New Jersey Income Taxes and NJ State Tax Forms EFile 2021

Understanding the New Jersey Nonresident Tax Return

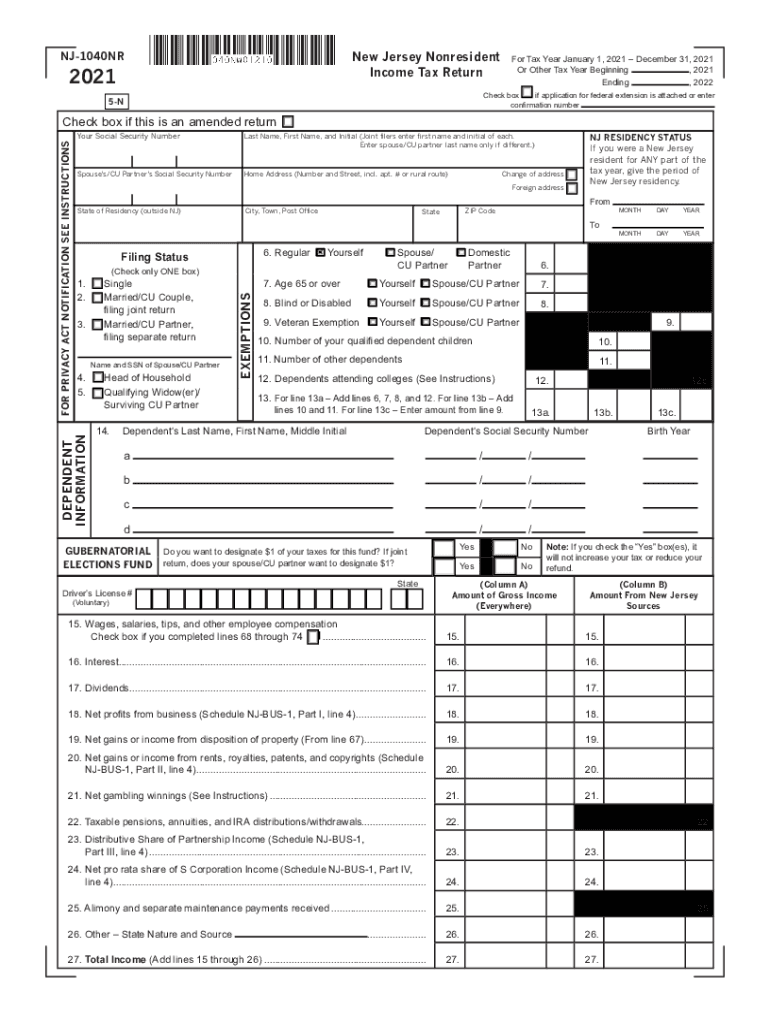

The 2020 NJ 1040NR is the New Jersey nonresident tax return form. It is specifically designed for individuals who earned income in New Jersey but do not reside in the state. This form allows nonresidents to report their New Jersey-sourced income and calculate their tax liability accordingly. Understanding the form's purpose is essential for compliance with state tax laws and for ensuring accurate tax filing.

Steps to Complete the 2020 NJ 1040NR

Completing the 2020 NJ 1040NR involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099 forms, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your New Jersey-sourced income in the designated sections of the form.

- Calculate your total tax liability based on the income reported.

- Complete the signature section, ensuring that all required signatures are included.

Required Documents for Filing

To accurately complete the 2020 NJ 1040NR, you will need specific documents:

- W-2 forms from employers for income earned in New Jersey.

- 1099 forms for any additional income received.

- Records of any deductions or credits you plan to claim.

- Your Social Security number and identification information.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the 2020 NJ 1040NR. Typically, the deadline for submitting the form is April fifteenth of the following year. If you require additional time, you may file for an extension, but ensure that any tax owed is paid by the original deadline to avoid penalties.

