Form 637 Instructions 2019

What is the Form 637?

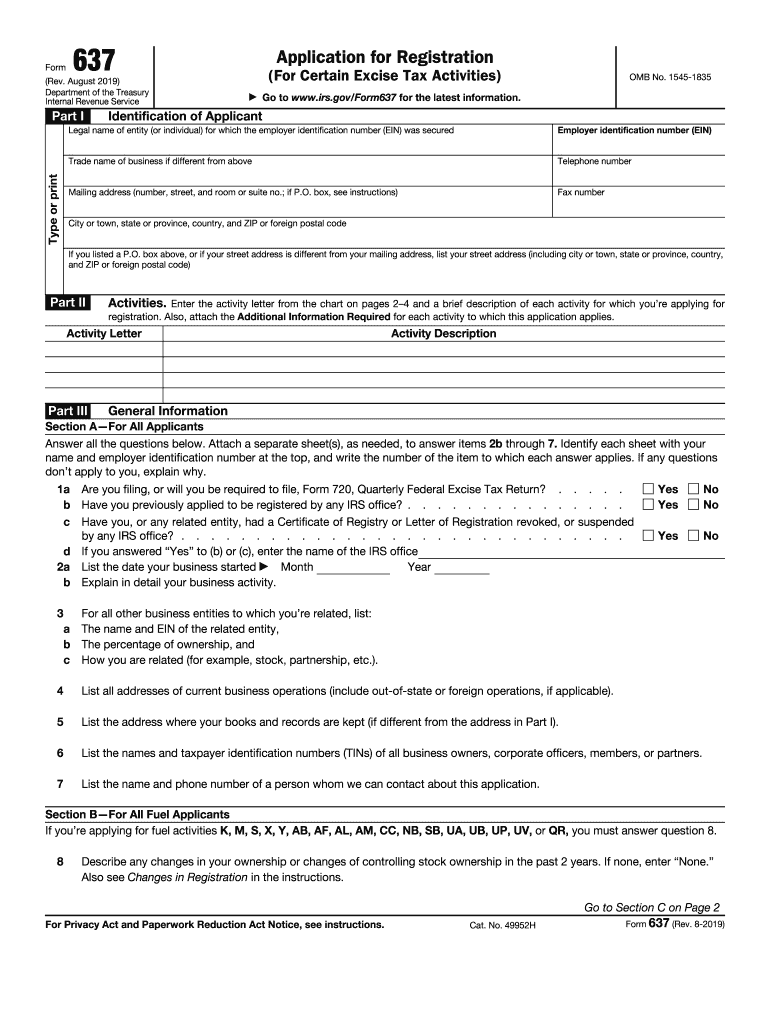

The Form 637 is an essential document used for IRS registration purposes, specifically designed for businesses involved in excise tax activities. This form allows entities to apply for a registration number that is necessary for reporting and paying federal excise taxes. Understanding the purpose of Form 637 is crucial for compliance with IRS regulations, especially for businesses operating in sectors subject to excise taxes.

Steps to Complete the Form 637

Completing the Form 637 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including the legal name, address, and type of entity. Next, provide details regarding the specific excise tax activities your business will engage in. It is important to carefully follow the instructions provided on the form to avoid any errors that could delay processing. After filling out the form, review it thoroughly before submission to ensure all information is correct.

Legal Use of the Form 637

The legal use of Form 637 is critical for businesses to maintain compliance with federal tax laws. Submitting this form correctly ensures that your business is recognized by the IRS for excise tax purposes. Failure to properly register can lead to penalties and interest on unpaid taxes. Therefore, understanding the legal implications of Form 637 is essential for any business involved in activities subject to excise taxes.

Required Documents for Form 637

When submitting Form 637, certain documents may be required to support your application. These typically include proof of business registration, such as articles of incorporation or a partnership agreement, and any relevant licenses or permits related to your excise tax activities. Having these documents ready can streamline the application process and help ensure a successful registration with the IRS.

IRS Guidelines for Form 637

Adhering to IRS guidelines when completing Form 637 is vital for compliance. The IRS provides specific instructions on how to fill out the form, what information is required, and how to submit it. Familiarity with these guidelines can help prevent common mistakes that could lead to delays or rejections. It is advisable to regularly check for updates on IRS regulations related to excise taxes to stay informed.

Filing Deadlines for Form 637

Understanding the filing deadlines for Form 637 is crucial for businesses to avoid penalties. The IRS typically sets specific deadlines for submitting this form, which can vary based on the type of excise tax activity. Keeping track of these deadlines ensures that your business remains compliant and avoids any potential issues with the IRS regarding tax liabilities.

Eligibility Criteria for Form 637

Eligibility for completing Form 637 is determined by the nature of your business activities. Generally, businesses that engage in activities subject to federal excise taxes must register using this form. It is important to assess whether your business qualifies under the IRS criteria for excise tax registration to ensure compliance and avoid unnecessary complications.

Quick guide on how to complete excise tax forms and publicationsinternal revenue service irsgov

Complete Form 637 Instructions effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily find the correct template and securely store it in the cloud. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without hassles. Handle Form 637 Instructions on any device using airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to edit and electronically sign Form 637 Instructions with ease

- Find Form 637 Instructions and click Get Form to begin.

- Utilize the available tools to fill out your form.

- Mark pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal standing as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your requirements in document management with just a few clicks from any device you choose. Modify and electronically sign Form 637 Instructions and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct excise tax forms and publicationsinternal revenue service irsgov

Create this form in 5 minutes!

How to create an eSignature for the excise tax forms and publicationsinternal revenue service irsgov

How to create an eSignature for your Excise Tax Forms And Publicationsinternal Revenue Service Irsgov in the online mode

How to generate an eSignature for your Excise Tax Forms And Publicationsinternal Revenue Service Irsgov in Google Chrome

How to make an eSignature for signing the Excise Tax Forms And Publicationsinternal Revenue Service Irsgov in Gmail

How to create an eSignature for the Excise Tax Forms And Publicationsinternal Revenue Service Irsgov right from your mobile device

How to create an electronic signature for the Excise Tax Forms And Publicationsinternal Revenue Service Irsgov on iOS

How to create an eSignature for the Excise Tax Forms And Publicationsinternal Revenue Service Irsgov on Android devices

People also ask

-

What is the significance of 637 in relation to airSlate SignNow?

The term '637' refers to our pricing plan that offers extensive features for businesses to send and eSign documents efficiently. Choosing the 637 plan allows users to access advanced functionalities that enhance their document management process, ensuring a smooth experience.

-

How does airSlate SignNow's 637 plan compare with other pricing options?

The 637 plan is designed to provide a higher value by including more features at a competitive price. Unlike standard plans, the 637 option offers advanced integration capabilities and enhanced security features, catering to businesses that require robust document solutions.

-

What features are included in the 637 package?

The 637 package includes an array of features such as customizable templates, advanced reporting tools, and secure cloud storage. By leveraging the 637 plan, businesses can automate their workflows, streamline processes, and improve overall productivity.

-

Can I integrate other applications with airSlate SignNow's 637 plan?

Yes, the 637 plan supports integration with popular applications such as Salesforce, Google Drive, and Dropbox. This flexibility allows businesses to merge their existing tools with airSlate SignNow, providing a seamless eSigning and document management experience.

-

What benefits does choosing the 637 plan offer for my business?

Selecting the 637 plan offers numerous benefits, including a user-friendly interface and powerful automation features that enhance efficiency. Businesses can signNowly reduce document turnaround times and improve customer satisfaction through this comprehensive solution.

-

Is customer support available for users of the 637 plan?

Absolutely! Users of the 637 plan receive dedicated customer support to assist with any questions or technical issues that may arise. Our team is committed to ensuring that your experience with airSlate SignNow is smooth and effective.

-

How does the eSigning process work in the 637 plan?

The eSigning process in the 637 plan is straightforward and intuitive, allowing users to send documents for signature with just a few clicks. Recipients can sign documents electronically from anywhere, thus expediting the signing process and reducing delays.

Get more for Form 637 Instructions

Find out other Form 637 Instructions

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document