IRS Form 1040NRNon Resident Income Tax Return 2023

What is the IRS Form 1040NR Non-Resident Income Tax Return

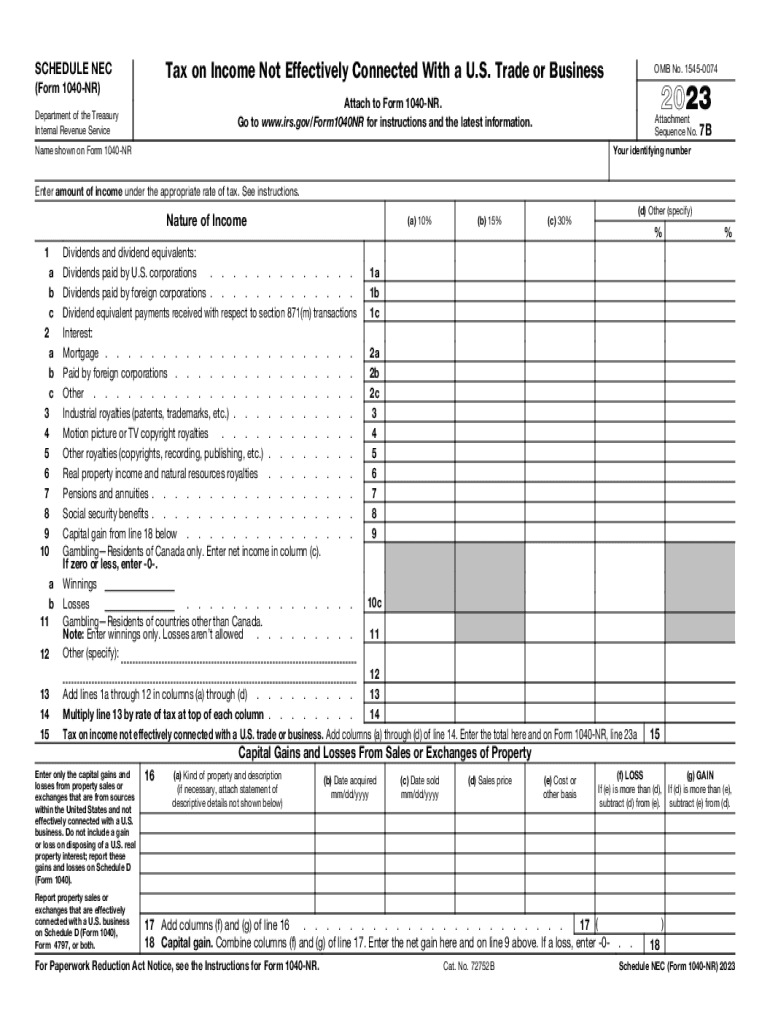

The IRS Form 1040NR is specifically designed for non-resident aliens who need to report their income earned in the United States. This form is essential for individuals who do not meet the criteria to file as residents but have U.S. source income. Non-resident aliens include foreign students, scholars, and workers who are in the U.S. on temporary visas. Understanding this form is crucial for compliance with U.S. tax laws.

Key Elements of the IRS Form 1040NR Non-Resident Income Tax Return

Several key elements are integral to the IRS Form 1040NR. These include:

- Filing Status: Non-residents must select the appropriate filing status, such as single or married filing separately.

- Income Reporting: All U.S. source income must be reported, including wages, salaries, and investment income.

- Deductions: Non-residents can claim specific deductions, but they are limited compared to residents.

- Tax Calculation: The form guides users through calculating their tax liability based on the reported income.

Steps to Complete the IRS Form 1040NR Non-Resident Income Tax Return

Completing the IRS Form 1040NR involves several steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status and eligibility for deductions.

- Fill out the form accurately, ensuring all income is reported.

- Calculate your tax liability based on the instructions provided.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the IRS Form 1040NR. Typically, non-resident aliens must file by April 15 if they have U.S. source income. However, if there is no U.S. source income, the deadline extends to June 15. Keeping track of these dates helps avoid penalties and ensures compliance with tax regulations.

Required Documents

To complete the IRS Form 1040NR, specific documents are required:

- Income Statements: W-2 forms and 1099 forms showing U.S. income.

- Identification: A valid passport and, if applicable, a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Supporting Documentation: Any documents related to deductions or credits claimed on the form.

Form Submission Methods

The IRS Form 1040NR can be submitted in several ways. Non-resident aliens can file electronically using approved tax software or submit a paper form via mail. It is important to choose the method that best suits your situation, as electronic filing may expedite processing times. Ensure that the form is sent to the correct IRS address based on your location.

Quick guide on how to complete irs form 1040nrnon resident income tax return

Effortlessly Prepare IRS Form 1040NRNon Resident Income Tax Return on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, allowing you to access the required form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage IRS Form 1040NRNon Resident Income Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign IRS Form 1040NRNon Resident Income Tax Return with ease

- Find IRS Form 1040NRNon Resident Income Tax Return and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a standard wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you would like to share your form—via email, text message (SMS), invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, and mistakes that require reprinting document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign IRS Form 1040NRNon Resident Income Tax Return and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1040nrnon resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the irs form 1040nrnon resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are itemized deductions on IRS Schedule A?

Itemized deductions on IRS Schedule A allow taxpayers to reduce their taxable income by listing eligible expenses. This includes expenses such as medical costs, mortgage interest, and charitable contributions. Understanding how to accurately report these deductions can signNowly impact your tax liability.

-

How can I find IRS Schedule A itemized deductions easily?

You can find IRS Schedule A itemized deductions by downloading the IRS form directly from the official IRS website. Additionally, tax software like airSlate SignNow can guide you through the process, ensuring all eligible expenses are included to maximize your deductions.

-

What are the benefits of using airSlate SignNow for IRS Schedule A itemized deductions?

Using airSlate SignNow streamlines the process of completing your IRS Schedule A itemized deductions by providing user-friendly templates and eSignature capabilities. This can save you time and effort while ensuring that your documents are well-organized and compliant with IRS requirements.

-

Does airSlate SignNow help with the integration of IRS Schedule A itemized deductions?

Yes, airSlate SignNow can integrate with various accounting and tax software platforms. This facilitates the seamless transfer of data required for completing your IRS Schedule A itemized deductions, ensuring that you maintain accuracy and consistency throughout the process.

-

Is there a cost associated with using airSlate SignNow for IRS Schedule A itemized deductions?

airSlate SignNow offers cost-effective pricing plans that suit both individual users and businesses. Depending on your needs, you can choose a plan that provides access to essential features for managing your IRS Schedule A itemized deductions effectively.

-

What features does airSlate SignNow offer for managing deductions on IRS Schedule A?

airSlate SignNow offers a variety of features including customizable templates, secure eSigning, and document storage specifically designed to assist with IRS Schedule A itemized deductions. These features help you manage your documents efficiently and legally.

-

Can airSlate SignNow assist small businesses in preparing IRS Schedule A itemized deductions?

Absolutely! airSlate SignNow is designed to assist both individuals and small businesses in preparing IRS Schedule A itemized deductions. The platform simplifies tax preparation processes to ensure you maximize your deductions while staying compliant.

Get more for IRS Form 1040NRNon Resident Income Tax Return

Find out other IRS Form 1040NRNon Resident Income Tax Return

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast