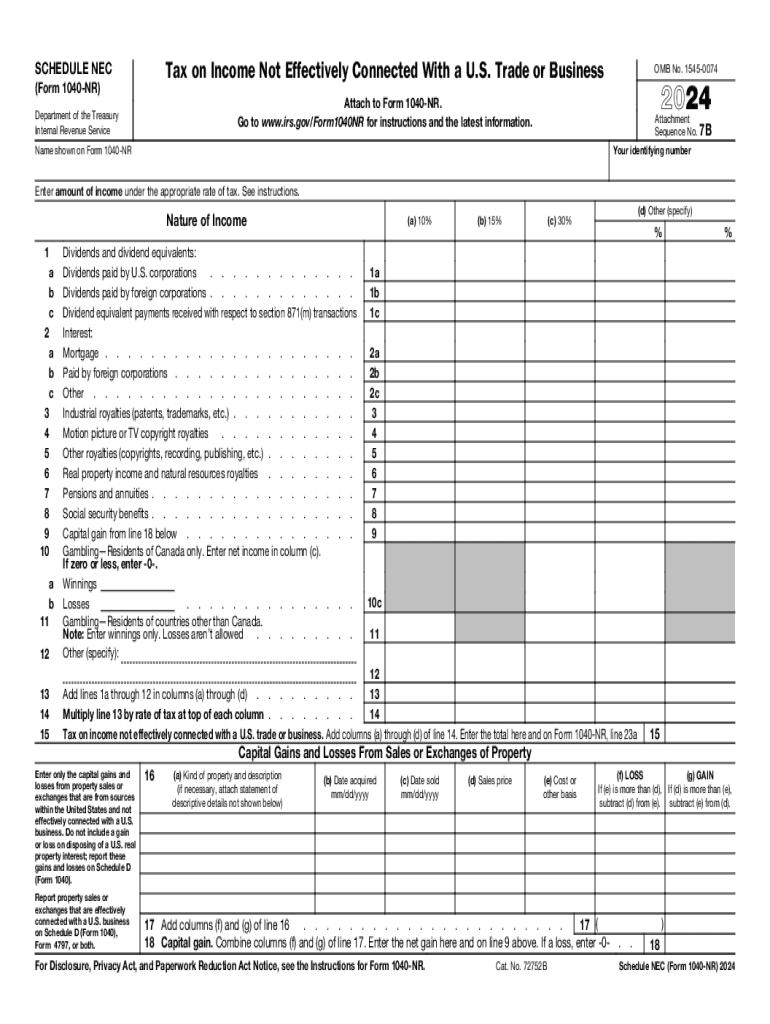

Schedule NEC Form 1040 NR Tax on Income Not Effectively Connected with a U S Trade or Business 2024

Understanding Schedule A Itemized Deductions

The Schedule A form is used by taxpayers to report itemized deductions on their federal income tax return. This form allows individuals to detail specific expenses that can reduce their taxable income, providing a potential tax benefit compared to the standard deduction. Common categories of deductions include medical expenses, mortgage interest, state and local taxes, and charitable contributions. Understanding the nuances of these deductions can significantly impact the overall tax liability.

Steps to Complete Schedule A Itemized Deductions

Completing the Schedule A form involves several key steps:

- Gather all necessary documentation, including receipts and statements for deductible expenses.

- Fill in personal information, including your name and Social Security number.

- Itemize your deductions by entering amounts in the appropriate sections, such as medical expenses and taxes paid.

- Calculate the total deductions and transfer this amount to your Form 1040.

Each step requires careful attention to detail to ensure accuracy and compliance with IRS guidelines.

Eligibility Criteria for Itemized Deductions

Not all taxpayers will benefit from itemizing deductions. Eligibility generally depends on the total amount of qualified expenses exceeding the standard deduction for the tax year. In 2024, the standard deduction amounts are higher for married couples filing jointly and heads of household. Taxpayers should evaluate their individual financial situations to determine the most beneficial approach for their tax filings.

IRS Guidelines for Schedule A Deductions

The Internal Revenue Service provides specific guidelines regarding what qualifies as an itemized deduction. Familiarizing oneself with these guidelines is crucial. For example, only certain medical expenses that exceed a specified percentage of adjusted gross income can be deducted. Additionally, taxpayers must keep accurate records and receipts to substantiate their claims. The IRS updates these guidelines periodically, so staying informed is essential.

Common Mistakes to Avoid When Filing Schedule A

When completing Schedule A, taxpayers often make several common mistakes that can lead to issues with their tax returns. These include:

- Failing to keep thorough documentation of deductions.

- Incorrectly calculating the total of itemized deductions.

- Not being aware of limits on certain deductions, such as state and local taxes.

Awareness of these pitfalls can help ensure a smoother filing process and reduce the risk of audits or penalties.

Filing Deadlines for Schedule A Deductions

Taxpayers must adhere to specific deadlines when filing their tax returns, including Schedule A. Typically, the deadline for filing individual tax returns is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines, especially in a tax year that may have unique circumstances.

Create this form in 5 minutes or less

Find and fill out the correct schedule nec form 1040 nr tax on income not effectively connected with a u s trade or business

Create this form in 5 minutes!

How to create an eSignature for the schedule nec form 1040 nr tax on income not effectively connected with a u s trade or business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to schedule a itemized deductions using airSlate SignNow?

To schedule a itemized deductions with airSlate SignNow, simply create your document and add the necessary fields for signatures and information. Once your document is ready, you can send it to the relevant parties for eSigning. The platform ensures a smooth and efficient process, allowing you to manage your deductions easily.

-

How much does it cost to schedule a itemized deductions with airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that fits your budget and allows you to schedule a itemized deductions without breaking the bank. Each plan includes features that enhance your document management experience.

-

What features does airSlate SignNow offer for scheduling itemized deductions?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking to help you schedule a itemized deductions efficiently. These tools streamline the eSigning process, making it easier to manage your documents and ensure compliance.

-

Can I integrate airSlate SignNow with other applications to schedule a itemized deductions?

Yes, airSlate SignNow offers integrations with various applications, allowing you to schedule a itemized deductions seamlessly. Whether you use CRM systems, cloud storage, or accounting software, you can connect your tools for a more efficient workflow.

-

What are the benefits of using airSlate SignNow to schedule a itemized deductions?

Using airSlate SignNow to schedule a itemized deductions provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are signed quickly and securely, allowing you to focus on other important tasks.

-

Is airSlate SignNow user-friendly for scheduling itemized deductions?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to schedule a itemized deductions. The intuitive interface allows users to navigate the platform effortlessly, regardless of their technical expertise.

-

What support options are available if I need help scheduling a itemized deductions?

airSlate SignNow offers various support options, including a comprehensive knowledge base, live chat, and email support. If you encounter any issues while trying to schedule a itemized deductions, you can easily signNow out for assistance and get the help you need.

Get more for Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business

- Fro statement of arrears online form

- Vocabulary chart readwritethink form

- Lock out disclaimer form

- Bill nye germs worksheet answers pdf form

- Online cdphp member claim form

- Headache log form

- By signing this release and cancellation of contract for sale and purchase release buyer 396036746 form

- Separation from employmenthuman resourceseastern form

Find out other Schedule NEC Form 1040 NR Tax On Income Not Effectively Connected With A U S Trade Or Business

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors