Irs Form 637 2009

What is the IRS Form 637

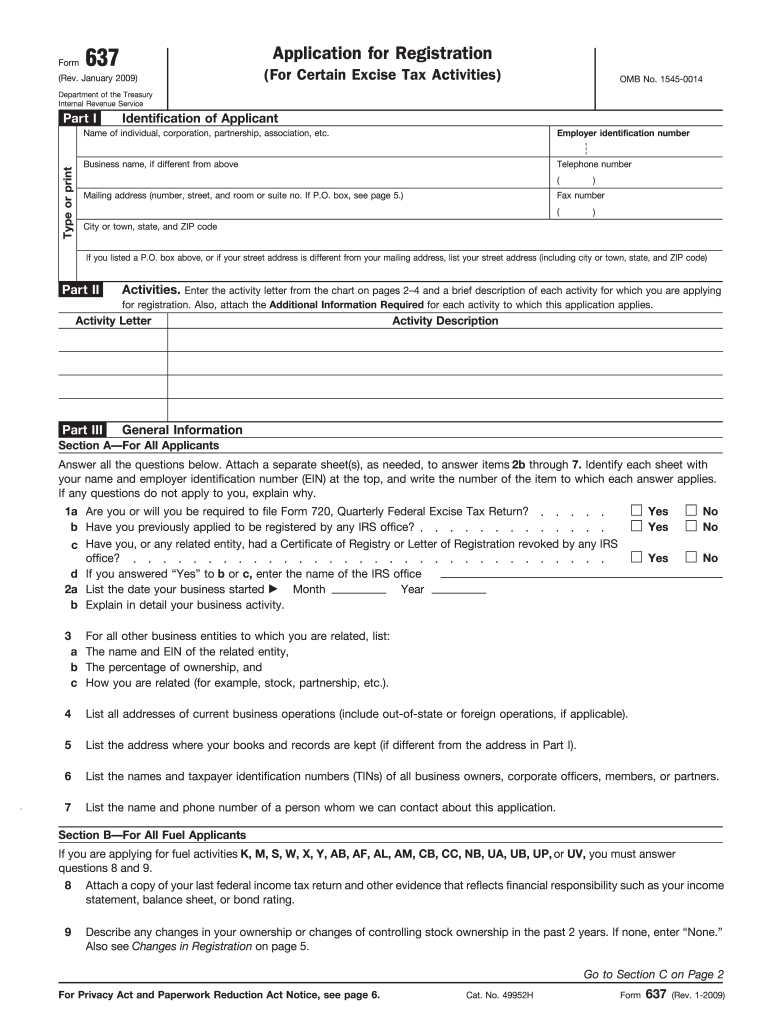

The IRS Form 637 is a crucial document used by businesses and individuals to apply for and obtain a registration to make tax-exempt sales of certain products. This form is primarily utilized by those involved in the sale of fuel, including gasoline and diesel, as well as other products that may be subject to excise taxes. By completing this form, applicants can demonstrate their eligibility for tax-exempt status under specific circumstances, allowing them to avoid paying certain taxes upfront.

How to use the IRS Form 637

Using the IRS Form 637 involves several key steps. First, applicants must accurately fill out the form, providing all required information about their business and the nature of their tax-exempt sales. Once completed, the form must be submitted to the IRS for approval. It is important to ensure that all details are correct, as inaccuracies can lead to delays or rejections. After receiving approval, businesses can proceed with making tax-exempt purchases as outlined in their application.

Steps to complete the IRS Form 637

Completing the IRS Form 637 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about your business, including your Employer Identification Number (EIN) and details about the products you sell.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS via the appropriate method, typically by mail.

- Await confirmation from the IRS regarding your application status.

Legal use of the IRS Form 637

The legal use of the IRS Form 637 is essential for ensuring compliance with federal tax regulations. This form must be used by eligible businesses to claim tax-exempt status for specific sales. Misuse of the form or failure to comply with IRS guidelines can result in penalties, including fines or revocation of tax-exempt status. It is crucial for applicants to understand the legal implications of their claims and to maintain accurate records of their transactions.

Eligibility Criteria

To qualify for tax-exempt status under the IRS Form 637, applicants must meet specific eligibility criteria. Generally, this includes being engaged in businesses that sell products subject to excise taxes, such as fuel. Additionally, applicants must demonstrate that their sales are for qualified purposes, such as resale or use in specific exempt activities. Understanding these criteria is vital to ensure that the application process is successful.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 637 can vary based on the specific circumstances of the applicant. It is important to be aware of any relevant deadlines to avoid penalties. Generally, businesses should submit their applications well in advance of the intended date of tax-exempt purchases. Keeping track of important dates ensures that businesses remain compliant and can take advantage of their tax-exempt status without interruption.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 637 can typically be submitted by mail, which is the most common method. Applicants should ensure that they send the form to the correct IRS address to avoid delays. Currently, there is no online submission option available for this form, and in-person submissions are generally not accepted. Properly following the submission guidelines is crucial for a smooth application process.

Quick guide on how to complete irs form 637 2009

Complete Irs Form 637 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It presents a fantastic eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Irs Form 637 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign Irs Form 637 with minimal effort

- Locate Irs Form 637 and then click Get Form to begin.

- Utilize the resources we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Put aside worries about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Edit and electronically sign Irs Form 637 to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 637 2009

Create this form in 5 minutes!

How to create an eSignature for the irs form 637 2009

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is IRS Form 637 and why is it important?

IRS Form 637 is a form used to apply for tax-exempt status for certain organizations. Understanding how to fill out this form can save businesses money and time during tax season. Using airSlate SignNow can streamline the process of eSigning and submitting IRS Form 637 efficiently.

-

How can airSlate SignNow help with IRS Form 637?

AirSlate SignNow enables users to digitally sign IRS Form 637 and other documents easily. Our platform ensures that your documents are legally binding and securely stored, simplifying the eSigning process. This helps businesses manage their tax-exempt applications more effectively.

-

Is there a cost associated with using airSlate SignNow for IRS Form 637?

Yes, airSlate SignNow offers various pricing plans suitable for businesses of all sizes. Each plan is designed to provide access to features that enhance your ability to manage IRS Form 637 and other essential documents. A cost-effective solution is available, helping you save on paper and administrative expenses.

-

What features does airSlate SignNow provide for managing IRS Form 637?

AirSlate SignNow includes features such as document templates, customizable workflows, and secure cloud storage. These tools simplify the process of completing and eSigning IRS Form 637, ensuring that your applications are processed quickly. Our user-friendly interface enhances productivity, allowing you to focus on your core business functions.

-

Can I integrate airSlate SignNow with my existing software to handle IRS Form 637?

Yes, airSlate SignNow integrates seamlessly with numerous software applications such as CRM systems and cloud storage services. This enables a smooth workflow when managing IRS Form 637 and other documents. Our integrations help you maintain your current business processes while enhancing your eSigning capabilities.

-

What are the benefits of using airSlate SignNow for IRS Form 637?

The primary benefits of using airSlate SignNow for IRS Form 637 include increased efficiency, cost savings, and improved compliance with tax regulations. Our platform allows for quick access to eSign and submit documents creating a hassle-free experience during tax filings. Additionally, secure storage of your signed forms provides peace of mind.

-

Is it easy to learn how to use airSlate SignNow for IRS Form 637?

Absolutely! AirSlate SignNow features an intuitive interface designed for easy navigation, making it simple for all users to handle IRS Form 637 and other documents. We also offer helpful resources and customer support to help you get started quickly. Training materials and tutorials are readily available to ease the learning curve.

Get more for Irs Form 637

- In corporation form

- Sample organizational minutes for an indiana professional corporation indiana form

- Sample transmittal letter for articles of incorporation indiana form

- Sample operating agreement for professional limited liability company pllc indiana form

- Pllc notices and resolutions indiana form

- Transmittal letter 497307222 form

- Indiana protective order form

- In notice order form

Find out other Irs Form 637

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now