Legal Use of the 2020 NJ 1040NR

The 2020 NJ 1040NR must be completed and submitted in compliance with New Jersey tax laws. The form is legally binding, meaning that all information provided must be accurate and truthful. Failure to comply with legal requirements can result in penalties, including fines or additional taxes owed.

Form Submission Methods

You can submit the 2020 NJ 1040NR through various methods:

- Online filing through authorized tax preparation software.

- Mailing a paper copy of the completed form to the appropriate New Jersey tax office.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete new jersey income taxes and nj state tax forms efile

Easily Prepare New Jersey Income Taxes And NJ State Tax Forms EFile on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without delays. Handle New Jersey Income Taxes And NJ State Tax Forms EFile on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and eSign New Jersey Income Taxes And NJ State Tax Forms EFile Effortlessly

- Obtain New Jersey Income Taxes And NJ State Tax Forms EFile and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select how you want to distribute your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow addresses your document management needs with just a few clicks from any device of your preference. Edit and eSign New Jersey Income Taxes And NJ State Tax Forms EFile while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jersey income taxes and nj state tax forms efile

Create this form in 5 minutes!

How to create an eSignature for the new jersey income taxes and nj state tax forms efile

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The way to generate an e-signature straight from your smartphone

How to make an e-signature for a PDF on iOS

The way to generate an e-signature for a PDF document on Android

People also ask

-

What is the 2020 NJ 1040NR form?

The 2020 NJ 1040NR form is the Non-Resident Income Tax Return for New Jersey that must be filed by non-residents who earned income in the state. Understanding how to correctly fill out this form is crucial for compliance with New Jersey tax laws. Using airSlate SignNow can streamline the signing and filing process.

-

How can airSlate SignNow help with filing the 2020 NJ 1040NR?

AirSlate SignNow simplifies the process of filling out and submitting your 2020 NJ 1040NR form by allowing you to eSign and send documents electronically. This not only saves you time but also ensures that your forms are submitted securely and accurately. Leveraging our platform can help you manage your tax paperwork efficiently.

-

Is there a cost associated with using airSlate SignNow for the 2020 NJ 1040NR?

AirSlate SignNow offers competitive pricing plans that are designed to be cost-effective for businesses of all sizes. There are different subscription options available, which provide features suitable for managing documents, including tax forms like the 2020 NJ 1040NR. Visit our pricing page for details on the best plan for your needs.

-

Can I integrate airSlate SignNow with accounting software for 2020 NJ 1040NR preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software, making it easier to manage your 2020 NJ 1040NR preparation. These integrations can help synchronize your documents and data, thereby enhancing efficiency in your tax filing process. Check our integrations page for more information.

-

What security measures does airSlate SignNow implement for 2020 NJ 1040NR documents?

AirSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to ensure that your 2020 NJ 1040NR documents are protected. We adhere to industry standards to ensure confidentiality and integrity of your sensitive tax information. Trust us with your important documents for peace of mind.

-

Can I track the status of my 2020 NJ 1040NR filings through airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your 2020 NJ 1040NR filings and document workflows. Our platform allows you to see when your documents have been viewed, signed, and completed, giving you full visibility throughout the process. This feature helps you stay organized and ensures you meet filing deadlines.

-

What additional features does airSlate SignNow offer for 2020 NJ 1040NR preparation?

In addition to eSigning, airSlate SignNow offers features like document templates, API access for custom integrations, and mobile-friendly accessibility, which are all beneficial for preparing your 2020 NJ 1040NR. These features enhance usability and provide flexible options tailored to your specific needs. Explore our platform to learn more about all we offer.

Get more for New Jersey Income Taxes And NJ State Tax Forms EFile

- Missouri trust 497313348 form

- Missouri assignment 497313349 form

- Notice of assignment to living trust missouri form

- Revocation of living trust missouri form

- Letter to lienholder to notify of trust missouri form

- Mo contract form

- Missouri forest products timber sale contract missouri form

- Assumption agreement of deed of trust and release of original mortgagors missouri form

Find out other New Jersey Income Taxes And NJ State Tax Forms EFile

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed