Excise Tax Forms and Publications 2022-2026

What is the Excise Tax Forms And Publications

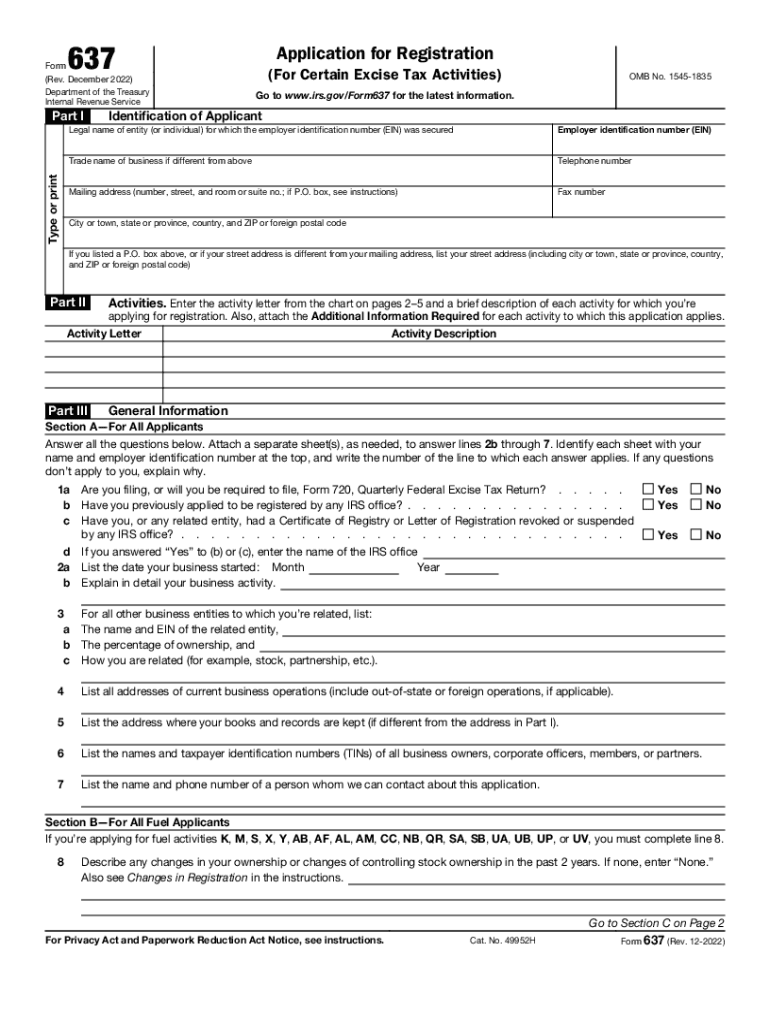

The excise tax forms and publications are essential documents used by businesses and individuals to report and pay specific taxes imposed on certain goods, services, and activities. These forms are issued by the Internal Revenue Service (IRS) and provide guidelines on how to calculate, report, and remit excise taxes. The most commonly used form is the 637 excise tax form, which is necessary for businesses involved in activities subject to excise tax, such as fuel production and transportation. Understanding these forms is crucial for compliance with federal tax regulations.

Steps to complete the Excise Tax Forms And Publications

Completing the excise tax forms requires careful attention to detail to ensure accuracy and compliance. Here are the steps to follow:

- Gather necessary information, including business details and tax identification numbers.

- Review the specific instructions provided with the excise tax form you are completing.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the excise tax owed based on the guidelines provided.

- Double-check your entries for any errors or omissions.

- Submit the completed form by the specified deadline, either electronically or by mail.

Legal use of the Excise Tax Forms And Publications

Using excise tax forms legally involves adhering to IRS regulations and guidelines. The forms must be filled out completely and accurately to be considered valid. Electronic submissions are accepted and are often preferred for their efficiency. Additionally, maintaining records of submitted forms and any correspondence with the IRS is essential for legal compliance. This ensures that businesses can defend their filings in case of audits or inquiries.

Filing Deadlines / Important Dates

Filing deadlines for excise tax forms vary depending on the type of tax and the reporting period. Generally, businesses must file their excise tax forms quarterly or annually. It is important to be aware of these deadlines to avoid penalties. For example, the IRS typically requires quarterly filings for certain excise taxes, while others may have annual deadlines. Keeping a calendar of these dates helps ensure timely submissions.

Required Documents

When completing excise tax forms, several documents may be required to support your submission. These documents can include:

- Business registration details.

- Records of sales and purchases related to excise tax activities.

- Invoices and receipts for taxable goods and services.

- Previous tax returns, if applicable.

Having these documents organized and readily available can streamline the filing process and ensure compliance.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting excise tax forms. These guidelines outline the specific requirements for each form, including eligibility criteria, calculation methods, and submission procedures. It is essential to review these guidelines thoroughly to ensure that all aspects of the form are addressed correctly. The IRS website offers resources and publications that can further assist in understanding the requirements for excise tax compliance.

Quick guide on how to complete excise tax forms and publications

Prepare Excise Tax Forms And Publications effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to access the correct format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files quickly and efficiently. Manage Excise Tax Forms And Publications on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Excise Tax Forms And Publications without hassle

- Find Excise Tax Forms And Publications and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Excise Tax Forms And Publications and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct excise tax forms and publications

Create this form in 5 minutes!

How to create an eSignature for the excise tax forms and publications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to excise taxes?

airSlate SignNow is a powerful eSignature solution that helps businesses streamline their document management processes. It allows users to manage, send, and eSign crucial documents necessary for compliance, including those related to excise taxes. By using our platform, users can easily ensure that all excise-related paperwork is processed efficiently.

-

How much does airSlate SignNow cost for managing excise documents?

The pricing for airSlate SignNow is designed to be cost-effective, especially for businesses needing to manage excise documents. We offer various plans that cater to different organizational needs and sizes, ensuring that you find a solution that fits your budget while providing all the necessary features for handling excise documentation.

-

What features of airSlate SignNow are best for excise document management?

airSlate SignNow offers a range of features specifically beneficial for excise document management, including easy eSigning, document templates, and real-time tracking. These features help businesses remain compliant with excise regulations while saving time on document handling. The platform also provides secure storage for all excise-related files.

-

Can airSlate SignNow integrate with other tools for managing excise documentation?

Yes, airSlate SignNow seamlessly integrates with various tools popular among businesses managing excise documentation. These integrations can enhance your workflow and make it easier to manage your excise papers alongside other business operations. Popular integrations include CRM systems, cloud storage options, and financial software.

-

What benefits does eSigning provide for excise document processing?

ESigning with airSlate SignNow provides signNow benefits for processing excise documents, including faster turnaround times and improved accuracy. With electronic signatures, the entire process is simplified, reducing the time spent on paperwork and minimizing errors associated with manual signing. This leads to better compliance with excise regulations.

-

Is airSlate SignNow compliant with regulations related to excise?

Yes, airSlate SignNow is compliant with various legal standards and regulations, including those pertaining to excise documentation. Our platform utilizes advanced security measures to ensure that all signed documents are legally binding and protected. Using airSlate SignNow helps businesses remain compliant with excise laws and reduces legal risks.

-

How does airSlate SignNow improve the overall efficiency of excise document workflows?

airSlate SignNow improves the efficiency of excise document workflows by automating key processes such as signing, storing, and tracking documents. This automation reduces the time spent on manual tasks and helps ensure that all excise-related documentation is managed more effectively. Consequently, businesses can focus on core activities while remaining compliant.

Get more for Excise Tax Forms And Publications

Find out other Excise Tax Forms And Publications

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online