INDIVIDUAL INCOME TAX RETURN City of Troy Income Tax 2022

What is the INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax

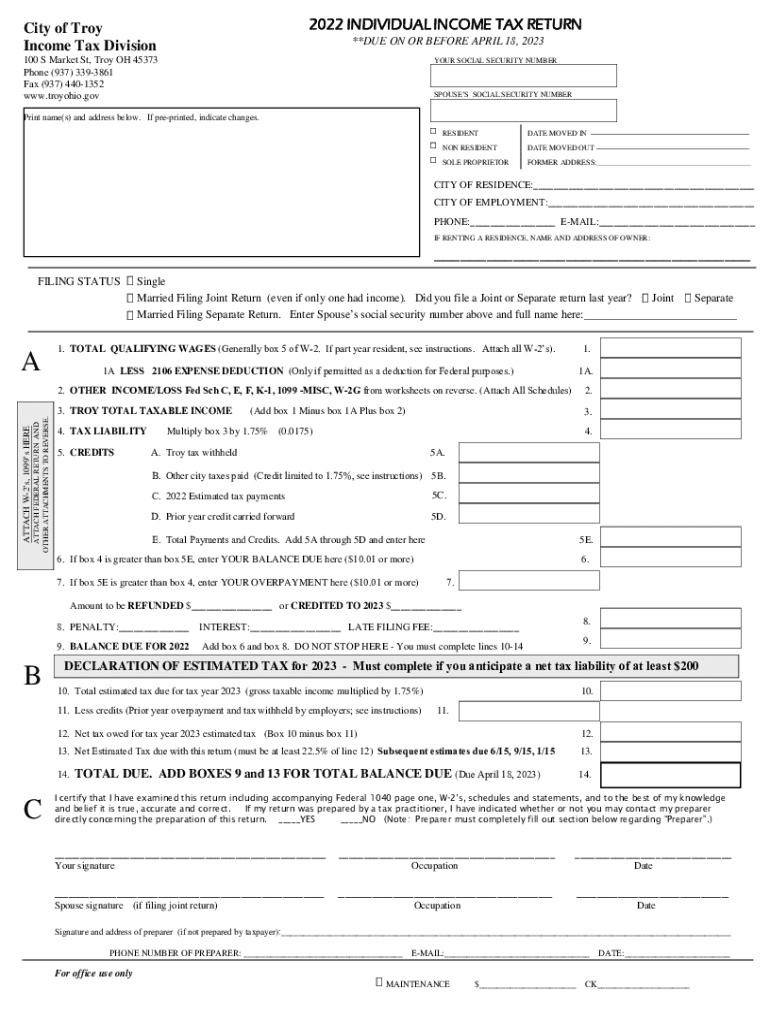

The INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax is a municipal tax form required for residents of Troy, Michigan, to report their income and calculate the amount of city income tax owed. This form is essential for individuals who earn income within the city limits, ensuring compliance with local tax regulations. The tax collected is used to fund various city services and infrastructure projects.

Steps to complete the INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax

Completing the INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax involves several key steps:

- Gather necessary financial documents, including W-2 forms, 1099 forms, and any other income statements.

- Access the tax form, which can be obtained online or through the city’s tax office.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include any applicable deductions or credits.

- Calculate the total tax owed based on the provided tax rates.

- Review the completed form for accuracy before submission.

Required Documents

To successfully file the INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax, you will need the following documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as mortgage interest statements or medical expenses

Form Submission Methods (Online / Mail / In-Person)

There are multiple ways to submit the INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax:

- Online: Use the city’s online portal to fill out and submit the form electronically.

- Mail: Print the completed form and send it to the designated city tax office address.

- In-Person: Visit the city tax office to submit the form directly and receive assistance if needed.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax to avoid penalties. Typically, the deadline aligns with the federal tax deadline, which is usually April 15. However, it is advisable to check for any specific local extensions or changes each tax year.

Penalties for Non-Compliance

Failure to file the INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax on time can result in penalties. The city may impose fines, interest on unpaid taxes, and potential legal action for continued non-compliance. It is important to file on time and pay any taxes owed to avoid these consequences.

Quick guide on how to complete 2022 individual income tax return city of troy income tax

Complete INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax with ease

- Find INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, either by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 individual income tax return city of troy income tax

Create this form in 5 minutes!

How to create an eSignature for the 2022 individual income tax return city of troy income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax?

The INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax is a document that residents of Troy must file annually to report their income and calculate their tax obligations. Proper filing ensures compliance with local tax laws and can impact your overall financial standing. airSlate SignNow provides an easy-to-use platform to assist you in managing this process efficiently.

-

How does airSlate SignNow help with the INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax?

airSlate SignNow offers a streamlined solution for eSigning and submitting your INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax. Our platform allows users to create, send, and sign documents electronically, reducing the time and effort needed to manage tax filings. Plus, you can track document status in real-time for greater peace of mind.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers various pricing plans to accommodate different needs, starting from a basic plan to more advanced features. Depending on the plan you choose, you can efficiently handle your INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax with additional functionalities like templates and integrations. Review our pricing page to find the best option for you.

-

Are there any additional features to assist with my INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax?

Yes, airSlate SignNow provides various features, including cloud storage, document templates, and customizable workflows to assist you in filing your INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax efficiently. These tools not only streamline the process but also enhance collaboration if multiple parties are involved in signing documents.

-

Is airSlate SignNow secure for filing my INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax?

Absolutely! Security is our top priority at airSlate SignNow, and we implement robust encryption protocols to protect your sensitive data during the filing of your INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax. Plus, we comply with industry standards to ensure your information remains confidential and secure.

-

Can I access airSlate SignNow on mobile for my INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax?

Yes, airSlate SignNow is mobile-friendly, allowing you to access the platform from any device at your convenience. This flexibility means you can manage and eSign your INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax on the go, making tax season less stressful and more manageable.

-

What integrations does airSlate SignNow offer for tax-related documents?

airSlate SignNow integrates seamlessly with various third-party applications, including cloud storage services, CRMs, and accounting software. These integrations can facilitate easier management and submission of your INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax by allowing you to sync documents and data directly, streamlining the entire process.

Get more for INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax

Find out other INDIVIDUAL INCOME TAX RETURN City Of Troy Income Tax

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF