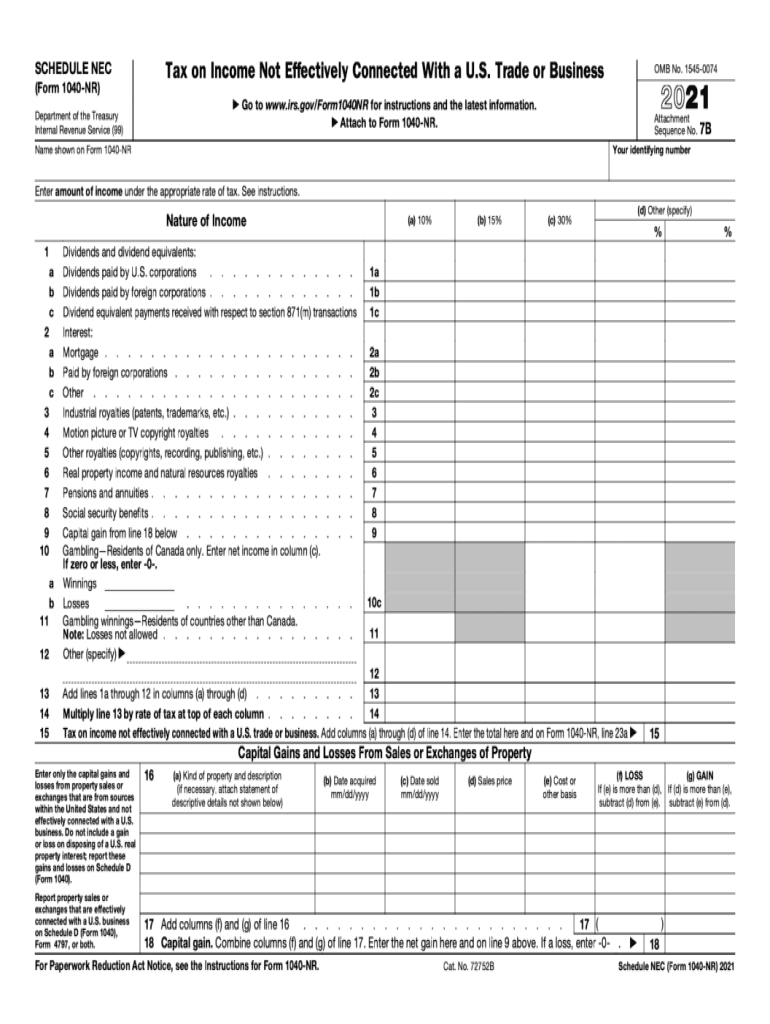

Irs 1040 Nr 2021

What is the IRS 1040 NR?

The IRS 1040 NR, or the 2021 IRS 1040 Non-Resident Alien Income Tax Return, is a tax form specifically designed for non-resident aliens who have U.S. income. This form allows individuals who do not meet the substantial presence test to report their income and claim any applicable deductions or credits. Non-resident aliens are typically foreign nationals who are in the United States temporarily and do not have a permanent resident status.

It is essential for non-resident aliens to file this form to comply with U.S. tax laws and avoid penalties. The 1040 NR form is distinct from the standard 1040 form used by U.S. citizens and resident aliens, reflecting the unique tax situation of non-residents.

Steps to Complete the IRS 1040 NR

Completing the IRS 1040 NR involves several key steps to ensure accurate reporting of income and deductions. Here’s a simplified process:

- Gather Required Documents: Collect all relevant documents, including W-2 forms, 1099 forms, and any other income statements.

- Determine Filing Status: Identify your filing status, which could be single or married filing separately.

- Report Income: Fill out the income sections of the form, reporting all U.S. sourced income, including wages, dividends, and interest.

- Claim Deductions: Use Schedule A (Form 1040 NR) to itemize deductions if applicable. This includes deductions for certain expenses like state and local taxes.

- Calculate Tax Liability: Use the tax tables provided by the IRS to determine your tax liability based on your taxable income.

- Sign and Date the Form: Ensure you sign and date the form before submission to validate your filing.

Legal Use of the IRS 1040 NR

The legal use of the IRS 1040 NR is crucial for non-resident aliens to fulfill their tax obligations in the United States. Filing this form is a legal requirement for those who earn income from U.S. sources. Failure to file can result in penalties, interest on unpaid taxes, and potential legal issues with the IRS.

It is important to ensure that all information provided on the form is accurate and complete. Non-resident aliens must also adhere to the specific guidelines set forth by the IRS regarding eligible deductions and credits. Understanding these legal requirements helps maintain compliance and avoid complications.

Required Documents for the IRS 1040 NR

When preparing to file the IRS 1040 NR, certain documents are necessary to support your income claims and deductions. These documents may include:

- W-2 forms from employers showing wages earned.

- 1099 forms for other income sources, such as freelance work or interest income.

- Form 1042-S for any income subject to withholding.

- Receipts for deductible expenses, if itemizing deductions.

- Passport or visa documentation to verify non-resident status.

Filing Deadlines for the IRS 1040 NR

The deadline for filing the IRS 1040 NR is typically April 15 of the following year for income earned in the previous calendar year. However, if you are a non-resident alien living outside the United States, you may qualify for an automatic two-month extension, making the deadline June 15. It is important to file on time to avoid penalties and interest on any taxes owed.

If additional time is needed, you can file for an extension using Form 4868, which grants an extension until October 15. However, it is crucial to note that this extension applies only to the filing of the return, not to the payment of any taxes owed.

IRS Guidelines for the 1040 NR

The IRS provides specific guidelines for completing the 1040 NR, which are essential for ensuring compliance with tax laws. These guidelines include:

- Understanding the definition of U.S. sourced income and how it applies to non-resident aliens.

- Identifying which deductions and credits are available to non-resident aliens, as they differ from those available to residents.

- Following the instructions provided by the IRS for filling out the form accurately, including any necessary schedules.

- Being aware of any treaty benefits that may apply based on your country of residence.

Quick guide on how to complete irs 1040 nr

Prepare Irs 1040 Nr effortlessly on any device

Digital document management has gained prominence among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely archive it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents rapidly without delays. Manage Irs 1040 Nr on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Irs 1040 Nr with minimal effort

- Locate Irs 1040 Nr and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact confidential information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Adjust and eSign Irs 1040 Nr and guarantee outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 1040 nr

Create this form in 5 minutes!

People also ask

-

What is the 2021 IRS 1040NR form, and who needs to file it?

The 2021 IRS 1040NR form is designed for non-resident aliens who have U.S. income and need to report their earnings to the IRS. If you are a non-resident alien with income that is effectively connected to a U.S. trade or business, you must file this form. Understanding the requirements helps ensure compliance with U.S. tax regulations.

-

How can airSlate SignNow assist with signing the 2021 IRS 1040NR form?

airSlate SignNow enables users to eSign the 2021 IRS 1040NR form securely and efficiently. Our platform allows you to upload your completed form, sign it electronically, and send it directly to the IRS or your accountant. This simplifies the signing process and ensures your documents are handled with the utmost care.

-

What are the pricing options for using airSlate SignNow for the 2021 IRS 1040NR?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including options for single users and teams. Our cost-effective solutions provide access to essential features, such as document signing and storage, making it easy to manage the 2021 IRS 1040NR form. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing tax documents like the 2021 IRS 1040NR?

Our platform includes features such as customizable templates, in-person signing, and real-time document tracking which are essential for managing tax documents like the 2021 IRS 1040NR. These tools streamline the signing process, making it easier for businesses to ensure compliance and organize tax documentation efficiently.

-

Can airSlate SignNow help with reminders for filing the 2021 IRS 1040NR?

Yes, airSlate SignNow offers reminder features that can help you stay on track for filing the 2021 IRS 1040NR form. By setting up due date alerts within the platform, you can ensure that you never miss a crucial deadline, thus avoiding any penalties associated with late filings.

-

Is it safe to use airSlate SignNow for my sensitive tax documents like the 2021 IRS 1040NR?

Absolutely, airSlate SignNow prioritizes the security of your sensitive tax documents, including the 2021 IRS 1040NR form. Our platform uses industry-leading encryption and security measures to protect your information, ensuring that your documents remain confidential and secure during the signing process.

-

What integrations does airSlate SignNow offer to support filing the 2021 IRS 1040NR?

airSlate SignNow integrates with various popular applications, enhancing your workflow and facilitating the filing of the 2021 IRS 1040NR. You can connect with tools like Google Drive, Dropbox, and CRM systems, making it easier to manage and share your tax documents seamlessly.

Get more for Irs 1040 Nr

Find out other Irs 1040 Nr

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure