New Jersey Nonresident Tax Form 2020

What is the New Jersey Nonresident Tax Form

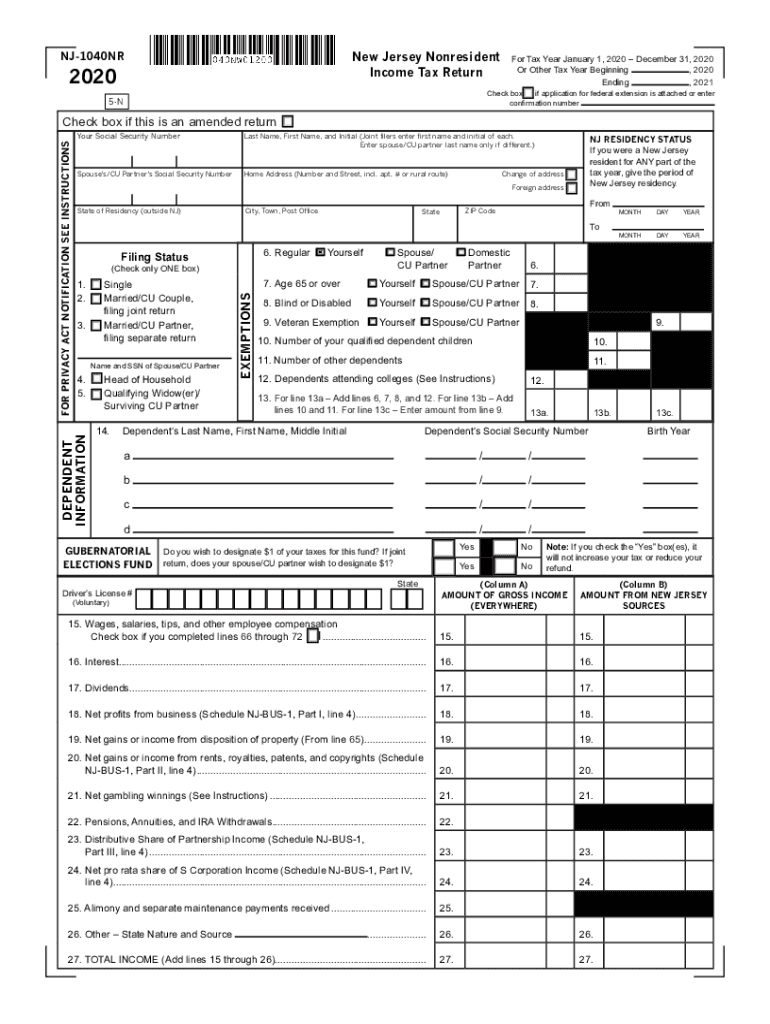

The New Jersey nonresident tax form, known as the NJ-1040NR, is designed for individuals who earn income in New Jersey but do not reside in the state. This form allows nonresidents to report their New Jersey-sourced income and calculate the tax owed. It is essential for ensuring compliance with state tax laws while allowing nonresidents to fulfill their tax obligations accurately.

How to use the New Jersey Nonresident Tax Form

To use the NJ-1040NR form effectively, nonresidents must first gather all relevant income documentation, including W-2s and 1099s that reflect earnings sourced in New Jersey. The form requires detailed reporting of income, deductions, and credits applicable to nonresidents. It is crucial to follow the instructions provided with the form closely to ensure all information is accurately captured and submitted.

Steps to complete the New Jersey Nonresident Tax Form

Completing the NJ-1040NR involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Fill out personal information, including your name, address, and Social Security number.

- Report your New Jersey-sourced income accurately.

- Calculate any deductions or credits you may qualify for as a nonresident.

- Review the completed form for accuracy before submission.

Legal use of the New Jersey Nonresident Tax Form

The NJ-1040NR form is legally binding when completed and submitted correctly. It must be signed and dated by the taxpayer, and any inaccuracies or omissions can lead to penalties or audits. The form must be filed by the designated deadline to avoid additional fees. Using a reliable electronic signature platform like signNow can enhance the legal validity of the submission.

Filing Deadlines / Important Dates

For the NJ-1040NR, the filing deadline typically aligns with the federal tax deadline, which is usually April fifteenth. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important for nonresidents to stay informed about any changes to these dates to ensure timely filing and avoid penalties.

Required Documents

When completing the NJ-1040NR, the following documents are generally required:

- W-2 forms from employers reporting New Jersey income.

- 1099 forms for any freelance or contract work performed in New Jersey.

- Documentation of any deductions or credits claimed.

- Previous tax returns for reference.

Quick guide on how to complete new jersey nonresident tax form

Complete New Jersey Nonresident Tax Form seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Handle New Jersey Nonresident Tax Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

The easiest way to alter and eSign New Jersey Nonresident Tax Form effortlessly

- Find New Jersey Nonresident Tax Form and click Get Form to begin.

- Leverage the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes just moments and carries the same legal authority as a customary wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign New Jersey Nonresident Tax Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jersey nonresident tax form

Create this form in 5 minutes!

How to create an eSignature for the new jersey nonresident tax form

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the NJ1040NR form?

The NJ1040NR form is a non-resident income tax return used for reporting income earned in New Jersey by individuals who do not reside in the state. It is essential for non-residents to file this form if they have earned income in New Jersey to comply with state tax laws.

-

How can airSlate SignNow help me with the NJ1040NR form?

airSlate SignNow provides a seamless platform for filling out and eSigning your NJ1040NR form. With its intuitive interface, you can easily input the necessary information and ensure that your form is completed accurately and securely.

-

What are the pricing options for using airSlate SignNow for NJ1040NR form?

airSlate SignNow offers flexible pricing plans that cater to individuals and businesses needing to manage NJ1040NR forms effectively. You can choose from monthly or annual subscriptions, ensuring you only pay for the features you need.

-

Is eSigning the NJ1040NR form legally valid?

Yes, eSigning the NJ1040NR form through airSlate SignNow is legally valid and compliant with state regulations. The platform employs advanced security measures to protect your data, making it a reliable choice for electronic signatures.

-

Can I integrate airSlate SignNow with other software for managing NJ1040NR forms?

Absolutely! airSlate SignNow offers various integrations with popular applications, enhancing your workflow for managing the NJ1040NR form. Whether you use CRM systems or document management tools, integration options are available to streamline your processes.

-

What features does airSlate SignNow offer for NJ1040NR form processing?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure storage for your NJ1040NR form. These tools help simplify the document management process, ensuring you can focus on completing your taxes efficiently.

-

How secure is the information I submit on the NJ1040NR form?

The security of your information is a top priority at airSlate SignNow when submitting your NJ1040NR form. The platform employs end-to-end encryption and complies with industry standards to protect your sensitive data and provide peace of mind.

Get more for New Jersey Nonresident Tax Form

- Cc20 monthly employment report city of san diego sandiego form

- Fillable general application form ds 3032

- San diego solar information go solar california cagov

- Fair political practices commission form 460

- Gws 12a historical use form

- Form gws 31 4 2012

- Fillable online denvergov total demolition guide denver form

- Www cra arc gc ca cra arc gc form

Find out other New Jersey Nonresident Tax Form

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free