New Jersey Nonresident Return, Form NJ 1040NR 2024-2026

What is the New Jersey Nonresident Return, Form NJ 1040NR

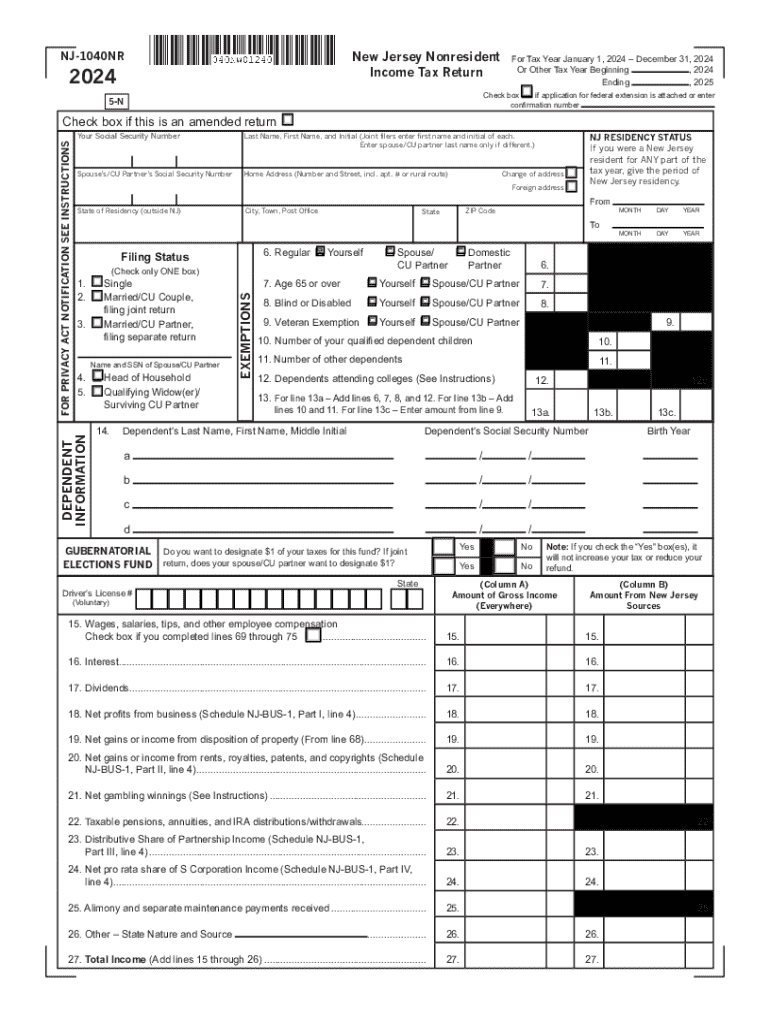

The New Jersey Nonresident Return, known as Form NJ 1040NR, is a tax document specifically designed for individuals who earn income in New Jersey but do not reside in the state. This form allows nonresidents to report their New Jersey-sourced income and calculate any tax liability owed to the state. It is crucial for ensuring compliance with New Jersey tax laws while accurately reflecting the income earned within the state.

Steps to complete the New Jersey Nonresident Return, Form NJ 1040NR

Completing the NJ 1040NR involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your New Jersey-sourced income by identifying all earnings generated within the state.

- Fill out the NJ 1040NR form accurately, ensuring all income and deductions are reported correctly.

- Calculate your tax liability based on the instructions provided with the form.

- Review the completed form for accuracy before submission.

Required Documents

To successfully file the NJ 1040NR, you will need the following documents:

- W-2 forms from employers for income earned in New Jersey.

- 1099 forms for any freelance or contract work performed in the state.

- Records of other income sources, such as rental income or investment earnings tied to New Jersey.

- Documentation of any deductions or credits you plan to claim.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the NJ 1040NR. Typically, the deadline for submitting your nonresident tax return aligns with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended. Always verify the current year's deadlines to ensure timely filing.

Eligibility Criteria

Eligibility to file the NJ 1040NR is determined by your residency status and the source of your income. You must be a nonresident of New Jersey who has earned income within the state during the tax year. This includes wages, business income, and rental income. Additionally, you should not have established residency in New Jersey for the tax year in question.

Form Submission Methods (Online / Mail / In-Person)

The NJ 1040NR can be submitted through various methods:

- Online filing through approved tax software that supports New Jersey forms.

- Mailing a paper copy of the completed form to the appropriate New Jersey tax office.

- In-person submission at designated tax offices, if applicable.

Key elements of the New Jersey Nonresident Return, Form NJ 1040NR

Key elements of the NJ 1040NR include sections for reporting income, calculating tax owed, and claiming any applicable deductions. The form also requires personal information, such as your name, address, and Social Security number, even though you are a nonresident. Accurate reporting of all New Jersey-sourced income is essential for compliance and to avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct new jersey nonresident return form nj 1040nr

Create this form in 5 minutes!

How to create an eSignature for the new jersey nonresident return form nj 1040nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nj 1040nr form and who needs it?

The nj 1040nr form is a non-resident income tax return for individuals who earn income in New Jersey but do not reside there. If you have earned income in New Jersey and are a non-resident, you are required to file this form to report your income and pay any applicable taxes.

-

How can airSlate SignNow help with the nj 1040nr filing process?

airSlate SignNow simplifies the nj 1040nr filing process by allowing users to easily eSign and send documents securely. With our user-friendly platform, you can manage your tax documents efficiently, ensuring that your nj 1040nr is filed accurately and on time.

-

What are the pricing options for using airSlate SignNow for nj 1040nr?

airSlate SignNow offers flexible pricing plans that cater to different needs, making it cost-effective for individuals and businesses alike. You can choose from monthly or annual subscriptions, ensuring you have access to all the features necessary for managing your nj 1040nr efficiently.

-

Are there any features specifically designed for nj 1040nr users?

Yes, airSlate SignNow includes features tailored for nj 1040nr users, such as document templates, automated reminders, and secure storage. These features help streamline the filing process and ensure that all necessary documents are easily accessible and organized.

-

Can I integrate airSlate SignNow with other tools for nj 1040nr management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your nj 1040nr alongside your other financial documents. This seamless integration helps you maintain an organized workflow and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for my nj 1040nr?

Using airSlate SignNow for your nj 1040nr provides numerous benefits, including enhanced security, ease of use, and time savings. Our platform ensures that your documents are securely signed and stored, allowing you to focus on other important aspects of your tax filing.

-

Is airSlate SignNow compliant with New Jersey tax regulations for nj 1040nr?

Yes, airSlate SignNow is fully compliant with New Jersey tax regulations, ensuring that your nj 1040nr filings meet all legal requirements. Our platform is designed to help you navigate the complexities of tax documentation while adhering to state guidelines.

Get more for New Jersey Nonresident Return, Form NJ 1040NR

- Products use and general services form

- Shared services agreement technology solutions co and form

- Tax sharing and disaffiliation agreement technology form

- Agreement and plan of merger dated november 7 secgov form

- Employeeshareholder escrow agreement by daleen form

- Interpretation of trust agreements estate and elder law blog form

- Master services agreement corporate counsel findlaw form

- Sec interpretation independent directors of investment form

Find out other New Jersey Nonresident Return, Form NJ 1040NR

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free