New Jersey Income Tax Forms by Tax Year E File Your Taxes 2022

Understanding the New Jersey Income Tax Forms for 2017

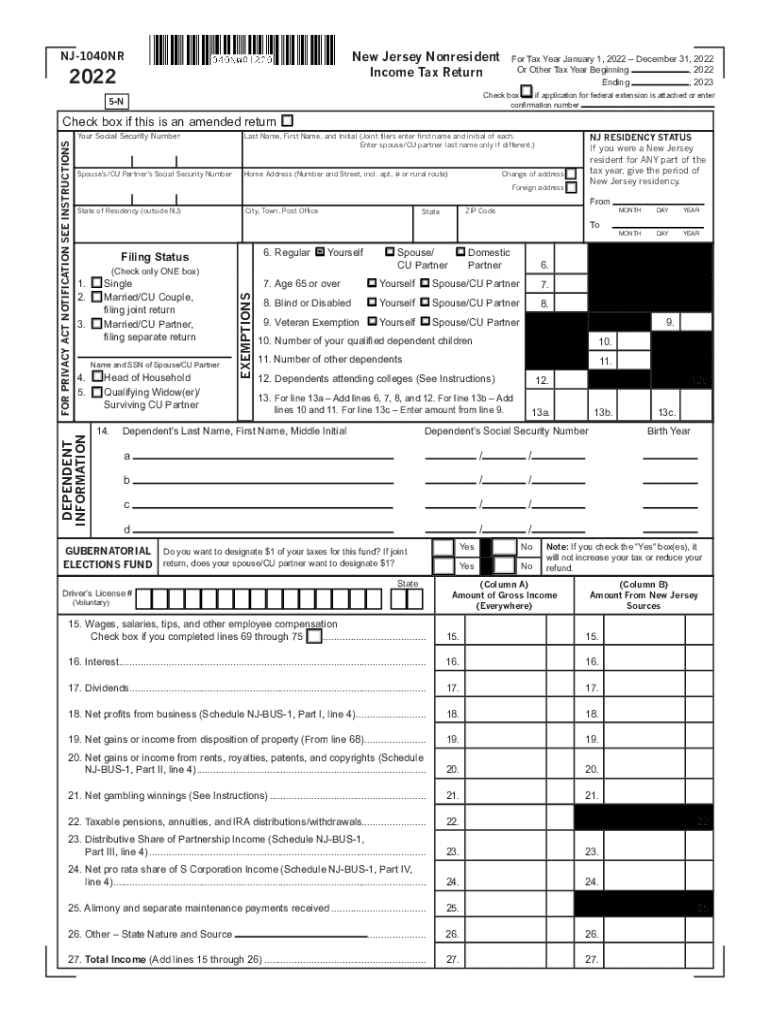

The New Jersey income tax forms for 2017 are essential documents for residents and non-residents who need to report their income to the state. The primary form used is the NJ-1040 for residents and the NJ-1040NR for non-residents. Each form has specific requirements and instructions that must be followed to ensure accurate filing. The forms require information such as income, deductions, and credits applicable to the tax year.

Steps to Complete the New Jersey Income Tax Forms for 2017

Completing the New Jersey income tax forms involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Choose the appropriate form: NJ-1040 for residents or NJ-1040NR for non-residents.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that you include any taxable income.

- Claim any deductions or credits you are eligible for, which can reduce your overall tax liability.

- Review the completed form for accuracy before submission.

Filing Deadlines for New Jersey Income Tax Forms

The filing deadline for the 2017 New Jersey income tax return was April 18, 2018. It is important to file on time to avoid penalties and interest on any taxes owed. If you missed the deadline, you may still file your return, but you should be aware of potential late fees.

Required Documents for Filing New Jersey Income Tax

To successfully file your New Jersey income tax forms, you will need the following documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental or investment income.

- Documentation for any deductions or credits claimed, such as mortgage interest statements or property tax bills.

Legal Use of New Jersey Income Tax Forms

The New Jersey income tax forms are legally binding documents that must be filled out accurately and truthfully. Misrepresentation or failure to report income can lead to penalties, including fines or legal action. It is crucial to ensure that all information provided is correct and that you comply with state tax laws.

Form Submission Methods for New Jersey Income Tax

There are several methods for submitting your New Jersey income tax forms:

- Online filing through the New Jersey Division of Taxation's website.

- Mailing a paper form to the appropriate tax office.

- In-person submission at designated tax offices, if available.

Quick guide on how to complete new jersey income tax forms by tax year e file your taxes

Complete New Jersey Income Tax Forms By Tax Year E File Your Taxes effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed forms, allowing you to easily locate the necessary document and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your papers quickly without interruptions. Manage New Jersey Income Tax Forms By Tax Year E File Your Taxes on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to alter and eSign New Jersey Income Tax Forms By Tax Year E File Your Taxes with ease

- Find New Jersey Income Tax Forms By Tax Year E File Your Taxes and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method of delivering your document, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign New Jersey Income Tax Forms By Tax Year E File Your Taxes and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jersey income tax forms by tax year e file your taxes

Create this form in 5 minutes!

How to create an eSignature for the new jersey income tax forms by tax year e file your taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for handling 2017 New Jersey tax documents?

airSlate SignNow offers robust features such as eSigning, document templates, and customizable workflows specifically designed for handling 2017 New Jersey tax documents efficiently. These features streamline the entire signing process, ensuring that your tax documents are completed quickly and securely. Additionally, users can track document status in real-time, which is crucial during tax season.

-

How can airSlate SignNow assist with compliance for 2017 New Jersey tax submissions?

Using airSlate SignNow helps ensure compliance with the latest regulations for 2017 New Jersey tax submissions. The platform provides legally binding eSignatures and an audit trail that records every activity on your documents, which can be invaluable in case of audits. With built-in compliance features, businesses can confidently handle their tax documents without fear of regulatory issues.

-

What pricing options are available for airSlate SignNow when managing 2017 New Jersey tax documents?

airSlate SignNow offers flexible pricing plans suitable for various business sizes, especially for those dealing with 2017 New Jersey tax documents. Plans typically include monthly subscriptions and annual discounts, allowing businesses to select an option that best fits their needs. All plans provide access to essential eSignature features necessary for efficient tax handling.

-

Is airSlate SignNow secure for processing sensitive 2017 New Jersey tax information?

Yes, airSlate SignNow employs advanced security measures to protect sensitive 2017 New Jersey tax information. The platform uses encryption, secure cloud storage, and follows industry compliance standards to ensure that your documents are safe from unauthorized access. Users can sign confidently, knowing their tax documents are well-protected.

-

Can airSlate SignNow integrate with other software for managing 2017 New Jersey tax tasks?

Absolutely! airSlate SignNow integrates seamlessly with various popular software, making it easy to manage 2017 New Jersey tax tasks. Whether you use accounting software, CRM platforms, or document management systems, the integrations enhance your workflow and reduce manual data entry, allowing for more efficient tax processing.

-

What are the benefits of using airSlate SignNow for 2017 New Jersey tax filing?

Using airSlate SignNow to file your 2017 New Jersey tax offers several benefits, including time savings and improved accuracy. The platform allows for quick eSigning of important documents, reducing the time spent on administrative tasks. Furthermore, automated reminders help ensure that deadlines are met, minimizing the risk of late submissions.

-

How user-friendly is airSlate SignNow for those handling 2017 New Jersey tax documents?

airSlate SignNow is designed with user-friendliness in mind, perfect for those handling 2017 New Jersey tax documents. The intuitive interface simplifies the eSigning process, making it accessible even for users who may not be tech-savvy. This means you can manage your tax documents with ease and efficiency, regardless of your experience level.

Get more for New Jersey Income Tax Forms By Tax Year E File Your Taxes

- Letter with instructions form

- Reimbursement for expenditures resolution form corporate resolutions

- Easement utilities form

- Intent transaction form

- Cleaning or janitorial services agreement 497328510 form

- Employee nondisclosure form

- Assumption risks form

- Contract to groom small animals such as cats and dogs form

Find out other New Jersey Income Tax Forms By Tax Year E File Your Taxes

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online